Regulations Help To Rein In Runaway For-Profit Colleges, But Schools Still Find Loopholes Image courtesy of Fujoshi Bijou

If a company routinely charges more for its products than the competition and its product is often inferior to the more affordable option, that business won’t remain open for long. But thanks to deep-pocketed backers and a government that has handed over hundreds of billions of dollars in federal student aid without asking too many questions, the for-profit college industry continues to rake in the bucks while frequently leaving its students with subpar educations and faint employment hopes. Some federal regulators have attempted to make the industry more accountable, but these schools continue to take advantage of loopholes while legislators and consumer advocates scramble to make reform.

One attempt came in the form of the so-called 90/10 rule, which bars for-profit colleges from receiving more than 90% of their revenues from Department of Education federal student aid. The remaining 10% of the company’s revenue must be found through other means.

There Was A Need Then, There’s A Need Now

Image courtesy of (The Joy Of The Mundane)The 90/10 rule predates the for-profit boom of the previous decade, and was actually a response to concerns Congress had about the state of for-profit educators back in the 1990s, when many of these schools were career-training programs without any pretense to offering the “college” experience.

Even then, lawmakers were worried that some for-profit schools were recruiting students who were not ready for higher education. Many of these students left school with no new job skills and few employment prospects in their fields of study and many defaulted on their federal student loans.

So in 1992, Congress enacted the 85/15 rule, which mandated schools obtain at least 15% of their revenue from sources other than federal student aid. The idea was that if a school’s offerings were truly valuable, or in demand, then it would be no issue for someone other than the federal government to pay for the schooling.

The original version of the rule lasted for nearly six years, when in 1998 Congress amended it to the current 90/10 split.

In all, the rule aims to prevent for-profit education institutions from making a large profit off of tax dollars, and keep them from preying on low-income students – who tend to account for a large portion of enrollment.

Failing Grades

Image courtesy of (DennisMancini)During the 2011-12 federal aid award year, the Dept. of Education found 29 schools to be in violation of the funding rule. One of those schools, Montebello Beauty College in California lost its eligibility for federal funds, while the other 28 schools were only in their first year of violation.

The following year, nearly 372 of the 2,042 for-profit institutions in the United States were receiving 85% to 90% of their revenue from federal student aid.

That same year, the Huffington Post reports, three of the 15 institutions in violation of the funding rule lost their federal student aid eligibility. Those schools included Healthy Hair Academy, based in California; College of Office Technology, based in Illinois; and Suburban Technical School, based in New York. Healthy Hair and Suburban Technical School eventually close.

A 2010 Government Accountability Office report detailed what specific characteristics were present in for-profit schools that receive the highest percentage of federal student aid and were likely to violate funding rules:

* Schools that granted no degree higher than associate’s (75% of funding from federal student aid)

* Schools that specialized in healthcare (75%)

* Schools that offered distance education (72%)

* Schools with a student population of more than 2,000 (74%)

* Schools owned by a publicly traded parent company (72%)

* Schools that were part of a chain (70%)

Always Finding A Way

Image courtesy of (frankieleon)While it appears that the rule does have the effect of highlighting rogue aid-abusers, advocates say there are glaring issues that pose a big problem for prospective students and their futures.

“The 90/10 rule as currently written doesn’t go far enough to protect students and taxpayers from shoddy for-profit college programs,” Suzanne Martindale, senior counsel for Consumers Union, tells Consumerist. “It only applies to Title IV money – so, Pell grants and federal student loans mostly – meaning that other kinds of federal dollars can be counted in the remaining 10% the school takes in.”

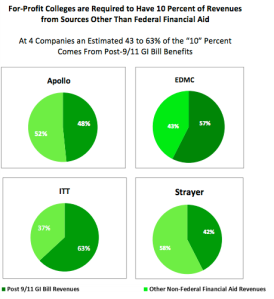

Those funds include veterans’ and active duty servicemembers’ federal student aid – such as G.I. bill benefits and the Department of Defense’s tuition assistance funds. And as a result, for-profit educational institutions have been aggressively recruiting and enrolling veterans, service members and their families to their programs as a way to comply with the 90/10 rule.

And so, the G.I. Bill, which was created to further the education of United States servicemembers and their immediate family members, now serves as a bullseye for the for-profit education industry.

A recent Health, Education, Labor, and Pension Senate Committee report [PDF] found the Post 9/11 GI Bill provided $1.7 billion to for-profit colleges during the 2012-13 school year.

“This is why many investigations have concluded that servicemembers, who receive their own special education benefits outside of Title IV, have been so aggressively recruited for enrollment,” Martindale continues.

Indeed, eight of the top 10 recipients of post-9/11 G.I. Bill benefits are for-profit colleges. Servicemember enrollment at for-profit colleges increased from 23% to 31% over the last five years, while the enrollment at public colleges decreased from 62% to 50% during the same time period.

