College-Educated Consumers With Student Debt Have Median Net Worth Of Just $8,700

(eric371)

A new Pew Research report “Young Adults, Student Debt and Economic Well-Being” examines just how college debt affects the overall wealth of consumers and why having a degree, despite the debt associated, is still better in the long run.

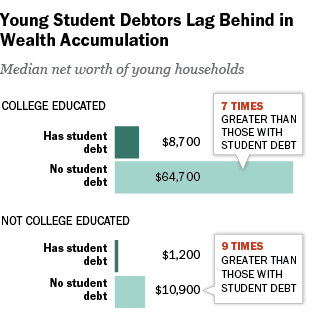

Nearly four-in-ten U.S. households headed by an adult younger than 40 currently have student debt and a median net worth of just $8,700.

That’s a stark contrast to the median net worth of $64,700 that young college graduates without student debt have accumulated. Additionally, consumers without a degree and without student debt have a net worth of $10,900, once again greater than that of degree holders with debt.

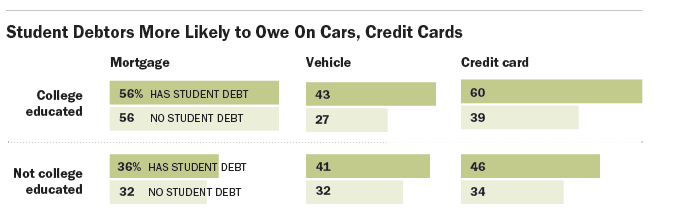

While student loan debt does play a large role in the low median wealth of college graduates with student loan obligations, Pew found these consumers were more likely to take on other debts that contributed to the wealth gap.

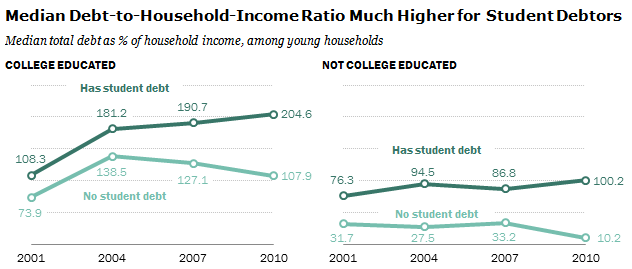

Student debtors have an average of $13,000 in loan obligations, but their debts don’t end there. Those consumers are more likely to owe for mortgages, car loans and credit cards. In fact, the indebtedness for young college-educated consumers is $137,010, twice that of similar households with no student debt.

The median young household with debts spends about 18% of monthly household income to service those debts. A common benchmark to determine financial distress occurs when households must devote more than 40% of monthly income to repay debts.

With a low net wealth and high amounts of debt it might not be surprising that households heads who borrowed for college are less satisfied in their personal financial situation. Nearly 30% of student loan debtors were dissatisfied financially, while only 14% of graduates without student loan debt were dissatisfied.

Despite these findings Pew reports that the income of college graduates with student loans doesn’t seem to be impacted. College-educated student debtors typically have a household income of $57,941, nearly twice that of homes in which the heads do not have bachelor’s degrees.

Despite these findings Pew reports that the income of college graduates with student loans doesn’t seem to be impacted. College-educated student debtors typically have a household income of $57,941, nearly twice that of homes in which the heads do not have bachelor’s degrees.

That number only reiterates Pew’s findings earlier this year that the earnings gap between millennials with a college degree and those with only a high school diploma is the highest it’s ever been.

Student debt doesn’t just affect a graduates economic well-being, it’s also been found to affect the nation’s economic well-being. In February, the Consumer Financial Protection Bureau found that rising student debt could prove to be one of the most painful aftershocks of the Great Recession. Housing experts related the debt to a decline in first-time home buyers entering the housing market.

Young Adults, Student Debt and Economic Well-Being [Pew Research Center]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.