Most Debt Collector Complaints Made By Consumers Being Hounded For Money They Don’t Owe

(nvaine)

Since 2011, the Consumer Financial Protection Bureau has been working to rein in collectors’ less than savory tactics of separating consumers from their money. A report to Congress highlights the Bureau’s efforts to carry out the Fair Debt Collection Practices Act, including a review of the new consumer complaint system.

NONEXISTENT DEBT

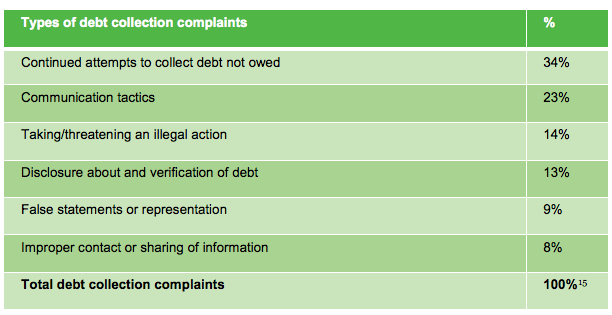

While the Act creates a fairly straight forward list of things debt collectors can’t do when contacting consumers, a number of collectors don’t play by the rules. And that’s evident when reviewing the more than 30,300 consumer complaints the Bureau received about the market from July 2013 through December 2013.

The CFPB’s “Fair Debt Collection Practices Act” annual report [PDF] shows that nearly 34% of complaints received by the Bureau involve consumers being hounded by collectors for a debt the consumer does not believe is owed.

Of those complaints 65% of consumers report the debt is not theirs, and 27% report the debt was paid.

The reports notes that in many cases the attempt to collect the debt is not the issue, but rather the calculation of the amount of underlying debt is inaccurate or unfair.

“Consumers should never be hounded about debts they do not owe,” CFPB Director Richard Cordray says in a news release. “We will not tolerate companies harassing consumers or threatening illegal actions in the debt collection market. We will continue to work hard to ensure that consumers are treated with dignity and fairness.”

AN AGGRESSIVE PURSUIT

The second-most frequent complaint the Bureau received involves aggressive tactics used by debt collectors. Many of the complainants, 55%, detailed frequent or repeated improper telephone calls made by collectors.

Often, these complaints stem from being called about another person’s debt. Sometimes the call is for someone with a similar name. More often, it appears the consumer’s phone number has mistakenly been included in the collector’s information about another person’s account. Consumers often complain to the CFPB when the collector continues to call even after the consumer has repeatedly told the collector that the alleged debtor cannot be contacted at the dialed number.

Consumers also complained about debt collectors calling their places of employment or third parties.

Additionally, 30% of consumer complaints alleged that collectors threaten to take legal action, while 2% complain about the use of obscene, profane or abusive language during phone calls.

ILLEGAL ACTIONS

The third most common complaint consumers made involves the collector threatening action deemed illegal under the FDCPA.

The act makes it illegal for debt collectors to threaten to arrest consumer for not paying a debt, yet 60% of the complaints about illegal action involved a collector threatening just that.

Another big no-no for debt collectors is to impersonate law enforcement or government officials. Even with the Federal Trade Commission cracking down on such cases, nearly 31% of complaints about false statements or representations involved a collector pretending to be a government official.

Consumer advocates say the issues dealt with in the complaints come as no surprise.

“We’ve been calling out these kinds of abuses for years,” our very own Consumers Union posted on the DefendYourDollars blog Thursday. “Most recently, we urged the CFPB to issue strong rules that will protection consumers from unfair and deceptive practices by debt collectors.”

COMPLAINT RECEIVED, NOW WHAT?

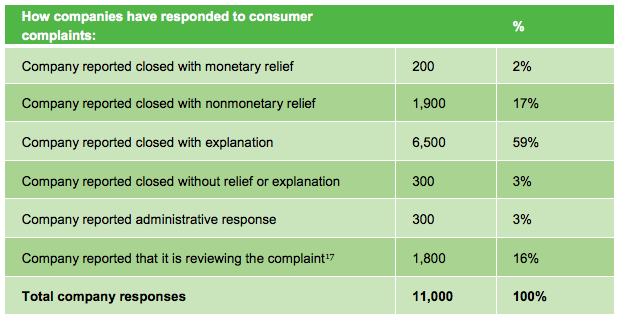

Of the 30,300 debt collection complaints received, the CFPB sent approximately 11,000 to companies for their review and response. Nearly 9,000 of the complaints sent to companies have elicited a response. More than half of those complaints were closed with an explanation to the Bureau.

The Bureau referred some of the remaining complaints to other regulatory agencies, while other were found to be incomplete or currently pending.

TAKING BABY STEPS

Although the number of complaints received in just half the year seem staggering, the CFPB made strides in reining in the debt collection market last year.

The Bureau sued online loan servicer, CashCall Inc., its owner, its subsidiary, and its affiliate for collecting money on loans that were legally invalid. In separate action, the Bureau ordered payday lender Cash America International, Inc. to refund up to $14 million to consumers for robo-signing court documents in debt collection lawsuits.

In January 2013 , the Bureau’s larger participant rule for debt collection went into effect. Under the rule, the Bureau has supervisory authority over any firm with more than $10 million in annual receipts from consumer debt collection.

In November, the CFPB created the Advance Notice of Proposed Rulemaking, the first step toward considering consumer protection rules for the debt collection market.

While ANPR is an adequate start, consumer advocates say more can be done to ensure consumer protection.

Consumers Union continues to urge the Bureau to write rules that achieve: sensible regulations that apply to all persons collecting debt and strong federal standards for information flow and verification procedures.

“The debt collection system has been long overdue for a comprehensive overhaul, to address current market realities and provide meaningful protections to consumers,” officials with Consumers Union posted on its DefendYourDollars blog. “By writing strong rules of the road at the federal level, the Bureau can help ensure that consumers across the country have basic important protections against improper collection practices.”

Consumer Financial Protection Bureau: Consumers Report Being Hounded About Debts Not Owed [CFPB]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.