Report: States Have The Power To Rein In For-Profit Colleges, They Just Don’t Use It

Over the past several months there has been much talk about the federal government reining in for-profit colleges through the proposed gainful employment rule. While a decision on that measure is still forthcoming, a new report from the National Consumer Law Center points to state governments as the one entity that could truly make a difference when it comes to protecting consumers by strengthening their own oversight over the sometimes predatory for-profit industry.

While the federal government’s efforts to enact a gainful employment rule – which would require for-profit schools to do a better job of preparing students for gainful employment, or risk losing access to taxpayer-funded federal student aid – could provide a strong defense against unsavory colleges, that action simply won’t be enough to prevent ongoing abuses perpetrated by the for-profit school industry, officials with NCLC point out in its latest report [PDF].

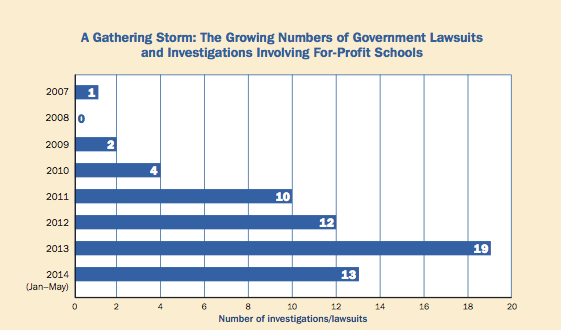

Since 2007, federal and state regulators have brought forth 61 lawsuits and investigations involving for-profit schools. The NCLC predicts that number will continue to grow unless each individual state takes action to create through, uncompromising oversight of the industry.

“Increasing numbers of state and federal investigations have revealed the widespread use of deceptive and illegal practices throughout the sector, including by large accredited schools owned by Wall Street investors,” the report states. “After being subjected to these deceptive practices, hundred of thousand of students enrolled in inferior education programs and ended up with nothing but debt.”

WHAT’S THE PROBLEM WITH FOR-PROFIT COLLEGES?

Shady practices being proliferated by for-profit colleges are no secret; investigations and lawsuits against for-profit institutions have covered a range of issues, from lying to students about their employability upon graduation to pressuring students into taking out costly, and often devastating, loans.

Perhaps the brightest light to be shone on the inner-workings of for-profit colleges came in 2012 when the U.S. Senate Committee on Health, Education, Labor and Pensions (HELP) issued a wide-ranging report that focused on predatory recruiting, low completion rates, billions of dollars spent on marketing and executive salaries instead of actual education and gaming the regulatory system to make a profit.

The HELP report found that only 17% of what these colleges spend actually goes to instruction, while 42% of the money goes to marketing, recruiting and profits for the companies. Not-for-profit schools pay less than 1% on average for marketing.

Additionally the report found that, on average, 54% of students who began at a for-profit institution during the 2008-2009 school year withdrew by summer 2010. Nine schools in the study had withdrawal rates of at least 60%, with the highest being 84%.

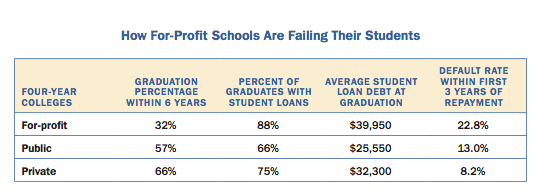

Those numbers have changed very little in the past several years. The NCLC report released today, found that students who attend a for-profit college have tend to leave with more debt and a significantly change of defaulting on loans than students who attended public and private four-year colleges. In fact, the percentage of student who graduate form a for-profit college within six years is just 33%, while both private and public four-year institutions have graduation rate well above 50%.

WHAT CAN BE DONE?

So how do regulators, along with federal and state governments protect consumers from shady for-profit colleges?

There are a number of rules and regulations that have been proposed in Congress that could have a detrimental effect to the business model of these kinds of institutions, however, very few of these bills ever see the light of day.

One such rule that should help prospective students is Title IV of the Higher Education Act (HEA), but the NCLC report says that while the Act provides for more oversight, little has been done to use it to regulators advantage.