While servicemembers, their families and all other consumers have the right to choose a higher-education institution that best fits their needs, they aren’t always given the most truthful information from for-profit colleges.

Earlier this summer, legislators and consumer advocates expressed outrage that Corinthian Colleges Inc., the operator of Everest University, Heald College and Wyotech, continued to aggressively recruit active-duty servicemembers at military bases despite the fact that the company is currently dismantling and selling or closing its campuses.

8 of the top 10 recipients of post-9/11 G.I. Bill benefits are for-profit colleges

The Military Times reported in July that the CCI-operated Heald College and Wyotech representatives were actively recruiting servicemembers at education events at four military bases in California in just one week.

The recruiters were there encouraging active-duty troops to sign up for classes this fall, despite the fact the schools may no longer be operations. School representatives told the Military Times that they have no plans to curtail their new-student enrollment efforts for military and veteran students.

Other for-profit colleges have been known to not only heavily recruit at military education events, but also by sending representatives to barracks housing wounded servicemembers, some who have suffered traumatic brain injuries and may not be in the position to agree on enrollment.

Those tactics — coupled with ever-present marketing on television and radio — illustrate the lengths some companies will go to in order to protect the largest stream of revenue counted in the 10%.

Reform And Refocus

Image courtesy of (lungstruck)Ever since the 90/10 rule became, well… the 90/10 rule, legislators and consumer advocates have worked to close the loophole that allows G.I. Bill and other military funds to be counted in the 10% of for-profit college revenue.

Just this year, Sen. Dick Durbin of Illinois introduced language in the Department of Defense Appropriations Act 2015 that would place new restrictions on some of the federal military benefits that can be used toward the calculation of for-profit schools 90/10 funding.

Durbin’s proposal would change the rule to include the Defense Department’s voluntary military education programs in the 90% fraction of the rule. The legislation would also prevent those funds from being used for advertising and marketing purposes, while the DoD would be required to better track how its Tuition Assistance and MyCAA funding is being spent by for-profit colleges.

The bill was passed by the House in late June and currently awaits consideration by the Senate.

While the measure would better protect servicemembers, it’s not nearly enough to rein in the for-profit industry’s often predatory recruitment and funding tactics, consumer advocates say.

“The idea behind the 90/10 rule is very good, and served as a minimal backstop to make sure that if people are willing to invest to a program that is of quality to get funds other than federal aid,” Leslie Parrish, deputy director of research for the Center for Responsible Lending, tells Consumerist. “But there are key problems.”

To address one issue, consumer advocates have been working on proposed reforms that include changing the rule back to an 85/15 split and including defense funds in the federal aid category.

“It’s probably not enough to entirely prevent abuses, but it could make servicemembers like everyone else being recruited, and that’s an improvement,” Parrish says.

Consumers Union would support a return to the initial 85/15 rule, explains Martindale, but with one important caveat.

“We would also support a prohibition on the use of federal funds for the purpose of marketing and recruitment,” she says. “If a school takes in federal taxpayer dollars, including loans that students have to repay, that money should go toward instruction and student support.”

That specific requirement could have devastating effects on the industry, financial aid expert Mark Kantrowitz said in a report [PDF] last year.

Since the largest for-profit schools spend about 20% of their total revenue on advertising and recruitment, he argues it would effectively increase the threshold for schools to 80/20.

Gainful Employment Standards Are Key

Image courtesy of (Tara Chavez)While both Parrish and Martindale agree that a stronger funding rule would vastly improve protections for students, it still lacks the power to determine the quality of programs a school offers.

“The 90/10 or 85/15 rule is important, but… it’s not the end-all be-all,” Parrish says. “The Gainful Employment Rule is even more important.”

The Gainful Employment Rule, which is currently being finalized after a previous attempt failed to create a useful rule, would require institutions to certify that all career-education programs meet applicable accreditation requirements, along with state and/or federal licensure standards.

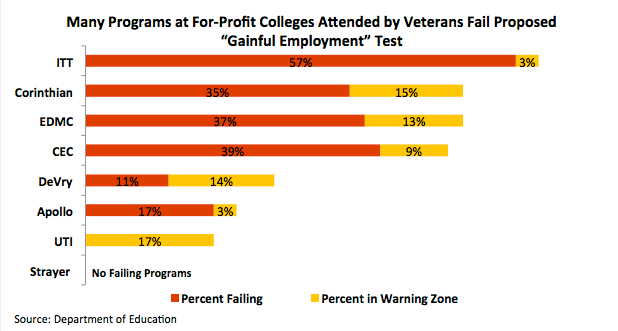

Programs would be deemed failing if loan payments of typical graduates exceed 30% of discretionary income or 12% of total annual income. Programs would be given a warning if a student’s loan payments amount to 20-30% of discretionary income, or 8-12% of total annual income. Discretionary income is defined as above 150% of the poverty line and applies to what can be put toward non-necessities.

