Compared to $40 billion-plus in penalties, settlements, adjustments, and legal fees Bank of America has already racked up because it flat-out stinks at servicing home loans, a $45,000 payment split between two couples is a molecule in a drop of water in the bucket. But this story, in which BofA decided that pregnant homeowners were too big a risk for mortgage refinancing, is a good reminder of consumers’ rights under the law and of BofA’s general incompetence. [More]

refinance

Data Shows Horrifying Bank Of America Refinance Story Actually Typical

The Chicago Reporter is a publication that reports on race and poverty in Chicago. This issue’s cover story is about mortgage modifications and the struggles that homeowners face when trying to access the Obama Administration’s refinance program. Apparently, banks are so incompetent that it can be almost impossible to actually modify your mortgage.

The article tells the story of a small business owner who thought he would always be able to pay his mortgage, but whose work dried up with the economy, and his wife, who was laid off from her full-time job. The husband was injured on the job, and the medical bills piled up. [More]

Find Out If You Qualify For Mortgage Assistance

The Obama Administration announced new details about its massive foreclosure relief program — and the Washington Post says that it includes a refinancing program for homeowners with little equity in their homes, but who otherwise would be able to refinance. The Post has a quick interactive tool that will help you to determine whether or not you qualify for the program.

Faces Of Foreclosure: The Nonagenarian (He's 92.)

Our sister publication, Consumer Reports, put together some video interviews with people who, for one reason or another, are facing foreclosure. They are the human side of this financial meltdown.

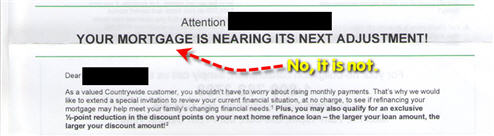

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

The 10 Cities With The Most Crazy Expensive Loans

The Chicago Reporter took a look at some recently released mortgage data with an eye to how many successful refinances there were last year. In addition to concluding that people who most needed a refinance (those with crazy expensive loans) were also the least likely to get one, the Reporter also found that Chicago lead the nation in the total amount of high-cost loans for the fourth year in a row. High-cost loans are loans that are at least 3% above the U.S. Treasury standard.