50% Of Americans 2 Paychecks Away From Having Big Financial Problemos

Whatever happened to developing an emergency fund to cover rainy day expenses? Apparently many Americans haven’t heard of this practice (or at least aren’t applying it) and now with the economy in the tanker, their financial lives are hanging by a thread. US News reports that half of Americans are two paychecks away from hardship.

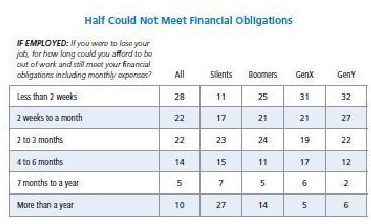

They quote this from a recent MetLife study to highlight the problem:”Without a steady paycheck, 50% of Americans say they could not meet their financial obligations for more than a month – and, of that, a disturbing 28% couldn’t support themselves for more than two weeks of unemployment.”

Ouch. Ok, so some of these are probably people that are earning just enough just to get by, with little to save at all. But even accounting for this, there are still significant numbers who simply didn’t plan for the future, didn’t sock away extra money, didn’t think they needed savings. Or conversely, they simply spent all they had without a care for the future. And now that the future has turned very ugly, they are in deep trouble if a job loss comes their way.

Just as frugality and saving money is making a comeback in popularity because of the economy, let the above fact also bring back the wisdom of having an emergency fund — three to six months (and some would say more in this sort of economy) of living expenses to get you through a tough time in case of job loss or substantial unexpected expense.

Half of Americans Are Two Paychecks Away from Hardship [US News]

— FREE MONEY FINANCE (Photo: robinryan(www.robi nryan.ca))

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.