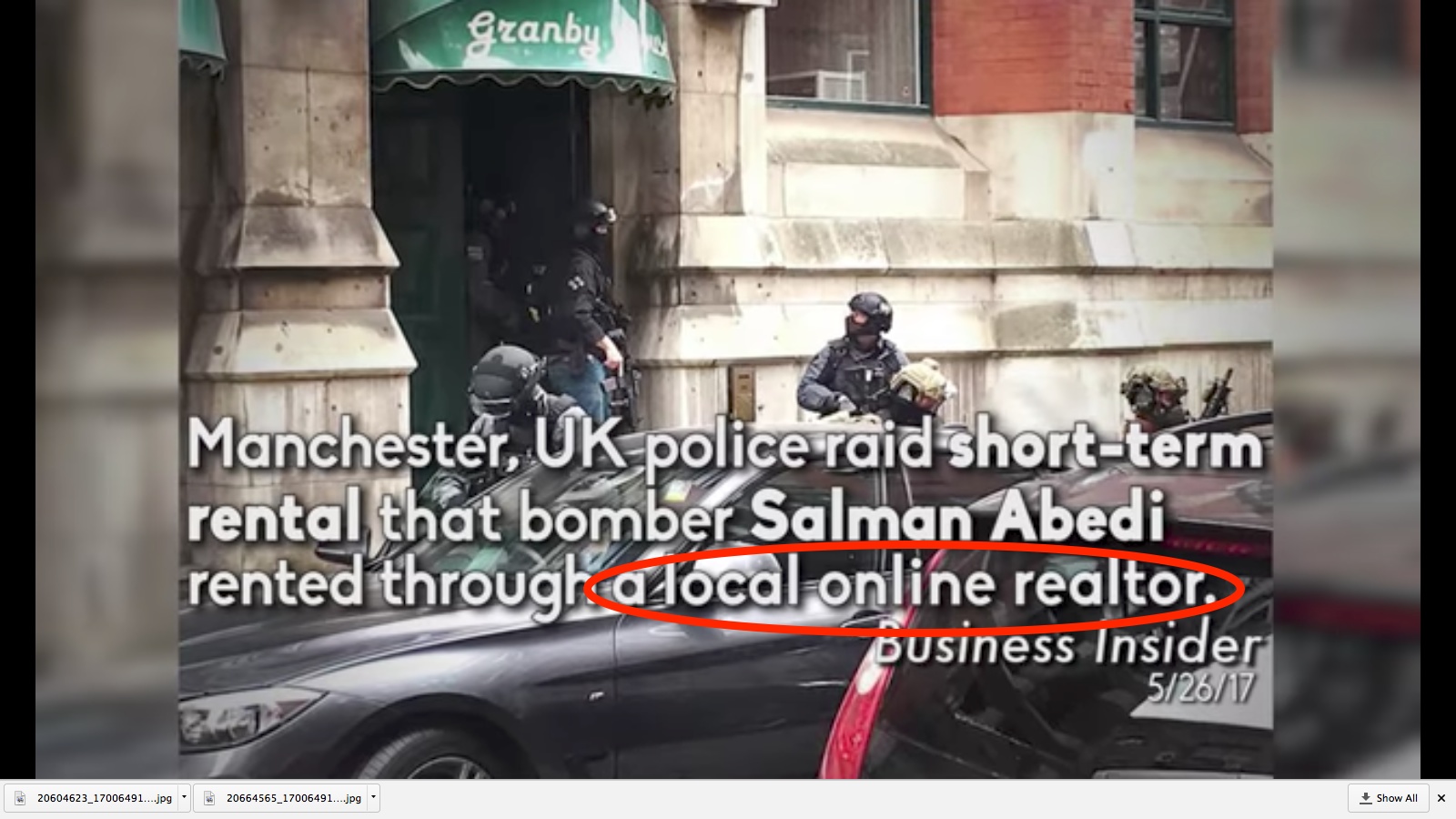

There are a lot of justifiable reasons to take issue with home-rental platforms like airbnb: “Mega hosts” who are renting out dozens — maybe hundreds — of listings without being subject to hotel taxes or regulations; hosts who will turn just about any vaguely inhabitable space into a rental property; and allegations that airbnb fails to properly vet hosts. But one anti-airbnb hotel group has gone a step further, using incidents of real human tragedy to try to create a false link between airbnb and terrorism. [More]

short-term rentals

New York State Dismissed From Vacation Rental Lawsuit; NYC And Airbnb To Settle Soon

It might be only people who enjoy renting an entire apartment to vacation in New York City who remember the legal fight between the state of New York and Airbnb over a new state law. Last month, the governor signed a bill limiting rentals in New York City and imposes stiffer penalties on people who rent out entire apartments. While it’s a state law, the lawsuit has been dismissed, and it’s the city that will enforce the law. [More]

Airbnb Sues New York Over New Short-Term Rentals Law, State Won’t Enforce It Yet

The latest govermnent to impose rules on short-term rental site Airnbnb is New York: while the law is statewide, it’s mostly intended to clamp down on whole-apartment rentals that critics say are affecting the supply and prices of housing in New York City. The governor signed the law on Friday, and Airbnb immediately sued. Now the state won’t enforce the law until the lawsuit has been resolved. [More]

