According to the WSJ Law Blog, the common consensus is that Patriots coach Bill Belichick will be able to deduct his $500,000 cheating fine as an “ordinary and necessary business expense.” Hooray?

tax tip

IRS Reminds You To Keep Your Education Related Receipts

When you’re cleaning out your purse or wallet this week, make sure to save your education related receipts because, depending on your situation, you may be eligible for some spiffy tax breaks in April.

Free Ben & Jerry's Ice Cream On Tax Day, April 17th

Tax Day is April 17th, but don’t be depressed. It’s also free cone day at Ben & Jerry’s. From 12pm to 8pm, at all participating Ben & Jerry’s, you, yes you, can be the recipient of free ice cream.

Consider Itemizing Your Telephone Tax Refund

I found out about the telephone tax refund available on this years tax returns via Consumerist. Would you please encourage your readers to itemize their excise tax charges instead of taking the standard refund amount?

Free Tax Help!

The clock is officially ticking, it’s time to do your taxes. Confused? Need help? You may qualify for some free tax preparation assistance from the IRS. The IRS Volunteer Income Tax Assistance (VITA) Program offer free tax help if you qualify. So, how do you qualify?

Tax Tip: Cell Phones Qualify For Telephone Excise Tax Refund

You may be one of the nearly 160 million phone customers who can request a refund of the 3% federal excise tax paid on long-distance and bundled phone service billed after Feb. 28, 2003 and before Aug. 1, 2006. Federal long-distance excise taxes paid on cell phone, land line, fax, Internet phone service and bundled service all qualify for the refund.

For more information about the telephone excise tax refund, click here.

Download Tax Cut For Free

Still haven’t done the old taxes? Here’s your chance to download TaxCut Premium Federal from HRBlock for free.

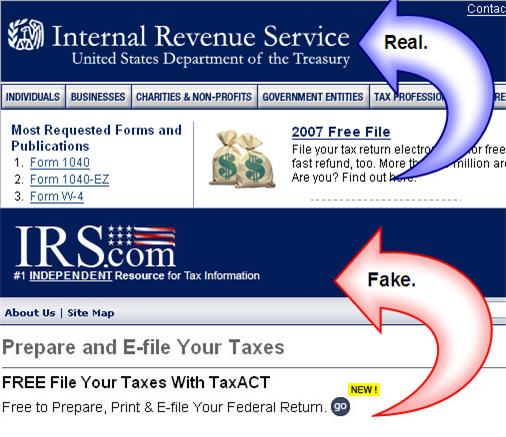

Tax Tip: Watch Out For Fake IRS Sites

The IRS issued an official warning to consumers to watch out for fake IRS sites. The only official IRS website is IRS.gov. Any sites ending with .com, .net, or any other common extension are not official IRS sites.

Why We Procrastinate On Our Taxes

•Delusion No. 1: If I put off filing until the last minute, I’ll have less chance of getting flagged for an audit amid the flood of deadline filers. “I don’t think so,” says Adams. “I’ve never heard that on either this side of the desk or the other.”

IRS Has $2.2 Billion For People Who Haven't Filed a 2003 Tax Return

If you’re one of the 1.8 million people who haven’t bothered to file your 2003 tax return… it’s not too late! No, really. It’s not. You have until April 17, 2007 to file. And why wouldn’t you? The IRS has 2.2 billion dollars waiting for you to collect. If you thought you were in trouble, don’t worry. There’s no penalty for filing a late return if you qualify for a refund.

How To: Attract An IRS Audit

Sometimes the best way to avoid something is to know what attracts it. Thankfully, J.D. at Get Rich Slowly has put together a list of suspicious items that will set off an audit flag on your return. Here are a few:

Hunt Down Your Missing W-2s and 1099s

The deadline for mailing W-2s and 1099s was Jan. 31, so if you don’t have yours yet…they’re probably lost in the mail. Don’t panic, Blueprint for Financial Prosperity has some tips to help track them down.

Tax Tip: New State Sales Tax Calculator

The Sales Tax Calculator is another interactive tool on the IRS.gov web site designed to help make it easier for taxpayers to figure their taxes,” said IRS Commissioner Mark W. Everson.

Tax Tip: April 17th Is Tax Day

• 2006 federal individual income tax returns, whether filed electronically or on paper.

Tax Tip: Do Not Put A Refund Anticipation Loan On A Prepaid Credit Card

As we’ve mentioned before, refund anticipation loans are a bad idea. They’re made doubly bad when they are deposited to a prepaid credit card, but that’s just what HR Block suggests that you do. Why is this a bad idea?

Tax Tip: The 50 Most Overlooked Deductions

AllFinancialMatters has a list of the 50 most overlooked deductions from The Ernst & Young Tax Guide 2007. Highlights of particular interest: