This Bank Customer Satisfaction Chart Is A Sad Reminder Of Rampant Consolidation

(source: ACSI)

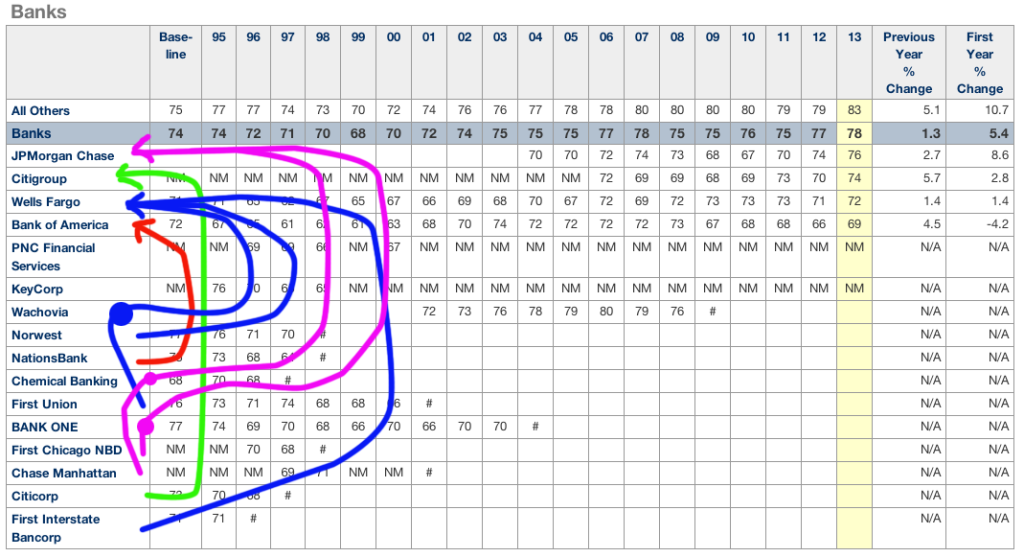

The above chart is the latest banking report from the American Customer Satisfaction Index, and while it shows that people don’t hate banks as much as they used to, it also shows how few banks remain to service consumers in the U.S.

While there are 16 individual institutions listed on the chart, with data going back as far as 1995, the latest ratings only have scores for 4 banks (along with an aggregate score for “all others”) — JPMorgan Chase, Citigroup, Wells Fargo, and Bank of America.

So what happened to the others on the list? With the exception of PNC and Key — which apparently didn’t receive enough data from customers to merit a score — the rest of the banks are all now part of one of the four remaining biggies.

We mentioned the fate of NationsBank in the earlier story, but the short version is that it merged with BankAmerica to form Bank of America.

Citicorp became Citigroup following its 1998 merger with Travelers Group.

First Union merged with Wachovia in 2001. When Wachovia failed following the collapse of the U.S. housing market, it became part of Wells Fargo, which had already acquired First Interstate in 1996, two years before Wells Fargo was acquired by Norwest (but kept the more recognizable Wells name).

Chemical Bank acquired Chase Manhattan in 1995, but chose to keep the Chase name intact, and then merged with J.P. Morgan to form JPMorgan Chase, which in 2004 merged with Bank One, which had previously acquired First Chicago.

These now-gone banks are just a drop in the bucket of the 10,000+ financial institutions that have disappeared (whether through merger or failure) since 1984.

Fewer options is never a good thing, especially at a time when the companies that control the market increasingly treat the average consumer like a necessary evil who should pay dearly for the privilege to have a place in which to deposit his money.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.