Dear New Yorkers: Your Short-Term Airbnb Listing Could Lead To $7,500 Fine

It’s already illegal for New York residents to list their unoccupied apartments on Airbnb for less than 30 days, but now it’s illegal and it could cost them: Governor Andrew Cuomo on Friday signed into law a measure that penalizes hosts up to $7,500 for such listings. [More]

Airbnb Tries More Self-Regulation In New York, Too

If the vacation-booking site Airbnb has to be regulated, it at least wants to impose regulations on itself instead of having local governments do it. While the company is starting to self-regulate in San Francisco and cooperated with the city to make rules in Chicago, it also proposed rules for itself in New York. [More]

Airbnb Removes San Francisco Hosts With Multiple Listings, Ignores Other City Rules

The short-term home rental company Airbnb would really prefer to ignore hosts’ local regulations, leaving compliance up to individuals instead of the platform. However, the company has made a key concession to its hometown of San Francisco, pulling listings from hosts with multiple residences off the site, which violate current laws in San Francisco. [More]

San Francisco Proposal Would Limit Residential Airbnb Rentals To 60 Days/Year

The relationship between Airbnb and its home city of San Francisco is complicated to say the least. the least. The two have repeatedly duked it out over regulations, taxes, and liability, and now the stage is set for yet another battle between the city and the home-sharing platform, as the San Francisco Board of Supervisors considers reducing the number of days people in the city can rent out their homes each year. [More]

Airbnb Updates Rental Policy In Effort To Fight Discrimination By Hosts

In an effort to ensure that anyone who wants to rent a place to stay through Airbnb can do so without fear of being rejected based on their race, religion, gender, ethnicity, age, or disability, the company has updated its short-term rental policy to add some new anti-discrimination measures. [More]

Airbnb Hosts Having Difficulty Refinancing Homes

Until recently, home loans generally covered two types of properties: primary residences or investments. That was before services like Airbnb allowed anyone with an extra room to make a bit of extra money by renting it out for short periods of time. This blurred line between “my house” and “my investment” is causing trouble for some homeowners when they go to refinance their mortgages. [More]

Airbnb Agrees To Start Collecting Millions In Taxes From Los Angeles Hosts

Two years after Los Angeles warned Airbnb hosts of their tax-collecting obligations, the city and the short-term rental company have reached a deal in which the business will start collecting millions of dollars in lodging taxes from hosts. [More]

Senators Call For Inquiry Into Impact Of Airbnb & Other Short-Term Rentals On Affordable Housing

Short-term rental platforms like Airbnb, VRBO, and HomeAway are intended as a way to give travelers varied and interesting lodging options, while letting homeowners make a bit of money when they aren’t at home. However, a group of three senators are concerned that the affordable housing market is being squeezed by the increasing number of property owners cashing in on short-term rentals.

[More]

Airbnb Tells Mayors: Be Our Friend, And We’ll Collect Lodging Taxes For You

Airbnb just wants to be your friend, mayors. All it wants is for you to let city residents rent all or part of their homes out sometimes, and in exchange for that, the peer-to-peer short-term rental service will collect taxes and turn them over to cities. That’s the service’s pitch at the U.S. Conference of Mayors meeting this week in Washington, D.C. Are America’s mayors interested in the pitch? [More]

Airbnb Wants To Get Into Bed With U.S. Landlords

Though there are surely tenants out there renting their apartments out on Airbnb without their landlord’s blessing, the short-term rental site wants to get on the good side of apartment owners around the country. To that end, it’s reaching out to a few large companies with a lot of properties to see if all sides can work out something beneficial to all involved. [More]

San Francisco Votes Down Restrictions On AirBNB Rentals

If you don’t live or work in San Francisco and you aren’t an AirBNB host, you probably haven’t heard of Proposition F. The proposition asked the people of San Francisco to decide the future of short-term rentals through AirBNB and similar services, limiting the number of days per year a space could be rented to 75 and creating stricter penalties for hosts who disrupt their neighbors’ lives. The measure failed. [More]

San Francisco Creates New Office To Regulate Airbnb, Other Short-Term Rentals

The city of San Francisco and Airbnb have a somewhat contentious relationship, most recently involving tens of millions of dollars in back-taxes the short-term rental company agreed to pay the city earlier this year. Now, to ensure things continue to go smoothly for renters and rentees of services like Airbnb, the city has created a new office for the sole purpose of enforcing rules regarding vacation and short-term rentals. [More]

Airbnb Pays “Tens Of Millions” To San Francisco To Settle Hotel Tax Bill

Airbnb finally gave in to San Francisco’s demands that it fork over a bunch of cash to pay back-taxes after failing to pay the city’s 14% hotel tax going back a few years. Airbnb wouldn’t say how much it had paid, but officials had said it ran into the millions of dollars. [More]

Airbnb To Start Collecting Taxes In Portland, San Francisco, Maybe New York City

Airbnb is a site that lets people rent rooms or entire apartments or houses, directly from the homeowner or renter. It has proven popular with travelers, but less popular with landlords, the hotel industry, and local governments. Why do local governments care? Airbnb rentals aren’t subject to sales and hotel changes. In some cities, that’s about to change. [More]