Letting Sprint Buy T-Mobile Will Fix Broadband Competition, According To Sprint Chairman

As GigaOm reports, the clear implication behind Son’s “well-received” speech was that regulators should be happy to bless a merger of Sprint and T-Mobile, because then there will be valid competition to the internet-controlling juggernaut that Comcast is lined up to become if and when it acquires Time Warner Cable.

Son has worked this angle before, and Comcast too is happy to claim that mobile broadband is true competition for their internet offerings.

But just because a bunch of people say the same thing over and over doesn’t make it true. We’ve been down this path before. Mobile broadband is still too expensive, too inconsistent, and too slow to be a reliable full-time wired broadband replacement.

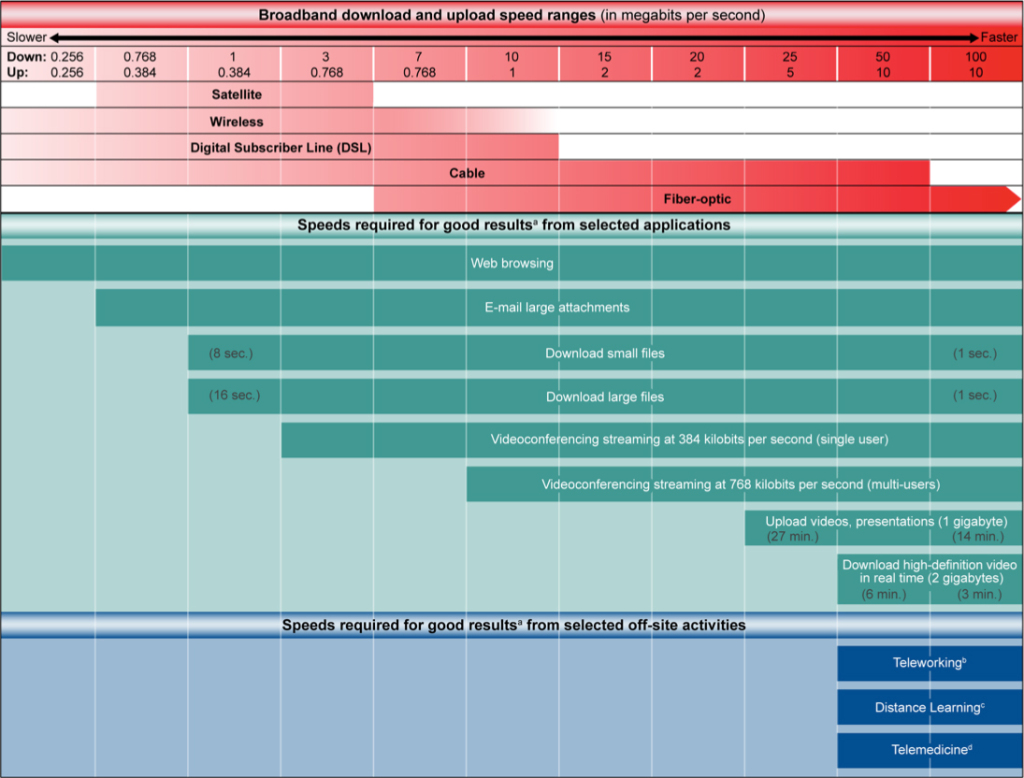

Netflix CEO Reed Hastings, speaking (and slamming Comcast) at the same conference, said that mobile data doesn’t really support Netflix very well. And at an average download speed of 6-7 MBps, there’s a whole lot else that mobile broadband can’t necessarily support yet, either.

Average broadband technology speeds as compared to uses, via the GAO.

As for the costs, GigaOm did the math and worked out that swapping out home broadband for a mobile-only solution could cost an average cord-cutting Sprint user about $10,000. And that’s not annually. That’s per month. Of course, the highest network users wouldn’t be able to hit a bill that high, because Sprint would be throttling their service anyway.

Still, maybe Son doesn’t mean Sprint could fix things today. As we’ve seen clearly over the past few decades, the technology landscape changes extremely rapidly. The world of 2014 is not the world of 2020, and in fact probably not even the world of 2015.

So what about the not-so-distant future? If Sprint did buy T-Mobile, as it has been murmuring about for months, it would have more reach and resources with which to improve its network, that much is true. But that still wouldn’t be nearly enough leverage to make mobile data a meaningful replacement solution for most consumers in the near term.

GigaOm also makes the critical point that while Sprint would be working on bringing two brands together under the same roof and getting that new improved network up and running, the rest of the world would just keep evolving around them:

Yes, one day we will be able to able to consume 100 or 200 GBs of mobile data for the same cost we pay for a home broadband connection. But it’s not like wireline broadband technologies or our internet consumption habits are standing still. We’re moving away from coaxial cable and copper to fiber links to the home. Meanwhile the resolution of our video programming is increasing and our apps and data storage are moving into the cloud.

Five years from now, when Son is ready to offer 200 GBs for $50 on the cellular network, 200 GBs a month will seem like a paltry amount. Son is chasing a moving target, and the simultaneous advancement of both wireless and wireless access technologies dictate that he’ll never catch up.

Sprint and T-Mobile are the 3rd and 4th largest mobile companies in the country, and although Verizon and AT&T are still far and away the most dominant, T-Mobile is beginning to catch up. It’s easy to see why Sprint would want to buy the company, but it’s also easy to see why consumers will benefit more if they don’t.

Why you shouldn’t buy the miracle broadband network Softbank’s Masayoshi Son is selling [GigaOm]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.