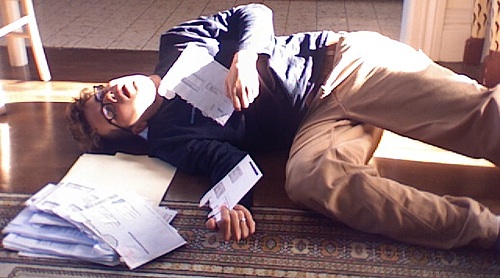

DaBears says TurboTax’s free online tax prep ended up sticking him with hidden fees totaling $60. He writes: [More]

turbo tax

Quicken Online To Be Shut Down Next Year, Accounts Merged With Mint

When news broke back in September that Intuit, the company behind Quicken, was buying personal finance website Mint, everyone wondered how the two services would co-exist. The worst case scenario was that Mint would be absorbed somehow into Intuit’s in-house competitor, Quicken Online. Thankfully, it looks like the opposite will happen.

Turbo Tax Tells You To Print An "Extra Form" But Won't Say Which One

Turbo Tax told reader I’m A Super that he needed to fill out an extra form to complete his state tax return, but wouldn’t tell him which form. Just to be safe, I’m A Super re-downloaded Turbo Tax only to get the same error message. When he called Intuit to ask about the mysterious form, he was that it was solely his responsibility to call the State Tax commission and to review his tax forms to make sure nothing was missing.

Wait, Why Are We Paying Turbo Tax Again?

When a taxpayer files electronically through TurboTax, the information goes first to Intuit’s data center, where the file is batched with others and then sent to I.R.S. computers. The process is almost instantaneous, the company said — when everything goes right. “We are just the transmitter of the return,” said Julie Miller, a spokeswoman for the Intuit TurboTax unit. “In the middle there are no additional steps we are taking.”

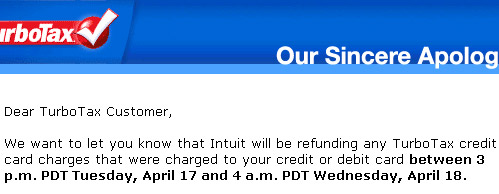

TurboTax Apologizes And Gives Refunds For Filing Slowdown

TurboTax sent an email this morning to customers saying sorry for the big server slowdown on April 17th, and pledging refunds to any one who tried to file that day.

IRS Won't Penalize Turbo Tax Late Filers

Tax procrastinators can stop biting their cuticles, the IRS says they won’t fine anyone who couldn’t file due to Turbo Tax server difficulties.

Interview: Reader Describes Last Night's Turbo Tax Slowdown

We followed up with Derek about his experience with last night’s Turbo Tax system slowdown.

Overwhelmed Turbo Tax Servers Slow To Crawl For E-Filers

Yep, looks like Turbo Taxes servers were totally bunged up last night. Some people were sitting there for hours, waiting for a confirmation after hitting submit. Intuit, makers of Turbo Tax, contacted the IRS but there’s been no official word whether people unable to submit their taxes by the midnight deadline will get an extension. Some statement from the IRS should be out today.

Turbo Tax's Servers Down?

Reader Derek reports he can’t e-file taxes because Turbo Tax’s servers are down. Not sure if others are experiencing this, but he could still file by printing out his return and rushing to a local post office. There may indeed be one nearby open until midnight. — BEN POPKEN

H&R Block Snuffs Tax Efficiency

If your mind has folded in on itself like a Chinese Puzzle Box trying to grok the convolution of this year’s tax forms, we have good news: the IRS bureaucracy wants to make the process as efficient as possible. Unfortunately, the guys you pay to do your taxes don’t… and they’ve successfully lobbied to continue their monopoly on their obtuse arbitration of your income.

Poll: How You’re Doing Taxes

Gawker Media polls require Javascript; if you’re viewing this in an RSS reader, click through to view in your Javascript-enabled web browser.