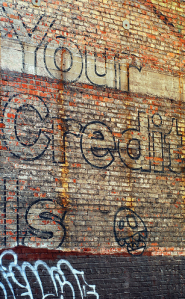

Poor Credit Reports Start Vicious Economic Cycle; Can It Be Stopped? Image courtesy of (James Callan)

For some people, bad credit is a result of being irresponsible. For others, it’s a matter of bad luck and overwhelming circumstance. Alas, the credit reporting agencies don’t make such distinctions, meaning someone whose house went into foreclosure because he lost his job and also had to be hospitalized is treated the same as the person who stopped making mortgage payments because they didn’t feel like it.

A new study by the National Consumer Law Center says there’s always more to the story, especially when it comes to the aftereffects of foreclosure during the recent recession.

Americans are still hurting from the collapse of the housing market, the subsequent recession and foreclosure fest, a crisis that resulted in more than 4.5 million people losing their homes. The long-term damage to these former homeowners’ credit means they will likely not be able to secure a new mortgage for another decade.

And the recession’s effect on American consumers’ credit is more than just the inability to get a loan. Bad credit can keep those consumers from getting jobs, affordable housing and insurance.

Not every home lost to foreclosure is the result of people buying properties they couldn’t afford or taking out loans they weren’t qualified to repay. Many foreclosures occurred because consumers lost their jobs, or fell victim to predatory lending and exploding Adjustable Rate Mortgages.

Even with circumstances out of consumers’ control, their credit histories are forever tainted. Foreclosures, which can lower a credit score by several hundred points, typically stay on a consumers’ report for seven years.

The NCLC is hoping its new report [PDF] is a step to changing the way consumers’ credit histories are viewed .

“For millions of Americans, bad credit records are the result of bad luck, not bad character,” Chi Chi Wu, National Consumer Law Center attorney and author of the report, wrote. “We hope this paper will prompt the development of methods to judge consumers so that they are not unfairly penalized by job loss, illness, or other life circumstances outside of their control.”

The report notes the recession created a vicious cycle of economic harm.

Economic harm causes low scores, which in turn prevents recovery and consumer’s lack of recovery continues to drag down the economy as a whole.

So how is the vicious cycle stopped? How do consumers get passed their credit history?

The NCLC lays out a number of options and ideas to lessen the negative impact on consumers:

- Revise the amount of time adverse mortgage information appears on credit reports – no more than three years;

- Prohibit insurers, employers and landlords from considering credit reports;

- Create exceptions or models to consider extraordinary life circumstances;

- Consider alternatives to traditional credit scores.

While more research is needed to improve credit judging methods, the NCLC maintains consumers should not be unfairly penalized for economic and life circumstances that are out of their control.

Solving the Credit Conundrum: Helping Consumers’ Credit Records Impaired by the Foreclosure Crisis and Great Recession [National Consumer Law Center]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.