1-In-3 Americans Have No Retirement Savings

While the largest portion of Americans saving for retirement started doing so in their 20s, nearly 70% of adults under the age of 30 don’t have any retirement savings.

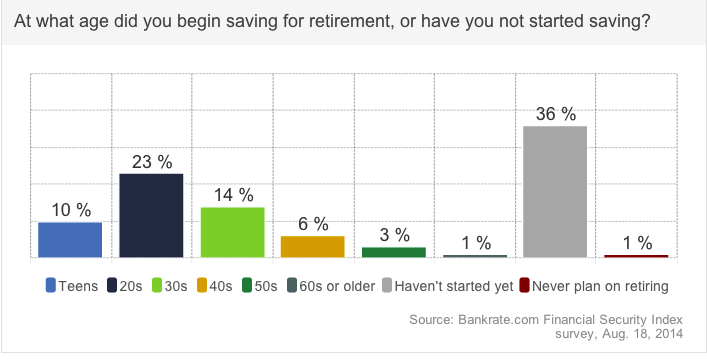

Bankrate.com has released its latest Financial Security Index report, showing that a scary 36% of American adults have nothing saved for their retirement years.

Not surprisingly, the youngest demographic — ages 18-29 — had the least saved, with only 31% of these whippersnappers having anything stashed away for their years spent yelling at pesky neighbor kids to shut up already.

When you look at the next age group — those between 30 and 49 — folks start acting more responsible, with 67% of them having some retirement savings. That number only increases slightly for those nearing retirement (ages 50 to 64), with 26% still lacking any savings for the non-working years that are in the offing.

Sadly, about 1-in-7 Americans of retirement age (65+) have no savings. This means they will need to continue working or depend on others for financial support.

Putting on my rose-colored glasses for a moment, it’s good to see the dramatic increase in retirement savings when people hit 30. However, the survey response doesn’t indicate how much these people are saving or whether it will be adequate for retirement.

A recent report from the Federal Reserve, found that nearly half of Americans had given little to no thought toward saving for retirement, while only about 27% had given at least a fair amount of thought to how they would sustain themselves through their final years.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.