A List Of Lists To Help You Organize Your Money

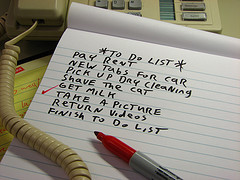

Those who are good with money are almost always organized. One way to get on top of your finances is to keep exhaustive lists of your funds, glimpse the ugly truth they reveal and set financial goals accordingly.

The magnificently named Daily Money Shot offers an idea of a checklist to help get you started.

The post suggests starting with a financial basics checklist, helping you to cobble together necessary financial documents that catalog all areas of your profile, including insurance records, a budget, your will and listings of your assets.

As you set money goals, such as rounding up a down payment for a new car, increasing your retirement investments and cutting your debt, you can use your list to evaluate your progress.

Financial checklists [Daily Money Shot]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.