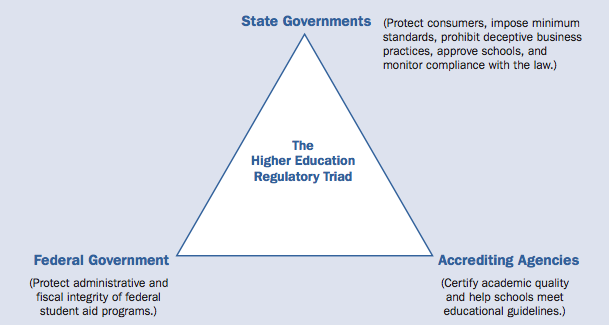

Title IV provides for the regulation of postsecondary institutions through three different entities – the federal government, accrediting agencies, and states.

Each of these entities are to serve complementary purposes. While the U.S. Department of Education is responsible for “protecting the administrative and fiscal integrity of the federal student aid programs,” accrediting agencies are responsible for assuring academic quality.

That leaves states with the primary responsibility for approving and overseeing schools and protecting students from abusive for-profit school practices. However, because of a lack of specificity, many states have come to view consumer protection as a federal and accrediting agency responsibility, and, as a result, many have provided little protection when it comes to for-profit schools, the NCLC reports.

Due to this lack of willingness on the part of many states, the Department enacted “state authorization” regulations to ensure some kind of oversight is provided by states. The authorization reaffirmed that states are key to regulatory measures and that they should “retain the primary role and responsibility for student consumer protection against fraudulent and abusive practices by some postsecondary institutions.”

STATES HAVE THE POWER

And according to the NCLC, states are in the best position to monitor everyday practices of for-profit schools and to take action when these institutions harm students. However, all state agencies and regulatory oversight laws need improvement.

So what should states do to better protect students with the power they’ve been given though Title IV? According to the NCLC report, they can do a lot.

1. Eliminate reliance on accreditation as a substitute for oversight and require all accredited and unaccredited schools to comply with minimum standards and consumer protections.

The NCLC found that as of July 2013, at least 33 states employ lenient standards or granted exemptions or automatic approval to accredited for-profit schools. Why does this matter? Because, accredited schools are the only institutions eligible for federal financial aid. Deceptive practices found at some for-profit colleges often cause the greatest financial harm to the largest number of students.

“States should therefore subject all unaccredited and accredited schools, including schools that are nationally or regionally accredited, to rigorous minimum standards and consumer protection requirements.”

2. Increase oversight of schools exclusively offering online/distance education programs.

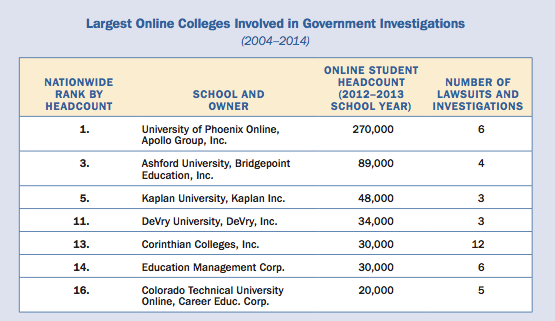

Online and distance education can provide a convent alternative to tradition classrooms for many working adults seeking an education. However, many of the top online colleges have been at the center of federal lawsuits and investigations. The University of Phoenix, the No. 1 ranked for-profit college by headcount, has an online enrollment of 270,000 and has been party to six lawsuits and investigations since 2004.

Because of lax oversight for online programs, the NCLC believes students are more vulnerable to fraud.

“States should protect students by expanding oversight laws to include for-profit schools that exclusively offer online programs. In addition, before signing onto multi-state reciprocity agreements, states should demand that those agreements, at a minimum, allow states to apply their own consumer protections to distance education schools.”

3. Establish and enforce meaningful minimum performance standards as requirements for state approval.

The ability of a school to produce good results is a clear indication that it is not likely to be engaging in deceptive practices. To protect students from low-quality and deceptive for-profit schools, states should require schools to maintain minimum completion and job placement rates as a condition of state approval.

However, state laws must put in place strict and clearly defined mandates for this kind of oversight in order to ensure schools are not manipulating or inflating their rates.