Perhaps the biggest fear for the for-profit industry with regard to the proposal is the fact that many of these schools would fail if measured against the proposed standards.

The H.E.L.P. Committee’s report on the G.I. Bill benefits found just that. Between 35% and 57% of the programs at Corinthian, Education Management Corporation, Career Education Corporation, and ITT Technical Institute would fail to demonstrate that they prepare students for employment in a recognized profession.

Just A Lot Of Talk?

Image courtesy of (Renee Rendler-Kaplan)The for-profit industry and its backers have strongly opposed both the gainful employment standards and changes to the funding rule from the beginning.

The industry spent million of dollars to fight the first attempt at a gainful employment rule proposed in 2011. Through their efforts the final version of the rule — which was dropped before being enacted — would have had no impact on the industry, which continues to use its well-lined pocketbooks to lobby against the newest incarnation of the rule.

As far as any changes to the 90/10 rule, they’re not exactly lining up to show their approval, despite the fact that most for-profit colleges have no problem meeting current standards.

Instead, the industry threatens to increase tuition, saying stricter rules would only hurt the low-income students that Congress is trying to protect.

“In short, the 90/10 Rule increases the risk of low-income students being denied access to postsecondary education,” Noah Black, vice president of public affairs for Association of Private Sector Colleges and Universities, tells Consumerist. “The 90/10 Rule is not a measure of institutional quality. It is a financial calculation that is a measure of the socioeconomic position of the student population served by an institution.”

Opponents of funding rule changes also argue that it’s unfair to hold for-profit schools to limits when some public schools are just as, if not more, reliant on federal aid.

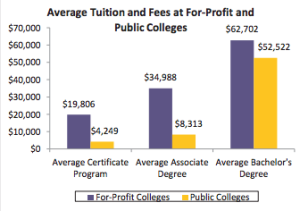

But what’s omitted from that argument is the fact that for-profit colleges generally cost significantly more than comparable programs at non-profit public schools. This is especially true in the certificate and associate degree programs that many of for-profits claim to specialize in.

But what’s omitted from that argument is the fact that for-profit colleges generally cost significantly more than comparable programs at non-profit public schools. This is especially true in the certificate and associate degree programs that many of for-profits claim to specialize in.

For example, if you assume that both for-profit and public schools rely on federal aid for 80% of their revenues, the disparity in costs at these two types of institutions means that taxpayers are nearly $28,000 for a student at an average for-profit school and only $6,650 at a public college.

And even if you believe the numbers from this for-profit industry study claiming that its schools only get an average 70% of their funding from the feds while public schools get 82%, the huge difference in tuition costs still has for-profits reaping almost $24,500 from taxpayers per student while still only funding public colleges to the tune of $6,817.

A 2012 H.E.L.P. report [PDF] found that Bachelor degree programs at for-profit schools averaged 20% more than those at public universities and associate degrees offered at profit schools averaged four times the cost of those at comparable public schools.

Those already high tuitions are likely to rise if changes to the funding rule come to fruition; further hurting those that the industry claims they work so hard to protect.

“One thing we hear from critics if we change to 85/15 or move veteran benefits then schools will simply raise their prices to say within limits,” Parrish says.

Although it wouldn’t be a surprise for these schools to increase tuition in retaliation, their reasoning for doing so isn’t exactly truthful – much like other aspects of the under-fire industry.

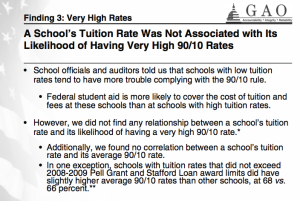

The GAO report on for-profits found there was no relationship between a school’s tuition rate and the likelihood of violating the 90/10 rule.

Even schools with a higher percentage of low-income students appear to be able to weather the changes. The GAO report found the average rate was 77% for those schools, still well below the 90% threshold and even the proposes 85%.

A Case For Change

Image courtesy of (the c-side)Perhaps it’s just fresh in our minds, but nothing quite illustrates the need to rein in the for-profit education industry more than the ongoing saga of Corinthian Colleges.

The company’s schools are closing or being sold while thousands of students and billions of federal dollars are left hanging in the balance.

Could stronger regulations have prevented the current situation? Maybe, says Parrish with CRL. With new rules other schools might be able to survive where Corinthian failed.

“Look at Corinthian, they weren’t able to sustain a 20-day wait on federal funds,” she explains. “That just shows that these schools are heavily reliant on federal funds.”

One thing is clear to advocates — changes need to be made to ensure students at for-profit schools are more than just a paycheck.

Adds Martindale, “A stronger 90/10 rule, stronger gainful employment rule, and diligent enforcement by the Dept of Education, would go a long way toward ensuring that low-performing schools don’t take advantage of students and taxpayers.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.