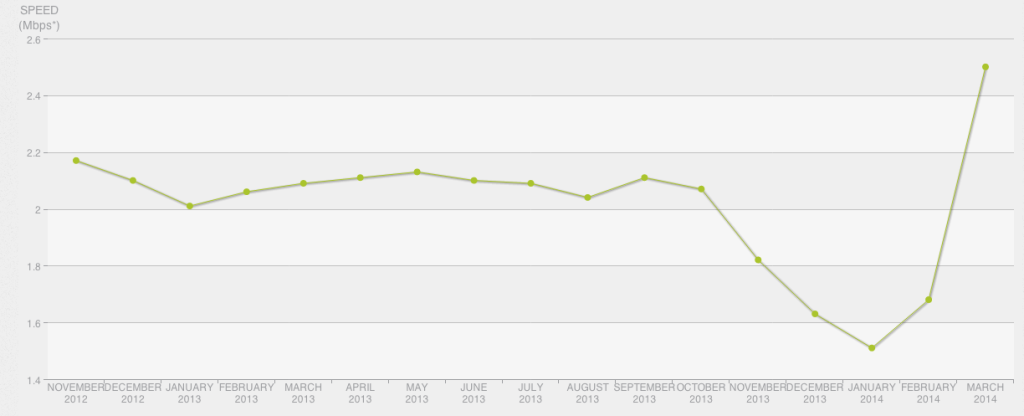

Now That Netflix Is Paying Comcast, Users Finally Get Decent Speeds… But At What Cost? Image courtesy of Comcast's speed has rebounded to its fastest ever since bottoming out in January.

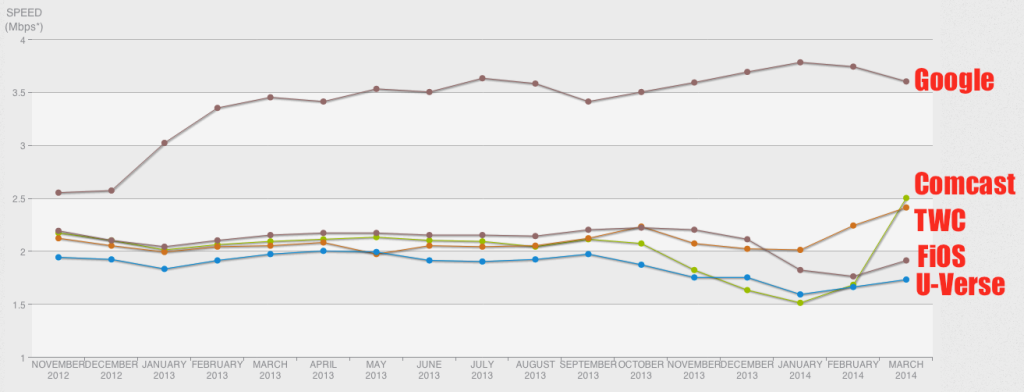

Netflix has released its latest Speed Index numbers, and in the two months since their paid-peering deal was announced, Comcast has jumped from the worst cable Internet provider in the group (only performing slightly better than standard DSL services) to the fifth-fastest provider in the U.S., with an improvement of 65% in downstream speeds.

While this is undoubtedly good news for Comcast subscribers who had been watching their Netflix signal degrade since last summer, as Comcast allowed the traffic to bottleneck, the precedent being set by this arrangement gives rise to some bigger-picture concerns, especially if Comcast’s merger with Time Warner Cable is approved.

1. ENCOURAGING THE OTHER GUYS

Comcast has shown the other ISPs that its strategy of refusing to open up peering connections worked to bring the country’s largest bandwidth user to the bargaining table. While Comcast is larger than any of the other ISPs currently trying this tactic (we’re looking at you AT&T U-Verse and Verizon FiOS), its success at getting Netflix to fork over the cash will only embolden the other providers to stick to their guns, even as FiOS and U-Verse continue to provide substandard speeds.

Remember, Comcast had an incentive to look good for the regulators investigating its merger with TWC. Verizon and AT&T have no such pressure and can continue playing this game of chicken until they get paid.

And when they do get paid, you can rest assured that Netflix will have to get that money from subscribers, which means higher rates, fewer selections, less investment in technology.

2. AN UNCLEAR FUTURE

It’s not known what, if any, considerations the Comcast/Netflix deal has for the 10 million or so customers Comcast could acquire if the TWC merger is approved. TWC has not acted to let Netflix service bottleneck and has instead maintained middle-of-the-pack status for quite some time.

Will be forced to pay even more money just because Comcast buys TWC? If not, will Comcast allow Netflix service to inherited TWC customers to degrade in order to justify getting more money from Netflix?

3. BARRIERS TO ENTRY

Netflix, with its large, established international customer base, is currently able to afford paid-peering deals. But what about its competitors that are just trying to crack the market, or the ones that are making their case right now to some venture capitalists? Streaming video content is already an incredibly complicated and expensive proposition without having to worry about being punished by the cable companies who often control the last mile of data to the home, and many of whom have competing services of their own.

Alas, while FCC Chair Tom Wheeler has said that peering and interconnectivity are indeed within his agency’s purview, his office recently confirmed that these issues will not be part of the updated net neutrality issues the FCC is currently drafting.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.