For U.S. troops returning from Iraq and Afghanistan, they’re coming home to a depressed job market and double-digit unemployment. That’s why a little Washington-based software company called Microsoft is ponying up $2 million in cash and $6 million in software to help these new civilians find jobs. [More]

recession watch

Well, The Census Is Hiring

Unemployed? If you’re looking for something to get you out of the house, the Census is hiring and apparently they’re really enjoying the sudden influx of lawyers and other professionals to choose from, says the Washington Post. [More]

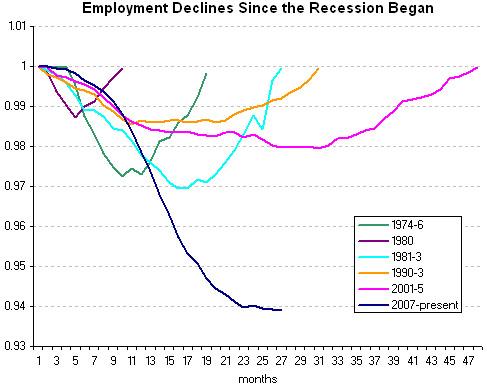

Well, This Employment Graph Is Just Terrifying

This graph shows employment declines at the same chronological point during America’s last six recessions. Guess which one represents the current recession. Go ahead, guess. [New York Times] (Thanks, Dan!) [More]

Fewer People Getting Laid Off These Days

Here’s some not-so-bleak news to brighten your day. A new study shows that only 20,000 Americans lost their job in the private sector in the last month. That’s down a whopping 67% from January’s numbers. And some are hoping this is just the start of an upward trend. [More]

Senate Passes Jobs Bill, Crosses Fingers & Says A Prayer It Works

In a rare move of semi-solidarity, both Republicans and Democrats in the U.S. Senate approved a $15 billion initiative intended to spur job creation and growth. Of course, that amount is still $5 billion less than the total amount of bonuses doled out by Wall Street banks last year. [More]

Low Interest Rate Party To Continue For An Extended Period

Fed Chairman and former South Of The Border employee, Ben Bernanke, says these historically low interest rates will continue… but not forever. [More]

FDIC: This "Troubled Bank" List Is Getting Ridiculous

The Federal Insurance Deposit Corporation announced today that it had added 450 more banks to its troubled bank list. The list is secret, because announcing that a bank is in trouble is a good way to kill it for good. [More]

Schwarzenegger Sez: Worst Of Recession Is Over

You might not know it because you’re too busy looking for a job, but apparently the worst of the recession is behind us. At least according to California Governor Arnold Schwarzenegger. [More]

Toyota Throttles Back On Production At Two U.S. Plants

With their sales sinking as they deal with the massive recall of 8 million vehicles, Toyota announced today that they are trimming back production at two U.S. factories in an effort to avoid an overstock of unsold automobiles. [More]

Consumer Sentiment Slips A Bit, Still Up From Last Year

In case you hadn’t noticed, these aren’t the brightest economic times in U.S. history. Perhaps you were distracted by the guys repossessing your car. And a new Reuters/University of Michigan survey of consumer sentiment shows that y’all aren’t expecting the USS Recession to turn around anytime in the immediate future. [More]

Ex-Merrill Lynch Boss John Thain Is A CEO Again

After successfully redecorating his office, merging Merrill Lynch with Bank of America, and then getting fired — John Thain is once again a CEO. This time he’ll be heading up a recently-bankrupt commercial and consumer finance company, CIT. [More]

After 3 Months, Only 35 Paying Customers For Newspaper's Web Site

Newsday is a Long Island newspaper. Some people bought it for $650 million and put it behind a pay wall. Three months later, they’ve got 35 subscribers. Yes, 35. [More]

Borders CEO Quits After A Year On The Job

Borders CEO Ron Marshall has decided to move on to better things after only a year. The troubled bookseller is currently in the process of closing 182 of its Waldenbooks stores (more than half of them), and is generally being frowned upon due to its lack of initiative in getting into the e-reader market. (Amazon has the Kindle, B&N has the Nook, and Borders has um…hmmm…) Now they’ll have to find a new CEO to turn things around. [More]

Big Bankers Will Only Pay Themselves $40 Billion In Bonuses

Three top Wall Street financial firms, Morgan Stanley, JP Morgan Chase and Goldman Sachs, plan to cut the bonuses offered to their top executives, as part of an effort to show that they’re willing to cut back on what the White House recently called “obscene” compensation. For 2009, the three banks will award themselves just $39.9 billion, down from $44.7 billion in 2007.

According to Bloomberg, “even with lower amounts allocated in the fourth quarter, the compensation costs are enough to pay each employee at the three firms $336,843, more than six times the U.S. median household income of $50,303 in 2008.”

Largest Ever Single Residential Property Deal Collapses Under Debt Mountain

The company that paid the most ever for a single residential property in the US is giving up and giving the development back to its lenders, says the WSJ. [More]

White House Proposes New Banking Rules, Wall Street Freaks Out

So, we used to have this thing called the Glass-Steagall Act, which separated investment banking from commercial banking. Then we didn’t anymore. Now the President has proposed new rules that would effectively restore some of the provisions of Glass-Steagall. Wall Street is like, so not cool with it, however. [More]

Starbucks Remembers How To Sell Coffee

Starbucks used to make a lot of money selling coffee-like sugar bombs that people loved and would pay for with cash from their HELOCs. Those days are over, but there’s good news. Starbucks has remembered how to sell coffee and is now doing so in a profitable way. [More]

Citi: We Lost $7.6 B, But On The Bright Side, We Fired 100,000 People

Citi CEO Vikram Pandit is reassuring investors today after his firm lost $7.6 billion in 2009 by telling them to look on the bright side — at least they fired 100,000 people. [More]