Getting Ahead On Paying Down Student Loans Is A Good Plan, But Not Without Problems

In his annual report [PDF] on the state of student loan servicing, CFPB Student Loan Ombudsman Rohit Chopra writes that some borrowers who try to get ahead of their loans face a variety of snags.

“Many consumers find that they are unable to verify whether payments are appropriately applied when they make additional payments in order to pay off their loans more quickly,” writes Chopra. “Typically, companies will first apply payments to satisfy outstanding fees and interest and then allocate any additional funds to principal. Generally, interest accrues daily on student loans, and therefore, the amount of the payment that is applied to principal depends on when the payment is submitted.”

Another issue is that servicers are placing some borrowers into “paid ahead” or “advanced payment” status, indicating that these people have paid a future bill, but not making it clear whether that balance is being applied immediately toward the principal of the loan. Generally speaking, the extra money is paying down the principal and being put toward the next month’s bill, but that isn’t always the case, and even when it is, servicers aren’t always making it clear.

“Consumers have expressed confusion when receiving a bill for $0.00 amount due,” reads the report, “leading many to be unsure as to whether their automatic debit payment will be processed or if they need to submit a payment the following month. Frequently, consumers do not know if their additional payment was actually applied to principal or whether it was used to satisfy a future installment.”

Problems with prepaying student loans are often compounded when the borrower has multiple loans with the same servicer. Payments for these loans may all be going to the same place, but they usually have different balances, interest rates, and amortization schedules.

“A number of private student loan borrowers note significant difficulties when submitting a single payment to cover several loans associated with the same servicer,” reads the report. “These borrowers claim that payments are generally not applied in a way that helps them to pay off their loans with the

highest rates.”

Some borrowers claim that even when they provide their servicers with explicit details of exactly how much of each payment should to which loans, “many student loan servicers elect to apply extra payments as they see fit — and not necessarily in the way that offers the greatest benefit to the borrower.”

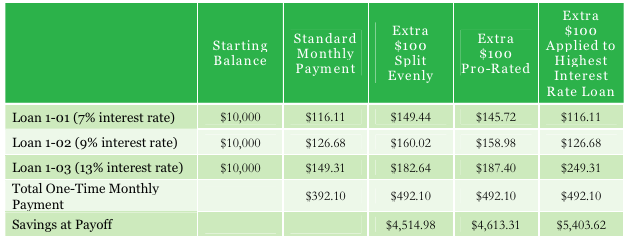

See the below chart for a hypothetical borrower with three, $10,000 loans, each with a different interest rate. Her monthly bill is $392.10. But what happens when she decides to get ahead of the loan and pay an additional $100/month?

It all depends on where the additional money is allocated. If it goes equally ($33.33/month) to each loan, she’ll save $4,515 in interest by the time she’s paid off all the loans. If the $100 is prorated so that each loan receives a proportional amount of the money, the savings are slightly higher ($4,613). But if the entire $100 is allocated only to the loan with the highest interest rate, the borrower saves $5,404.

And that’s just someone paying an extra 25% on top of their regular monthly payment. Some borrowers choose to pay significantly more than that to shake off the yoke of student loan payments. The savings difference could be thousands of dollars if the additional money isn’t allocated properly.

It seems like the default at most servicers is to prorate additional payments according to the size of the standard monthly payment, rather than apply the money to the loan with the highest interest rate. Depending on the balances on your various loans and their respective interest rates, this may be fine. You may even choose to pay down a lower-interest loan because it has such a high balance. Regardless, the choice for how your money is allocated should be yours.

If you have multiple loans with the same servicer, the CFPB has some guidance on how to contact your loan servicer, including a downloadable sample letter, to make it known exactly how you’d like any above-the-minimum payments allocated.

And remember that the CFPB has a complaint portal specifically for issues related to the servicing of student loans. According to the report, it received around 3,800 complaints between Sept. 2012 and Oct. 2013.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.