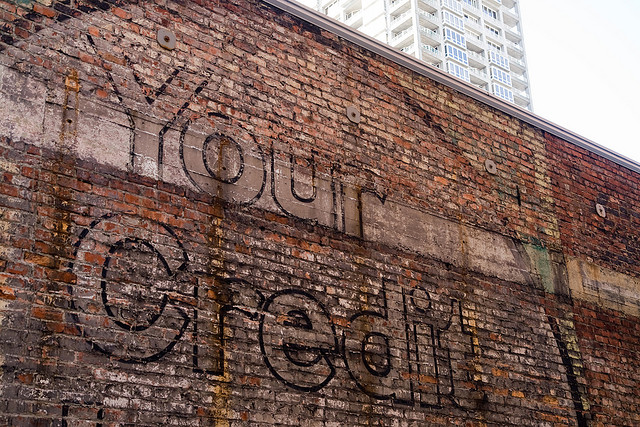

Under federal law, when someone erases a debt in bankruptcy, their bank is required to update their credit reports to indicate the debt is no longer owed. To ensure this happens, legislators have introduced a new bill that would give credit card borrowers with inaccurate credit reports the power to sue their bank or a third-party debt buyer for damages if they continue to send so-called zombie debt to credit reporting agencies. [More]

sherrod brown

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]

Ohio Senator Proposes Payday Loan Alternative That Allows Consumers To Access Early Tax Credits

For years, lawmakers have tossed around the idea of meaningful payday loan reform, from banning loans with annual percentage rates higher than 36% or looking to close loopholes that allow predatory lenders to claim tribal affiliation. This week, as Congress began its latest session, one lawmaker suggested a payday alternative that doesn’t involve another type of loan at all. [More]

Senator Asks Citi To Stop Reporting Frequent Flier Miles As Taxable Income

As we mentioned last week, a number of Citi customers around the country have been scratching their heads wondering why they received 1099 tax forms from the bank over frequent flier miles, even though IRS policy explicitly states that the agency as no interest in going after freebie miles as taxable income. Now the chair of the Senate Banking Subcommittee on Financial Institutions and Consumer Protection has fired off a missive to Citi asking the CEO to not be such a pain in the rear-end to its customers. [More]