Why Are Some People Having A Harder Time Paying Off Car Loans Post-Recession?

For many of us, things have improved since 2010, when the country finally began clawing its way out of the crater that resulted from the collapse of the housing market. So why are some consumers doing a worse job of making car loan payments than they were during the recession?

For many of us, things have improved since 2010, when the country finally began clawing its way out of the crater that resulted from the collapse of the housing market. So why are some consumers doing a worse job of making car loan payments than they were during the recession?

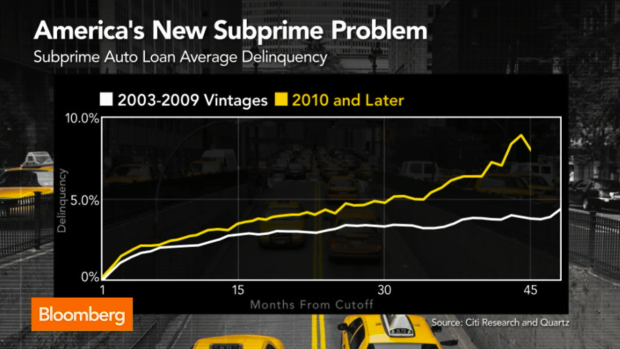

Bloomberg looked at the above graph comparing delinquency rates on auto loans made to subprime borrowers before and since 2010.

The white line represents delinquency rates on these loans issued between 2003 and 2009, and shows what you’d expect — that during the heart of the recession and the first few years of recovery, around 4-5% of subprime auto loans were delinquent.

But the yellow line is the head-scratcher. It represents delinquency rates for loans issued from 2010 to the present day. One would expect, with more financial stability and improved employment levels, that the delinquency levels would be lower than during the recession when many people had to scrounge for cash. Instead, the delinquency rate has been higher than during the bust years. And it actually peaks at around the 3.5-year mark, indicating that those who took out loans at the initial stages of the recovery are having the hardest time making payments.

In looking at the numbers, Sara Zervos from Oppenheimer reminds Bloomberg that while we may technically have been in a recovery at that point, “Things weren’t that great in 2010.”

There was still high unemployment and many consumers had credit reports with more dings than a car left out in a hail storm.

“Car makers just want to sell cars,” explains Zervos, theorizing that auto loans were likely given to people who should not have qualified. “There’s a lot of scrutiny on the home lending front; massive scrutiny on the supreme crisis. Not so much scrutiny on the auto side.”

Additionally, the pre-2010 numbers have to reflect that things were good for most people until around 2008. They still had income, still owned their homes.

What goes unmentioned in the Bloomberg piece but is worth considering is that a number of the people who lost their homes to foreclosure continued to make car payments while they allowed their mortgages to sink into default. It can take years for a home to be seized and sold off, but it only takes a few minutes for the repo man to snag a car out of the driveway. And you can live with friends or family while looking for a job; it’s much harder to rely on them to drive you to job interviews, so the car remained a necessity for many.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.