Report: 40 Million Consumers Have At Least One Student Loan

A new analysis of student loan trends from credit bureau Experian [PDF] found that student loan debt increased by 84% from 2008 to 2014, surpassing the debt related to home equity loans and lines of credit, credit cards and automobiles.

That increase resulted in nearly 40 million consumers with at least one student loan open. However, the report found that a majority of consumers actually average 3.7 open student loans creating the an average balance of $29,000.

That shouldn’t be a shocking figure considering tuition continues to increase and financial aid and scholarships have become increasingly competitive.

While previous reports have found as many as one-in-three student loans may be delinquent, Experian found that consumers ages 18 to 34 with student loans actually see an increase in their credit rating.

The group averages a credit score 20 points higher than others in their generation. However, that could also be a result of the number of consumers (39%) that are currently having their loans deferred – a period of time during which the consumer isn’t obligated to pay their loans.

For consumers who are currently in the repayment stage of their loan, Experian found that location matters.

Borrowers in Massachusetts, Vermont, Minnesota, North Dakota and New Hampshire are the most likely to repay their loans on time, while those in Missouri, Oklahoma, Louisiana, West Virginia and Arkansas are more likely to have incidents of late payments.

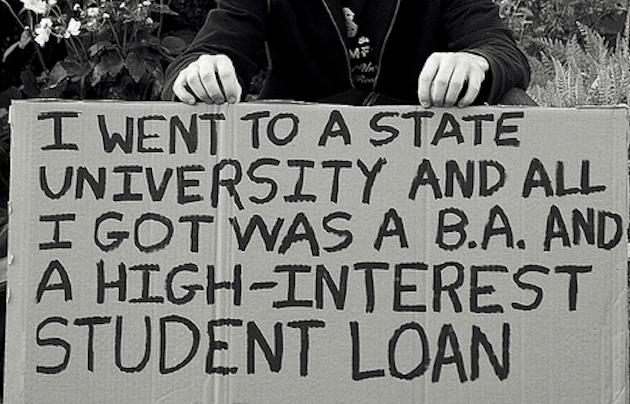

The level of student loan debt has been a hot topic for consumers, advocates and legislators in recent years.

Legislators have been seeking to provide relief to consumers through a variety of proposed laws that would allow consumers to refinance loans at lower rates, provide straight-forward details about loans and protect borrowers who have had a co-signer die or file for bankruptcy – an incident that could lead to devastating credit issues.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.