Earlier this year, lawmakers on Capitol Hill began the process of dismantling the Consumer Financial Protection Bureau’s long-awaited prepaid card rules — meant to improve transparency and curb runaway fees — that are set to to go into effect. As Congress prepares to consider three bills that would erase these rules, attorneys general from 18 states have called on legislators to put consumers’ needs over those of the prepaid card industry. [More]

prepaid cards

Congress Trying To Roll Back Consumer Protections For Prepaid Cards

Last fall, weeks before the election, the Consumer Financial Protection Bureau concluded a three-year process of trying to make prepaid cards less costly. Those new rules, which would improve transparency and curb runaway fees, are set to go into effect later this year, but not if lawmakers on Capitol Hill have their say. [More]

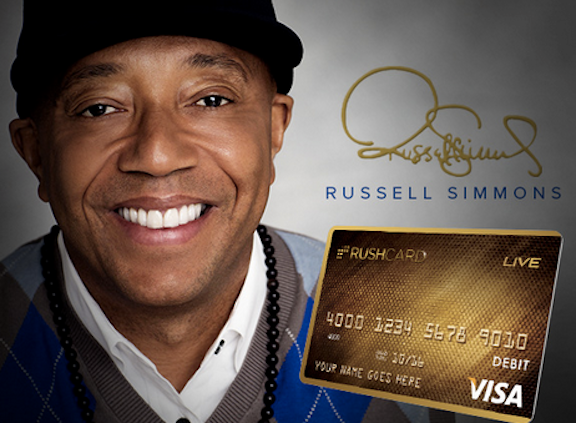

Feds Order MasterCard, RushCard Owner To Pay $13M Over Oct. 2015 Outages

Nearly 15 months after tens of thousands of users of the prepaid RushCard were cut off from their funds because of an apparent technical glitch, the company behind the card, UniRush and its payment processor MasterCard have been ordered to pay $13 million in refunds and penalties. [More]

Households Are Using Prepaid Cards More Than Ever Before

Weeks after federal regulators finalized rules aimed at making prepaid cards safer and less costly for consumers, a new report from the Federal Deposit Insurance Corp. finds that more households are relying on the financial products than ever before. [More]

Lawmakers Want Answers On Walmart Prepaid Card Glitch That Left Thousands Without Funds

When a prepared credit card system goes down, millions of unbanked American lose their ability to access funds needed to pay bills, buy groceries, and make other purchases. This scenario was illustrated last month when customers using Walmart-branded Green Dot prepaid debit cards said they had been stranded without their funds for several days, and in some cases weeks. Now, a pair of lawmakers wants to understand the debacle better and work to prevent something similar from happening again. [More]

Users Of Walmart’s Prepaid MoneyCard Say They Can’t Access Funds

Prepaid credit cards can serve as a lifeline for millions of unbanked Americans in need of an alternative to traditional banking, but they’re only helpful when users can actually get access to their funds. To that end, thousands of consumers who use Walmart-branded prepaid debit cards say they’ve been stranded without their funds for three days. [More]

RushCard To Pay $19M To Customers After Weeks-Long Glitch Last year

Last October, thousands of unbanked consumers who rely on prepaid RushCards were unable to access their funds because of a technical glitch. After toying with the idea of creating a compensation fund for those customers, RushCard announced Thursday that it will pay at least $19 million to card users affected by the weeks-long outage. [More]

Prepaid Debit Cards Are Not Quite As Terrible As They Used To Be

There are contexts where prepaid debit cards are useful. Consumers without bank accounts who would otherwise deal all in cash use them, and they’re also useful for distributing allowances. The problem with prepaid cards is that they impose high fees for functions like reloading, using out-of-network ATMs, or monthly fees for simply having the card. However, they’re better than they used to be, largely because at least they disclose those fees. [More]

RushCard To Create Reimbursement Fund For Customers Unable To Access Money

The thousands of unbanked consumers who rely on prepaid RushCards but have been unable to access their funds because of a technical glitch, may receive compensation for the issue. [More]

New Campus Banking Rules Hope To Protect Students From High Prepaid & Debit Card Fees

Back in May, the Department of Education proposed rules to govern college prepaid and debit cards in order to afford students proper protections from excess fees and other harmful practices. Fast forward five months, and those rules have are now finalized. [More]

After RushCard Fiasco, Consumer Advocates Urge More Oversight Of Prepaid Cards

For the better part of two weeks, thousands of unbanked consumers who rely on prepaid RushCards have been unable to access their funds because of a technical glitch. While the company run by Russell Simmons continues to fix the issue, consumer advocates are pointing at the incident as evidence that federal regulators need to do more to protect prepaid cardholders. [More]

Technical Glitch Locked Customers Out Of Prepaid RushCard System For The Past Week

While prepaid credit cards can serve as a lifeline for millions of unbanked Americans in need of an alternative to traditional banking, Russell Simmons’ RushCard recently left thousands of consumers stranded without their funds because of a technical glitch. [More]

Pew: With Nearly 23 Million Consumers Using Prepaid Cards, More Protections Are Needed

To the naked eye, general purpose reloadable prepaid cards function much like long-established credit and debit cards and have quickly gained traction with consumers, especially those who have been shut out from traditional banking options. In fact, about 23 million consumers use prepaid cards regularly. [More]

Fake Cop Wants Prepaid PayPal Cards To Make Your Warrant Go Away

Here’s an innovative scam that’s been reported near St. Louis, and could soon come to a doorstep near you. Victims report receiving a phone call from someone who identifies himself as a local police officer, who tells the target that they’ve missed a court date, and must pay up within an hour or an officer will immediately arrive to arrest them. While the threat of being arrested is scary, this is not an actual thing that happens. [More]

Dept. Of Education Proposes Rules To Govern College Prepaid Credit & Debit Cards

College students’ federal aid has increasingly been put at risk by the cozy relationship between institutions of higher education and credit card issuers over the years. While consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks, the Department of Education finally took steps today to ensure students are afforded proper protections from excess fees and other harmful practices with the proposal of regulations targeting the college debit and prepaid card marketplace. [More]

CFPB: College Credit Card Agreements On Decline; Debit, Prepaid Card Agreements Increase

Since Congress passed the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act in 2009, the cozy relationship between credit card issuers and institutions has fractured. But while the number of agreements between the two entities has declined drastically, that doesn’t mean banking on campus has gotten any safer for students. [More]

![Pew researchers analyzed 10 key elements of remote deposit services. [click to enlarge]](../../consumermediallc.files.wordpress.com/2014/11/key-points.png?w=300&h=225&crop=1)

Report: Many Banks And Prepaid Companies Lack Clear Disclosures For Smartphone Deposit Services

Some days, driving to the bank or searching for the right ATM, seems like too much effort to deposit a single check. Over the past few years time-crunched consumers have found some relief in the form of banks offering the ability to remotely deposit checks with a smartphone. While the technology may be convenient, a new report found certain drawback to the program, including poorly disclosed terms and conditions. [More]