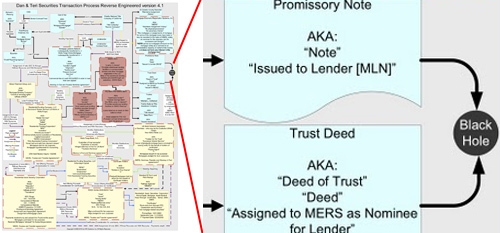

Super Complex Chart Of How A Mortgage Gets Securitized

Gee, how could people who haven’t graduated high school mess this up? This is a chart showing how a mortgage gets securitized made by a guy whose job is to audit securitizations by reverse-engineering them. This is one he did for the mortgage on his own house. My favorite part of the diagram is where the documents go into a black hole. Literally, that’s an actual part of this flowchart.

Go here for the large version. [via Zero Hedge] (Thanks to Gary!)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.