With less than two months left in the year, it’s time to start considering year-end money moves to reduce your 2009 tax burden. To help spur some ideas, MSN Money has ten suggestions as follows:

tax tip

I Underpaid My Taxes, Will I Still Get A Stimulus Rebate Check?

Reader Adam is wondering if he’ll get a rebate check, considering the fact that he underpaid his taxes for 2007:

Help! My Tax Stimulus Rebate Was Direct Deposited Into My IRA! Noooo!

Silly tax payer! You’re not supposed to deposit your tax rebate into your IRA. You’re supposed to spend it on blu-ray players and expensive diet pills and GPS systems! No more maps for you! Sadly, if you asked the IRS to deposit your tax refund into your IRA, they’re going to deposit your rebate there too.

Tax Tip For Lazy People: How To Get An Extension On Your Income Taxes

You need an extension.

Tax Cat: Help! I Owe The IRS Money And I Don't Have Any!

The IRS knows you owe them money and they realize that you may not actually have any to give them. Don’t worry, they’re not going to come in the night and steal all your Nerf footballs and catnip.

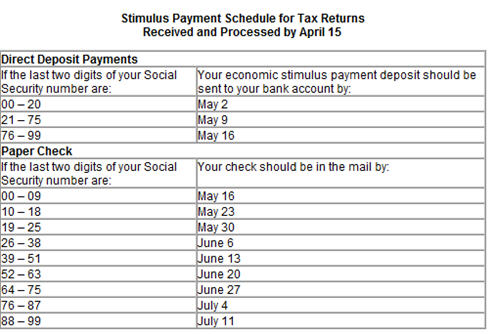

Check Out The IRS's Economic Stimulus Payment Calculator

The IRS has more information about the upcoming economic stimulus payments. Woohoo!

IRS Reminds You To File Your Tax Return In Order To Receive Stimulus Payment

“These special letters remind people that they won’t need to do anything more than file a 2007 tax return in order to put the stimulus payment process in motion,” Acting IRS Commissioner Linda Stiff said.

Tax Cat: Let's Learn About "Necessary And Ordinary Business Expenses"

If you have your own business, you can write off your expenses. This reduces you income, and lowers your tax bill. Sadly, you can’t just write off whatever you want.

Tax Tip: Mortgage Forgiveness Debt Relief Act of 2007

Tax Cat knows that it’s a hard subject, but if your home has been foreclosed there’s something you should know about changes to the tax laws.

What To Do If You're Missing Your W2

It’s February 1st and you don’t have your W2? Fear not. Tax Cat will help.

6 Tax Credits That You Shouldn't Overlook

Here are 6 tax credits that can help you with the cost of education, child care, and improving your home.

Worst Tax Product Ever: The Refund Anticipation Loan Debit Card

Refund anticipation loans are bad enough, but H&R Block and Jackson Hewitt want you to get a RAL, and then put it on a fee-riddled pre-paid debit card. What a great idea!

Tax Tip: Home Offices Are Worth The Deductions If You Qualify

The first question that must be asked about any home office in order for it’s expenses to be deductible is, is the workspace used exclusively and regularly for business? The answer to both of these questions must be yes before any deduction can be taken. If the workspace is used for both business and personal use, then it is not deductible. Furthermore, the space must be used on a regular basis for business purposes; a space that is used only a few times a year will not be considered a home office by the IRS, even if the space is not used for anything else. These criteria will effectively disqualify many filers who try to claim this deduction but are unable to substantiate regular and exclusive home office use. It should be noted that it is not necessary to partition off the workspace in order to deduct it (although this may be helpful in the event you are audited.) A simple desk in the corner of a room can qualify as a workspace, provided you count only a reasonable amount of space around the desk when computing square footage.

Last Chance To Donate Money In 2007

Today represents your final opportunity to donate money to charity for tax year 2007! CharityNavigator has some tips for holiday giving, and of course, you’ll want to brush up on the tax implications of your generosity.

Today Is The Deadline For Late Tax Filing

Today is the deadline to file your taxes if you got an extension back in April. File them.

If You Filed A Tax Extension You Have 10 Days To Get Your Crap Together

If you are one of the 10.2 million taxpayers who requested an automatic six-month extension, your time is almost up.

IRS Launches Special Website Section For People Facing Foreclosure

The IRS has launched a special section of its website aimed at helping people who are facing foreclosure navigate the tax issues that surround debt forgiveness.