FDIC & OCC Ask Banks To Please Stop Issuing Payday Loans As “Direct Deposit Advances”

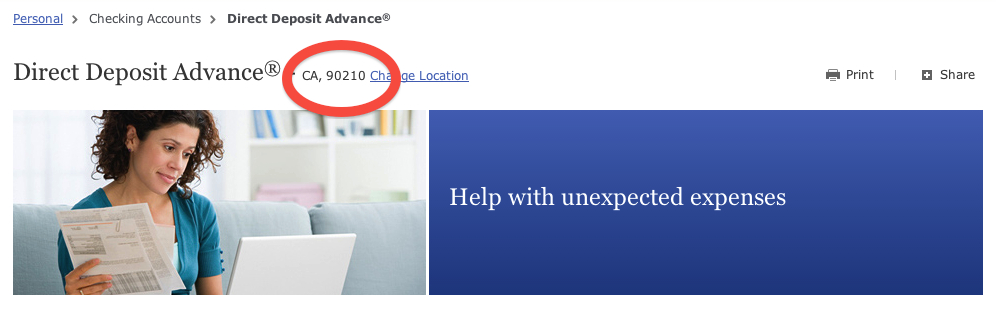

You’ll notice that I had to lie about my ZIP code on the Wells Fargo site just to make this screengrab, as Direct Deposit Advance is not available in states like Pennsylvania that don’t allow payday loans.

While many payday lending operations are not directly tied to federally insured banks, some of the biggest names in banking — most notably Wells Fargo — offer what are effectively payday loans via “Direct Deposit Advance Loans.” But today the FDIC and the Office of the Comptroller of the Currency have given some guidance to the banks they regulate, basically saying “That’s enough of that, don’t ya think?”

Just like payday loans, Direct Deposit Advances offer short-term, relatively low-value loans, but with hefty fees that can make the money difficult to repay in a short period of time. Thus, borrowers often need to take out a new loan to pay off the previous one, and so on and so on.

Earlier this year, a California woman testified before a Senate committee on how her $500 Wells Fargo Direct Deposit Advance ultimately ended up costing her $3,000.

For years, consumer advocates and even some lawmakers have called for an end to these loans, claiming they are predatory and that they also pose a financial and reputational risk to the banks that offer them.

And so, as a guidance to federally insured banks, the FDIC and OCC have each issued a 22-page guidance document [PDF] that spells out all the reasons banks should not offer these loans, effectively telling the institutions to put an end to the practice.

HUGE RISKS FOR ALL INVOLVED

“The FDIC continues to encourage banks to respond to customers’ small-dollar credit needs,” reads the letter, “however, banks should be aware that deposit advance products can pose a variety of credit, reputation, operational, compliance, and other risks.”

While banks justify the huge fees associated with Direct Deposit Advance loans as being in line with the high credit risk for the borrowers, the guidance points out that many lenders don’t even check a borrower’s creditworthiness before issuing a Direct Deposit Advance:

“Typically, the bank does not analyze the customer’s ability to repay the loan based on recurring debits or other indications of a need for residual income to pay other bills. The decision to advance credit to customers, based solely on the amount and frequency of their deposits, stands in contrast to banks’ traditional underwriting standards for other products, which typically include an assessment of the ability to repay the loan based on an analysis of the customer’s finances.”

This failure to consider whether the borrowers’ income sources are adequate to repay the debt while also covering typical living expenses and other debt payments “presents safety and soundness risks,” warns the guidance document.

REPEAT BUSINESS

The regulators also take issue with the controls that some banks have in place that are intended to curb repeat borrowing.

Some banks have mandatory “cooling off” periods for heavy borrowers — for example, someone who has taken out at least one loan per month for six consecutive months — that keep the borrower from taking out a new loan for a month or so. But once that period ends, the loan cycle can start anew.

Another attempt at reining in repeat borrowing puts a 1-year loan ban on someone who has maxed out their advance each month for six consecutive months. But as the FDIC and OCC point out, all the customer needs to do to avoid triggering this ban is take out slightly less than the maximum advance.

Banks are also taken to task for how they market Direct Deposit Advances:

“Banks market deposit advance products as intended to assist customers through a financial emergency or to meet short-term needs. These advances, however, are typically not included with the bank’s list of available credit products, but are instead listed as a deposit account ‘feature.’ Customers are alerted to the availability of the products by a reference on their account statements or a ‘button’ or hot link on their personal accounts’ webpages, but it is not clear that the customers are made equally aware of less expensive alternatives.”

RUINING YOUR REP

The letters make it quite clear that the regulators view Direct Deposit Advances as posing the same risks as payday loans, i.e., “high fees; very short, lump-sum repayment terms; and inadequate attention to the consumer’s ability to repay.”

As such, the FDIC and OCC warn banks against the ever-growing public sentiment against Direct Deposit Advances and how that backlash could ultimately harm the lending institution:

Deposit advance products are receiving significant levels of negative news coverage and public scrutiny. This increased scrutiny includes reports of high fees and customers taking out multiple advances to cover prior advances and everyday expenses. Engaging in practices that are perceived to be unfair or detrimental to the customer can cause a bank to lose community support and business.

LEGAL MATTERS

The regulators warn banks that they risk running afoul of numerous federal laws.

First, there is the FTC Act, which among other things outlaws deceptive marketing practices that cause consumers harm. “Deposit advance products may raise issues under the FTC Act depending upon how the products are marketed and administered,” reads the guidance, pointing out that the ban on unfair or deceptive acts and practices “applies not only to the product, but to every stage and activity, from product development to the creation and rollout of marketing campaigns, and to servicing and collections.”

To that end, “marketing materials and disclosures should be clear, conspicuous, accurate, and timely and should describe fairly and adequately the terms, benefits, potential risks, and material limitations of the product.”

Alas, that may take away all the fun and surprise of Direct Deposit Advances.

Another legal matter facing banks is the Electronic Fund Transfer Act, which prohibits creditors from mandating that loans be repaid by “preauthorized electronic fund transfers,” and allows customers to withdraw authorization for “preauthorized fund transfers.” This is not something that all lenders have made known to borrowers.

Then there’s the Truth In Savings Act Under which requires that account disclosures must include the amount of any fee that may be imposed in connection with the account and the conditions under which the fee may be imposed, while also prohibiting a bank from making any advertisement, announcement, or solicitation relating to a deposit account that is inaccurate or misleading or that misrepresents their deposit contracts.

GETTING THE MESSAGE?

“Although this guidance applies only to banks supervised by the FDIC and OCC, we expect and hope that all banks will accept this as a clear warning to stop pushing payday loans, including banks supervised by the Federal Reserve,” writes the Center for Responsible Lending in a statement. “We also expect that banks will view this guidance as a new opportunity to develop more responsible small dollar loan products that will be mutually beneficial to the banks and their customers.”

In a statement to Consumerist, a rep for Wells Fargo says that the bank, which is regulated by the OCC is “reviewing the OCC’s final guidance on deposit advance products. Once we’ve studied the OCC’s report, we will make a determination about our Direct Deposit Advance service and any changes that may be required. We will communicate extensively with our customers when we know more.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.