Senate Fails To Figure Out Solution To Keep Student Loan Rates In Check

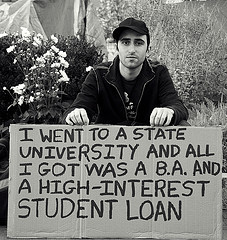

For the past few years, interest rates on subsidized Stafford loans has been kept at 3.4%. The latest extension of that interest rate expired on July 1, meaning that any loans disbursed for the first time after that date will have the new interest rate of 6.8%, which could means thousands of dollars in additional interest for new students, and even more student loan debt added to the $1 trillion that is already outstanding.

While the House of Representatives has passed a bill that would tie Stafford loan rates to the yield on 10-year Treasury notes, the Senate is divided on how to tackle the problem.

Some had hoped to simply extend the 3.4% interest rate to June 30, 2014 (retroactive to July 1) while a long-term deal was hammered out, but today’s procedural vote only received 51 of the 60 votes needed to move that bill forward.

“Today, we failed, and the nation’s students pay the cost of that failure,” lamented Sen. Tom Udall of New Mexico.

The House bill has both fans and critics in the Senate. Proponents say it is a forward-looking solution that ties interest rates to the performance of the economy, while opponents are concerned that it allows interest rates to vary too wildly and unpredictably. If the economy tanks again, students would be borrowing at next-to-nothing. If things improve dramatically, they could be paying more than the 6.8% interest that all this negotiating is intended to prevent.

Additionally, there is a rift over whether the government should make a profit on the loans — and then use that profit to pay down the debt — or whether loans should be given out at cost.

Shortly before the holiday break, a bipartisan group of Senators, led by Sen. Joe Manchin of West Virginia, created the Bipartisan Student Loan Certainty Act, which they see as a reasonable compromise. It ties student loan rates to the U.S. Treasury 10-year borrowing rate and fixes the interest rate for the life of the loan.

The Democratic leadership, pushing for the 1-year extension, did not allow a vote on this bill. Thus, several of its backers voted “no” in today’s procedural vote.

With many student loans set to be disbursed in early August, time is running out for some sort of deal to be hammered out. There was much more urgency from both sides in the summer of 2012, but that was a Presidential election year and both parties were making a final push for votes.

Democratic Rifts Stymie Senate Bill on Student Loan Rates [NY Times]

As Standoff Continues, Student-Loan Fix Fails in Senate [ABC News]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.