34% Of Uninsured Choosing To Stay Without Health Coverage, 70% Don’t Know About Subsidies

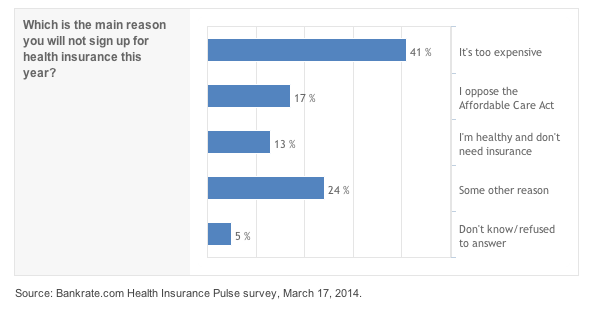

This is according to a new survey from the folks at Bankrate.com, which found that, of those opting to face the penalty instead of obtaining coverage, 41% said it was because they believed that insurance is too expensive for them.

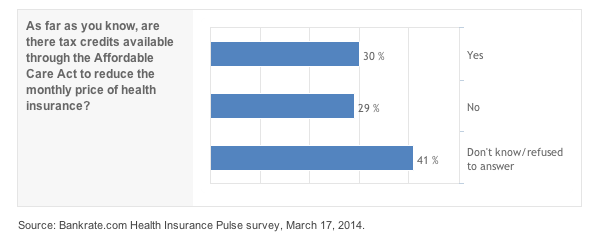

However, the survey also found that only 30% of uninsured Americans are even aware of subsidies and tax credits that are available to bring down the cost. That’s virtually the same number (29%) as those who incorrectly believe there are no such credits, and markedly below the 41% of uninsured people who admitted to not knowing about these subsidies.

Another reason given for choosing to not get coverage was opposition to the Affordable Care Act. This was the answer for about 1-in-6 of those people who said they will not get insurance by the March 31 deadline. That group was dominated by males, who were nearly three times more likely to give this reason than females.

The 18-29 year-old demographic has been the subject of much of the marketing for the ACA, but the Bankrate survey found what you’d probably expect to find among this age group — a sense of invincibility and a perceived immunity from all things that could make you sick or kill you — with 31% of uninsured young adults saying they simply don’t need insurance because they are healthy.

Just remember that thought when a piano or anvil falls on top of you from a comical height.

Whatever you decide to do, and whatever your reasons are, just know that the deadline is March 31. That way, you’re truly making a decision to obtain or not obtain coverage, rather than simply letting the deadline pass because you weren’t aware of it.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.