Consumer Reports is gearing up to release their supermarket ratings, but the preliminary results show that supermarkets are trying to help consumers by extending sales and rewarding loyalty. Inside, six ways to save a few bucks next time you fill up your shopping cart.

saving

5 Big Retail Mark-Ups To Watch Out For

The Lansing State Journal has put together a list of 5 marked-up retail categories to be aware of when you’re making purchasing decisions, most of which you hopefully already know. If you can’t find wholesale sources or DIY replacements, then at least make sure you do a lot of comparison shopping to get the best deal.

../../../..//2009/03/30/the-website-freeshippingorg-has-launched/

The website freeshipping.org has launched a new blog named “Go Frugal,” aimed at helping consumers find ways to save money. [Go Frugal]

If You Save Too Much — You Might Regret It Later!

We’re always telling people to save their money — but that’s just because we’re overcompensating for a society that spends too much. It is possible to be too frugal and you risk regretting that you didn’t have a little more fun while you had the chance.

Do Electricity Monitors Like The "Kill A Watt" Really Work?

If you’re concerned about your electricity use you may have considered getting one of those energy monitoring devices like the “Kill a Watt” or the “Watts Up.” But do they really work?

Your Piggy Bank Is Happy: Savings Rate At 14-Year High

Americans took their cost of living raises and stuck them in their piggy banks, says the Commerce Department, pushing the savings rate to a 14-year high. Not long ago we had a savings rate of 0.1% — now it has skyrocketed to 5%.

Sharing Restaurant Dishes Is Becoming Slightly More Acceptable

Good news thrifty diners, you’re not the only ones asking to share dishes at restaurants these days. Thanks to the recession, it’s becoming acceptable for everyone to split their dishes, and restaurants aren’t complaining. “Now all bets are off,” said David Pogrebin, manager of the snazzy French restaurant Brasserie. “People are not ashamed of being frugal.”

Split A Sitter, Save A Bundle

Here’s a good way to save a bundle on your bundle of joy – share a sitter with a neighbor. By dropping off her 15-month-old at a neighbor’s place 4 days a week, Real Simple reader Maureen Dempsey says she saves ~$400 a month. The article doesn’t specify it but I imagine babysitter watches both kids at the same time for a little bit more but not as much as hiring two separate sitters. Plus Maureen’s kid also gets to interact with another kid at the same time. Surviving the recession is all about working together and splitting up costs. [via Real Simple] (Photo: Ordinary Guy)

Trouble Saving Money? Harness Robots!

Sometimes when people have trouble saving at least 10% of their income on a regular basis, it’s because it hurts too much. After you pay the bills, set aside money for groceries, booze and guns, it seems you don’t have enough left over to save with. So, what you can do is exploit “out of sight, out of mind,”

../../../..//2009/01/15/need-to-save-money-on/

Need to save money on textbooks? Textbook Media offsets the cost of its digital copies by inserting ads at chapter breaks. BookSwim rents textbooks. Also see these old suggestions, and today’s morning deal.

Personal Finance Roundup

Here’s our weekly roundup of the best personal finance news. Inside: investing lessons, gadgets to buy, mentoring, career tips for women, and fixing money mistakes.

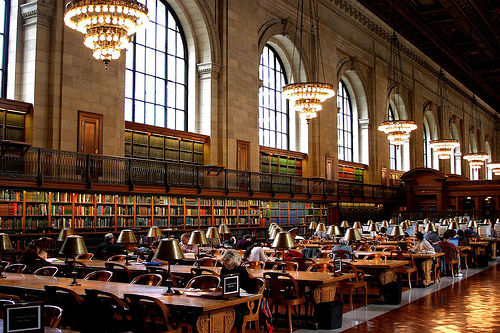

The Poverty-Stricken Masses Are Flocking To Libraries

Why waste precious cash at Borders and Barnes & Noble when you can go to the library for free? It’s a simple question that is causing traffic local libraries to spike as flocks of new patrons register for library cards. We’ve praised libraries before, but it takes a depressing recession to convince people that yes, even they could use an extra buck in their wallet.

../../../..//2009/01/06/the-consistently-useful-get-rich/

The consistently useful Get Rich Slowly has some New Year’s resolutions for you: 9 Methods for Mastering Your Money in 2009. We especially like methods 3 and 7, as they’re easy fixes that shouldn’t take more than a couple hours to implement.