Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully.

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully.

Joseph A. Smith, Jr. is the Monitor of the National Mortgage Settlement and he recently filed compliance reports on the five servicers with a U.S. District Court in Washington, D.C. He also published report cards for each servicer to show how the banks performed when tested on a wide variety of compliance issues; from small-ish things like providing a single point of contact for homeowners involved in the settlement to bigger issues like foreclosing in error.

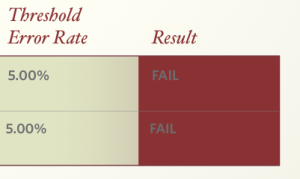

Only ResCap Parties, the name given to Ally’s former mortgage servicing portfolio that has since been sold off to new owners, passed all of the tests run by the Monitor during the previous six months. The four other servicers each failed at least one test.

Bank of America failed twice — first on the test to see if it provided accurate information in letters sent to homeowners before putting the property into foreclosure; then a second failure on the rule requiring servicers to let modification-seeking customers know within five days whether or not they have sent in all necessary documents.

That second one will come as little surprise to anyone who read the sworn statements of a half-dozen former BofA employees who allege the bank not only deliberately “loses” modification paperwork, but uses financial incentives to encourage employees to do so.

The monitor says that Wells Fargo also failed when tested for compliance with this same five-day notification rule.

Chase disclosed to the Monitor that it failed two tests. The first test requires that banks terminate forced-place insurance within 15 days of receiving proof that coverage exists. Forced-place insurance is purchased by mortgage servicers when a homeowners fails to provide her own homeowner’s insurance on the property. It is often significantly more expensive, and usually only covers the bank’s investment in the property.

Chase’s second fail was in the test to see if the servicer follows the timelines for making a decision on a borrower’s loan modification application and for notifying the customer of its denial decision.

With three failed tests, Citi was the worst performer of the bunch. Like BofA and Wells, it failed in the requirement of letting modification applicants know whether their documents had been received in a timely manner. It also shared BofA’s failure to provide accurate information on pre-foreclosure letters to homeowners. Perhaps the two were looking at each others’ tests?

For good measure, Citi threw in a third and final failure in the test for compliance with a requirement to notify borrowers about missing documents within 30 days of a request for a short sale.

When a bank fails one of these tests, it must provide the Monitor with a Corrective Action Plan, which may include compensation for wronged borrowers. The tests will then be repeated, and if further violations are discovered, there could be financial penalties.

“These findings, combined with the complaints I have heard from attorneys general, counselors and distressed borrowers, tell me there is still work to be done,” said Smith in a statement. “While I believe distressed servicing is better this year than it was last, it is not yet where it needs to be… While there is more work to be done, I remain confident that the Settlement is helping to improve the mortgage finance system.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.