Why Is TurboTax Asking Me For A Donation?

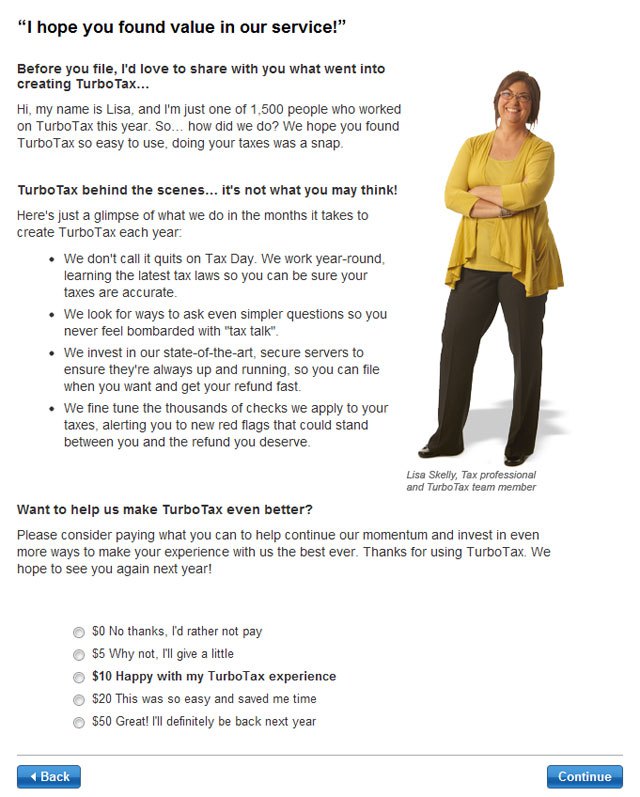

Well, that headline is a little disingenuous. We know exactly why. K. filed his federal return using the free e-file service through Intuit’s TurboTax. It nagged him to upgrade to the paid service here and there during the process, which you expect when using any free service. What he didn’t expect was a pop-up with Lisa the Friendly Accountant acting like a public radio host during pledge drive week. “Intuit is a multi-billion dollar corporation,” he pointed out in his e-mail to Consumerist. “I just found this a bit greedy.”

I did my free e-file with Turbotax. Throughout the process they have several nag screens asking to upgrade to their paid service and I’m ok with those, it’s part of the business. At the end, after failing to get me to upgrade, they show me this screen. They’re begging for a donation, not for some charity, but for themselves. I could understand if this was a small start up or a non-profit but Intuit is a multi-billion dollar corporation. I just found this a bit greedy.

Note that they’ve set the suggested donation at $10, while the basic paid service costs $34.95. (E-filing your state tax return costs extra above that.)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.