“For-profit schools often inflate completion and job placement rates while misrepresenting the salaries graduates can expect to earn. These deceptive practices are among the most abusive and harmful to students because they go to the heart of students’ hopes and dreams, and leave students mired in debt.”

4. Focus increased supervisory and enforcement resources on for-profit schools at risk of deceiving students.

Because many state oversight agencies lack the sufficient funds needed to closely monitor all for-profit schools, they should focus their energy on those institutions that are most likely to harm students.

“State law should require oversight agencies to develop specific criteria and procedures for identifying and investigating schools that may be engaging in systemic legal violations.”

5. Require a fair and thorough process for investigating and resolving student complaints.

There are few opportunities for student who have been wronged by for-profit schools to obtain the relief they need. Because of this, schools often don’t face consequences for their deceptive practices and continue to employ such measures.

“It is therefore critical that state law require the oversight agency to accept, investigate and resolve student complaints. To ensure it has sufficient investigative resources, state law should also require the agency to expend at least 60% of its budget on investigation and enforcement.”

6. Establish an independent oversight board to increase public accountability.

An independent oversight board should be considered as a way to increase public accountability, and therefore the effectiveness, of the state agency responsible for regulating for-profit schools.

“Because a public board is in a position to constantly pressure an agency’s staff to perform its statutory obligations, the creation of a board may lead to a more effective oversight agency as long as it is not dominated by institutional (school) representatives.”

7. Prohibit domination of the oversight board by the for-profit school industry.

While the creation of an oversight board could be beneficial to increasing public accountability, these boards can become dominated by institutions that seek to undermine the work of the oversight agency.

“States should therefore eliminate laws that require or allow the for-profit school industry or educational institutions to comprise the majority of oversight boards. State laws should also require a fair mix of school, employer, student, consumer advocate, public, and law enforcement representatives on oversight boards and prohibit licensed institutions from comprising a majority, including when vacancies exist.”

8. Assign responsibility for all for-profit school oversight to one agency with expertise in consumer protection and for-profit business regulation.

While one agency may lack the resources to oversee all for-profit institutions in a state, the NCLC says that spreading oversight to different agencies only weakens the state’s ability to protect students.

“States should therefore vest all for-profit school oversight in a single agency with expertise in investigative procedures and consumer protection, as well as higher education. Not only must the regulatory agency have the expertise necessary to evaluate higher education institutions, it must also have the specialized expertise necessary to handle investigations of for-profit businesses and enforce consumer protections.”

9. Provide a clear mandate that the state agency’s primary duty is consumer protection.

“State law must provide a clear mandate that the only or primary purpose of the oversight statute and agency is ensuring educational quality and consumer protection. Conflicting purposes or the failure to state any purpose can cause confusion among staff about an agency’s mission, provide the industry with an inappropriate level of influence over the agency, and cause the agency to neglect its consumer protection and oversight role.”

10. Eliminate sunset provisions in for-profit school oversight statutes.

The for-profit college industry is not going away anytime soon, and neither should state and federal oversight statues and agencies.

Some states currently have sunset provisions, which provide for the automatic termination of a statute and oversight agency on a set date unless extended by the state legislature. The NCLC recommends these provisions should be eliminated.

“[These provisions] also give the for-profit industry an opportunity to either water down standards or prevent the extension of a state law and agency. Rather than provide for the automatic termination of an oversight statute, state law should provide for periodic legislative reviews. Legislatures should affirmatively decide that an agency is unnecessary before that agency and its authorizing statute are terminated.”

WILL IT REALLY HELP?

While federal rules and regulations, such as the gainful employment rule, are currently being debated, the NCLC says the time for states to act is now.

“Without strong laws and agencies, students and their families will continue to suffer the long-term economic consequences of deceptive recruitment techniques and inferior educations.”

Only time will tell if state oversight agencies can truly protect consumers from for-profit colleges, but the NCLC recommendations set consumer advocates up with the tools that could make a difference.

“The state oversight role is critically important to ensuring that all students who invest in and work hard at a postsecondary education will end up with the skills and knowledge they need to improve their lives and the futures of their families.”

Ensuring Educational Integrity: 10-Steps To Improve State Oversight Of For-Profit Schools [National Consumer Law Center]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.