Reporter Lives For Month Without A Bank, Fee Orgy Ensues

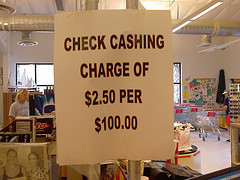

As an experiment, an AP reporter tried to live for a month without using a bank so she could get a taste of how people who can’t get an account, or choose not to, live. She discovered fees and confusion galore, and found that it would end up costing her $1,100 a year just to spend her own money. That’s not even counting the cost of standing in “Soviet-style” lines in grungy check-cashing places to cash her paycheck alongside the great unwashed, and unbanked. Overall, depressing, anxious, and time-consuming experience

Living without a bank: Fees and confusion galore [AP via LowCards.com]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.