Could Consumers’ Frustration With Mortgage Closings Be Solved By eClosing System?

After months of searching for a home, going through the process of applying for a mortgage, providing support for every speck of dust in your piggy bank (often multiple times), you finally get to closing day, where you’re often rushed through hundreds of papers of documents you’ve never seen before, hoping that you’re not inadvertently signing away your firstborn. Isn’t there something that can be done to make the closing process less daunting and more transparent?

A new report from the Consumer Financial Protection Bureau outlines problems in the current process and suggests an alternative in the form of a new Electronic Closing pilot project.

The report [PDF], “Mortgage Closings Today”, highlights the frustrations consumers have encountered when completing the mortgage portion of their new purchase and just how technology could ease some of those burdens.

“Mortgage closings are often fraught with anxiety,” CFPB Director Richard Cordray says in a news release. “We have taken action to address some of the problems consumers face, but more needs to be done.”

The key challenges that consumers and industry stakeholders reported there was not enough time to review closing paperwork, the paperwork often proves overwhelming and the documents often contain jargon not easily understood by consumers.

In many instances, consumers reported they were unable to see the closing package until they arrived at the closing table. This proved too late to digest the information, ask questions about changes in fees, or correct errors, without delaying the closing. Additionally, consumers felt there was a disconnect between themselves and key participants in the process.

The CFPB report points to two root causes behind consumer’s feelings of stress and confusion in the closing process: large, complex packages and inconsistent closing practices across transactions.

Of the responses received by the Bureau in their research regarding closing practices, nearly 33% of all stakeholders stated that documents were too large. Consumers described the process as tedious and stressful when trying to figure out where to sign, while others had to slow down the settlement agents in order to have them explain the paperwork sufficiently.

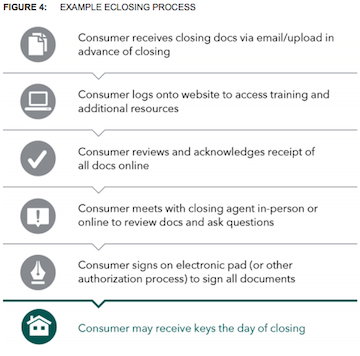

In an attempt to lessen the frustrations that consumers encounter when going through the mortgage closing process, CFPB has identified “a more streamlined, efficient, and educational closing process that would be beneficial to consumers” in the in the form of a Electronic Closing system.

eClosings are already happening in the market today, but adoption is low, CFPB reports. A pilot program is set to launch later this year and is designed to enable the Bureau to better understand the role eClosing can play in the mortgage process.

The implementation of an eClosing system could address challenges by shifting the experience toward a paperless process. The CFPB believes that eClosing solutions could provide increased flexibility to provide documents prior to the closing and could include embedded educational tools that would highlight key information or link to additional resources. Additionally, consumers could utilize eClosing to access an eVault that would house their previous documents.

While some consumers reported encountering errors in their information during the closing process, CFPB contends that eClosing could help such errors be spotted before closing takes place.

The new report and pilot program have been designed to promote best partitives in the marketplace ahead of the CFPB’s “Know Before You Owe” mortgage initiative. The initiative was designed to improve the home-buying experience for consumers by requiring new, raiser-to-read disclosure forms that lay out the terms of a mortgage to a homebuyer. The new rule is expected to be implemented in August 2015.

CFPB Report Highlights Pain Points for Consumers in Mortgage Closing Process [Consumer Financial Protection Bureau]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.