New insight into how the credit card companies have been secretly judging us all has emerged in a new Federal Reserve report. From Nov ’06-Nov ’09, some credit card companies admit to using more than just the usual income, credit and repayment history to evaluate if they should reduce your line of credit or raise rates. Yep, they’re looking at where you shop. [More]

your money

15 Ways To Protect Your Money While Traveling

Bankrate shares 15 tips to protect your stash of cash while traveling abroad. Before leaving, strip down your wallet to the bare essentials, including a backup credit card, and make copies of all financial documents. While abroad, stash the copies and the backup card in your hotel safe, and take common-sense precautions like sticking to legitimate bank ATMs, and avoiding crowds. Hit the link for the rundown of all 15 tips.

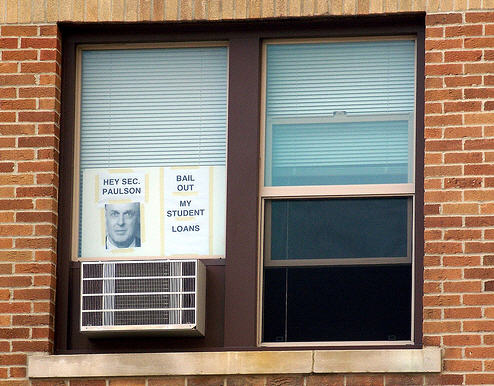

Help! Is Anyone Still Giving Out Private Student Loans!?

Reader Michael has some questions about how the credit crunch is affecting private student loans. Is anyone still lending?

6 Ways Not To F— Up Your Finances Before You're 30

1. Stop with the credit cards already! MSNMoney says that the average credit card debt among 25- to 34-year-olds was $5,200 in 2004. You should be saving in your 20s, not spending.

Don't Let Credit Blocks Eat Up Your Available Balance

Hotels and rental agencies like to carve out the full cost of their services on your credit or debit card before you pay in full. This credit blocking can catch anyone who sticks near their minimum or maximum balance off guard when they try to use their card. Inside, learn how to keep retailers from unexpectedly clogging your credit and debit cards with unwanted blocks.

Computer Glitch Renders Thousands Of HSBC Accounts Inaccessible

HSBC’s core banking system has been hosed for almost a week, preventing thousands of customers from knowing how much money is stashed in their accounts. The widespread problem is limiting access to HSBCDirect accounts, and at least 8,000 Catholic Health System employees up in Buffalo are still waiting for their direct deposit payments to materialize.

Use Your Bank Accounts Every Three Years Or They Will Go To The State

Each year banks give states $4.7 billion belonging to people who failed to “initiate a transaction or communicate with the financial institution” in the past three years. The money isn’t lost forever, but getting it back can be a bureaucratic hassle full of forms and headaches.

Your Bank Is Dead. Quick, Call The Hypnotist!

Gramps could go any minute, but banks only fail on Fridays, giving the FDIC carcass crew plenty of time to line up potential buyers, scrap outdated letterhead, and hire hypnotists to help bank employees remember vault codes…

5 Signs That It's Time To Fire Your Financial Planner

Just because an angry bear market is mauling your portfolio doesn’t necessarily mean that it’s time to fire your financial planner. But you may want to break out the axe at the sight of the following five warning signs…

12 Ways To Save Money Without Scrimping

Some economists think we’re starting to pull out of our not-recession. For those of us who believe them and want to save without putting too firm a dent in our wallets, consider these twelve tips endorsed by the Wall Street Journal.

What The Fed's Rate Cut Means For You

The Fed’s recent quarter-point rate cut could either mean more or less cash in your pocket, depending on what you accounts you own. Here is the breakdown:

Fed Cuts Interest Rates Again

As most economists predicted, the Federal Reserve Board has cut interest rates by a quarter of a point to 4 1/2 percent.

Investors Don't Like Mutual Funds Anymore?

USAToday is reporting that US stock funds, once the darling of investors, aren’t drawing dollars like they used to.

You're Never Too Young To Have Your Identity Stolen

The NYT has an article about Gabriel Jimenez, a 25-year-old who has been battling an identity thief for half his life. His SSN was stolen and used by an illegal immigrant when he was 11, and it’s been a nightmare ever since.

When Warmer Temperatures Throw Off Gas Pumps, Consumers Pay

“In the summer time fuel gets hot and as the fuel gets hot the volume expands, but the energy does not,” says a new report from NPR. The basic idea is that while the volume of fuel expands and contracts, the amount of potential energy within the gas stays the same. A gallon of gas at 80 degrees won’t push a car as far as a gallon of gas at 60 degrees.

A Simple Guide To Setting And Achieving Life Goals

Zen Habits has posted a simple guide to setting and achieving life goals, and we think it’s great. A lot of life goals have a personal finance aspect, and this guide can help you get yourself organized so that you’re not just dreaming of a the day where you have the things you want, you’re actively working towards that future.

It's Time To Think About Loan Consolidation

We know you just graduated and you don’t want to think about your student debt. Really. We understand. Sadly, you need to think about it, and you need to think about it before July 1st.

Walmart Subsidy Watch: Why Do Public Officials Give Your Tax Money To Walmart?

Here’s something we don’t really understand. Why do public officials feel they need to give government subsidies to the nation’s largest employer? It’s sort of baffling.