Chase Replaces Automatic Payments With Monthly Minimum On All WaMu Credit Cards

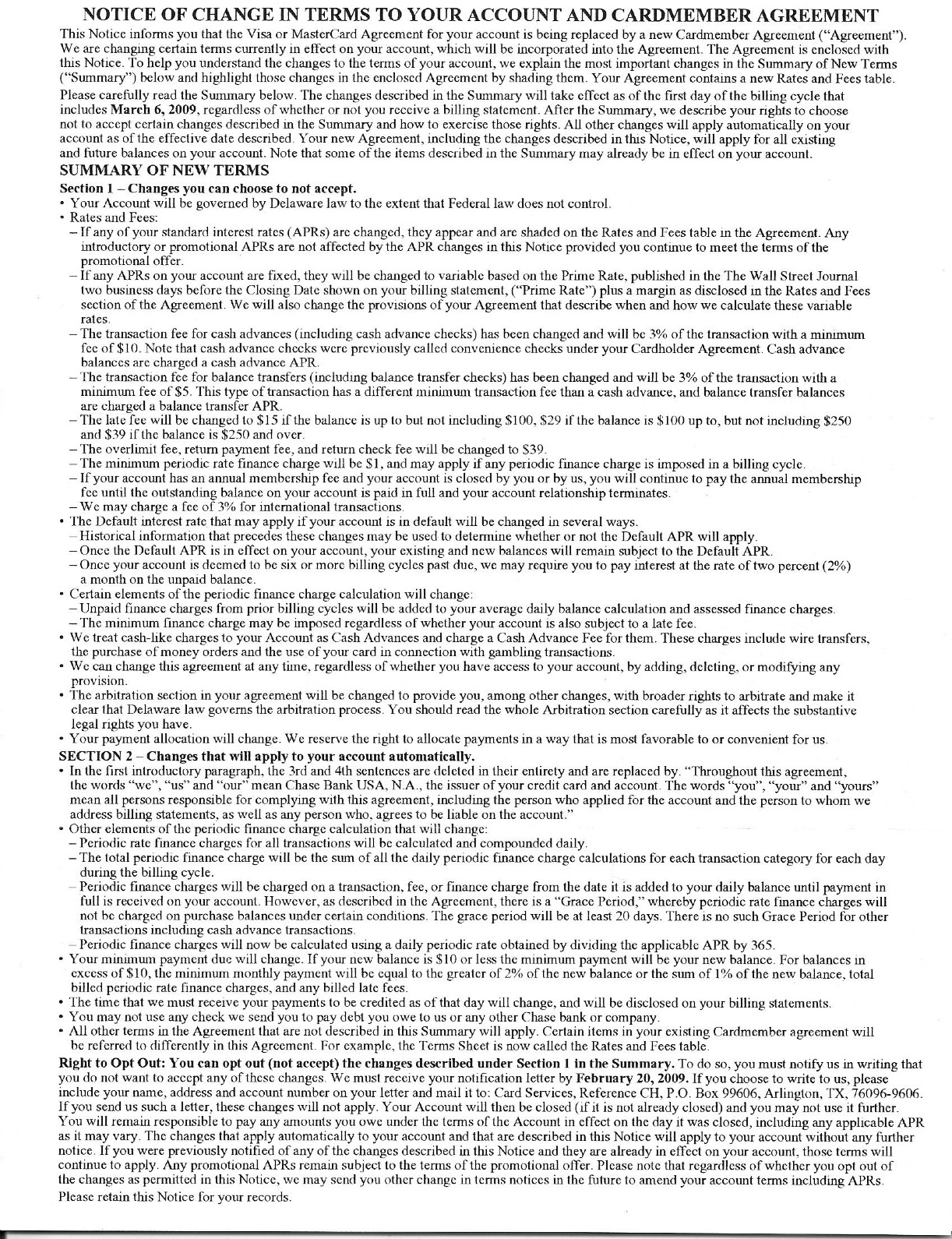

Is your Washington Mutual credit card set to receive automatic payments? If it is, and you pay anything less than the full balance, then come March 6, you’ll be paying only the monthly minimum. Why? Because it’s an easy way for Chase, WaMu’s new corporate overlord, to make money off unsuspecting cardholders…

Chris writes:

As a Washington Mutual credit card holder, I just received a notice from Chase about upcoming changes to my account. Most of it is fairly innocuous, and primarily indicates that account numbers won’t be changing so any automatic payments that use this account will be unaffected. They did slip one sneaky little gotcha in there, and while it won’t affect me I figure you might want to inform your readers. Paragraph four states:

“If you are enrolled in automatic payments to your credit card with a fixed payment amount (e.g. $300 monthly), effective March 6, 2009, your automatic payment will be changed to your monthly minimum payment due.”

That’s a sneaky little change that will hamper anyone who is trying to pay their cards off early; since the next ice age will hit before someone paying the minimum payments will finish paying off their card.

If you don’t like the new terms shown below, you have until February 20 to opt-out.

(Photo: dooleymtv)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.