Senate Signs Off On Marketplace Fairness Act; Online Sales Tax Inches Closer To Reality

If you’re one of the many Amazon customers whose state has yet to reach an agreement about the collection of online sales tax, this will probably be bad news. This afternoon, the Senate voted in favor of the Marketplace Fairness Act, which would give each state the authority to compel online businesses to collect applicable taxes.

If you’re one of the many Amazon customers whose state has yet to reach an agreement about the collection of online sales tax, this will probably be bad news. This afternoon, the Senate voted in favor of the Marketplace Fairness Act, which would give each state the authority to compel online businesses to collect applicable taxes.

Currently, online businesses without a physical presence in a state are not obliged to collect tax from customers — even though consumers have a duty to pay this usage tax when they file their annual tax returns. The Act would grant each state the ability to decide whether online businesses need to collect the tax (Prediction: They will).

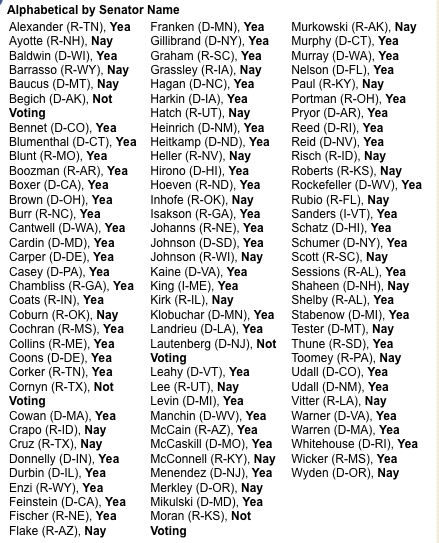

The 69-27 vote in favor of the Senate version of the Act is obviously a thrill to bricks-and-mortar retailers who have long claimed that putting the onus on consumer to pay the taxes from online purchases effectively allows shoppers to buy things “tax-free.” Cash-strapped state governments have also been championing the Act, as this would mean many millions of dollars in additional tax revenue that is currently going uncollected.

“The Senate’s overwhelmingly bipartisan passage of this legislation foreshadows the end of the special treatment of big online businesses at the expense of retailers on Main Street,” said the Sr. VP for government affairs of the Retail Industry Leadership Association. “After such a resounding vote in the Senate, we look forward to a constructive debate in the House to level the playing field for all retailers this year.”

Opponents of the Act claim that it puts an undue burden on smaller online businesses who sell to people in multiple states but who are not currently equipped to handle the collecting and reporting of the taxes in each state in which they sell.

“After a rushed legislative process culminating in only one minor amendment being processed out of the more than 50 filed, the Senate finally passed the misguided Marketplace Fairness Act,” says Andrew Moylan, Senior Fellow with the R Street Institute, which has tried to rally opposition to the Act. “By wiping away geographic limits to state tax authority, the bill would impose serious burdens on Internet retail and undermine basic tax policy principles. It is now up to conservative leaders in the House of Representatives to stop this bad legislation in its tracks.”

There was always little doubt that the Senate would pass the Act. The House has its own version of the Marketplace Fairness Act, which has yet to be scheduled for a hearing or vote. Some House Republicans have voiced concerns with the legislation. However, if the House does eventually give its go-ahead to the bill, the President has already stated he supports the idea.

“The House and the Senate are different institutions,” explains Matthew Shay, CEO of the National Retail Federation. “That’s going to dictate that we have different kinds of conversations.”

If you’re interested in how your state’s Senators voted (or didn’t vote, in a few cases), here’s a list:

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.