How Did $42 Girl Scout Cookie Purchase Become $800 Legal Bill?

A Colorado man says he was just trying to help out his local Girl Scout troop (and get some cookies in return, of course) when he wrote a check for $42, but it’s turned into a monster headache that has made him the target of a debt collector and cost him hundreds of dollars.

A Colorado man says he was just trying to help out his local Girl Scout troop (and get some cookies in return, of course) when he wrote a check for $42, but it’s turned into a monster headache that has made him the target of a debt collector and cost him hundreds of dollars.

The man tells CBS Denver that it was six months after he’d purchased the Girl Scout cookies that he received a notice from a collections agency that demanded $82 (the collector tacked on $40 in fees) for a check had allegedly bounced because his account had been closed.

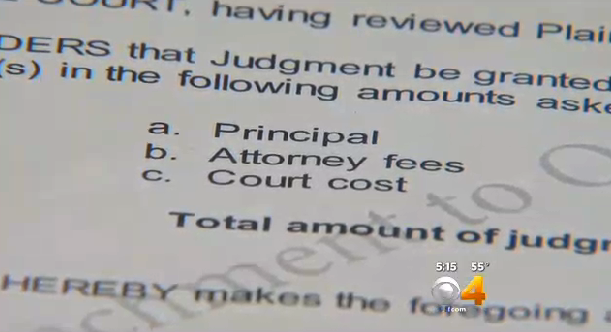

Since then, it’s spiraled into $800 worth of legal expenses trying to clear his name and shake the collections folks off his back. He got documented proof from his bank showing that his account was not closed, but the collection action continued.

He also claims that he attempted to send another payment to the troop but it was refused because they had already turned the debt over to collections.

“What did I do to deserve this? I just wrote the check. I was helping the Girl Scouts and now I’m having to go court over and over again and answering legal questions that I have no business answering,” he says.

A rep for Girl Scouts of Colorado explained to CBS that “When a check is reported as bad debt by a troop’s bank, the troop attempts to contact the customer and the council then attempts to resolve the debt” before it goes to collections.

However, the customer says that “No Girl Scout ever came to my house or left a note on my door.”

So now the man has advice for anyone looking to buy Girl Scout cookies: “pay cash!”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.