Study: Credit Card Applications Becoming More User Friendly, But Still Lack Valuable Informaton

(Michael)

Credit card companies love to advertise all the perks of being a cardholder — rewards points, cash back, airline miles, etc. — but card issuers have historically hidden the not-as-good stuff in the fine print of card applications. A new study finds that banks are doing a better job of making things more transparent — but not about everything.

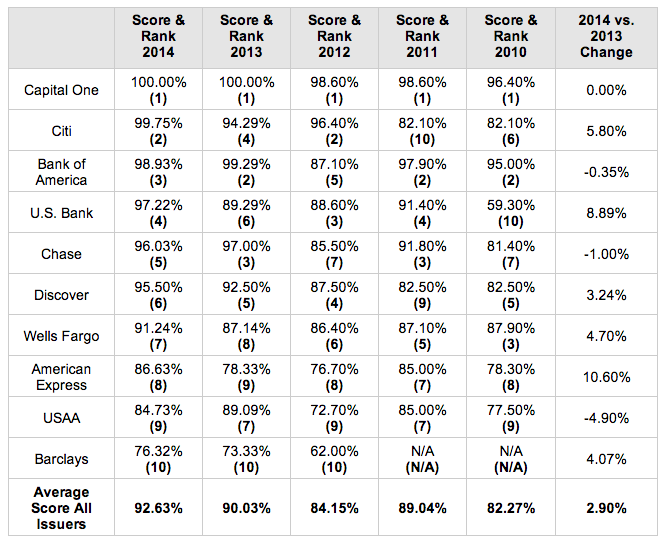

CardHub’s fifth annual Credit Card Application study scores and ranks the country’s 10 largest credit card issuers based on how clearly their online credit card application pages provide information on rewards, membership fees and key finance costs.

Maybe the Vikings in the Capital One commercials really do know a thing or two about picking out credit cards. For the fifth year in a row CardHub named Capital One tops when it comes to clear, concise application details.

Capital One scored a perfect 100% when looking at the company’s clarity on rewards, annual fees, costs for carrying a balance and cost for balance transfers.

On the flip side, the worst performing card was Barclays, had by far the worst score of 76.32%.

American Express increased its clarity by 10.6% over their 2013 score, the most of any card issuer. USAA dropped 4.9% in performance compared to the previous year.

According to CardHub, the overall transparency for all card issuers increased by nearly 3% to 92.63%, the highest score recorded since the study began in 2010.

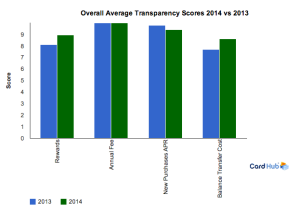

While the study found that most credit card issuers were clear on details regarding annual fees, how to earn rewards and information on purchase APR, there remained a significant amount of ambiguity when it came to balance transfer fees and reward redemption.

In the past year, transparency on rewards has gone up by 11% and visibility on balance transfer information by 12%. However, purchase APR information has become 4% less prominent than in the previous year.

While the latest card application study may provide valuable information for consumers shopping around for a new credit card, CardHub offers several tips:

- Determine your credit standing

- Compare offers with a purpose; which kind of card best suits your needs.

- Don’t let marketing sway your decision

- Don’t apply to multiple cards at one time

- Always consider secure cards

2014 Credit Card Application Study [CardHub]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.