Insurers have to maintain a safety net of money to protect themselves from unforeseen market conditions, but a new study from Consumers Union says that some Blue Cross Blue Shield insurers took it too far, preferring to focus exclusively on stockpiling cash at the expense of customers. Two of the worst cases have stockpiles 5 to 7 times higher than state solvency requirements, yet continue to hike premiums each year instead of using the, uh, surplus surplus to offset customer costs. [More]

premiums

Blue Cross Blue Shield Insurers Kept Hiking Premiums Even After Exceeding Recommended Surplus

Progressive Direct "Glitch" Hikes Premium From $800 to $2,000

Kevin received a surprise when he checked the renewal notice for his car insurance recently. A 260 percent surprise, in fact, even though he’s not a bad driver and hadn’t been in any accidents. [More]

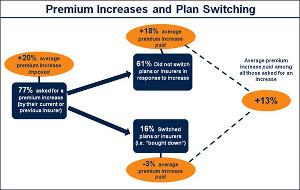

Self-Insured Premiums Jump By 20%, Triggering Warning From White House

About 10% of respondents in our informal poll yesterday about health insurance said they pay their own premiums, and according to a new poll from Kaiser Survey, three quarters of those people just faced a premium increase of 20% on average. The recent hikes have prompted the White House to say it will “sternly warn industry executives” today that insurers shouldn’t try to use the new health care law as an excuse to gouge customers, according to the New York Times. [More]

American Airlines To Charge $8 For Blanket And Pillow, If You're Lucky

Starting in May, American Airlines will sell blanket-and-inflatable-pillow packs for $8 each on domestic flights longer than 2 hours. If your flight is under 2 hours and you tend to get cold on a plane, relax: you can’t shiver to death in under 2 hours, and by then you’ll be at your destination. Or, okay, still on the runway at your departure spot, raiding your carry-on for snacks. You might want to bring a light jacket. [More]

State Investigators Find All Sorts Of Dirty Tricks At Mercury Insurance

This summer Californians will be able to vote on Proposition 17, which if passed will allow insurers to bypass some legal restrictions on how much they can charge for auto insurance. Mercury Insurance Group is a big proponent of the proposition, but maybe that’s because it’s been possibly sidestepping the law in recent years anyway. Hey, making it legal will just prevent another state report like the one Carla Marinucci at the San Francisco Chronicle obtained, which contains findings that Mercury “has engaged in practices that may be illegal, including deceptive pricing and discrimination against consumers such as active members of the military and drivers of emergency vehicles.” [More]

Tell Car Insurance Company You're Driving Less, Save On Premiums

It almost seems like a bad joke from a Geico commercial: I lost my job, but the good news is I just saved a bunch of money on my car insurance! [More]

Senate Passes Health Care Reform Bill

In case you missed it, Senate Democrats managed to succeed at their goal of pushing through some sort of health care reform bill before Christmas Day–the chamber voted this morning 60-39 along party lines and passed the bill. Up next: the Senate and House have to get together and negotiate some final version. If you want to compare what’s in the House and Senate versions, the New York Times has put together an excellent side-by-side comparison tool.

10 Strategies To Lower Your Auto Insurance

Over at the Mint blog they’ve posted a list of 10 ways to reduce your car insurance premium. You’ll want to contact your current insurer and ask some questions, like whether they offer a discount for paying up front, or if they’ll cut you a deal for being a long-term customer.

How To Reduce Your Insurance Premiums

Kiplinger has put together a list of ways to reduce costs for auto, home, and life insurance. For auto and homeowners insurance, boosting your deductible from $250 to $1000 can lower your premiums between 15-25%. If you haven’t looked at your life insurance policy in a while, don’t wait any longer to shop around—rates have “dropped significantly” over the past 15 years but are now on the rise. And when calculating homeowners insurance, don’t fall into the market value trap: make sure you’re covering the true cost of replacing only the home and what’s inside, not the value of the land.

Outside Magazine Will Send Your Free 2009 Calendar When It's In The Discount Bin

Outside Magazine offered Tracey two free 2009 Calendars if she signed up for an annual subscription early last December. She thought her dad would enjoy the magazine and the calendar, so she accepted. Now it’s March and there’s still no calendar, and Tracey says every time she calls to complain, they tell her they’ll send it. In the meantime, her dad still has no idea what day it is.

Tonik Insurance Sneaks 20% Premium Increase On Customer After Approval

Tonik is the rad, x-treme! lifestyle health insurance for young people who can’t afford regular insurance—sort of the Poochie of health insurance, except it’s not going to go away. Aasma wrote to us to let us know that when she signed up for it over the weekend, she got a nasty surprise after she submitted her credit card information.

Medicare Costs Going Up In 2009, So Be Ready To Compare Plans

If there’s one group of Americans who don’t carry their weight and need to pay more money to the healthcare industry, it’s those layabout senior citizens! That’s why their Medicare drug premiums are increasing by an average of 31% for the 10 most popular plans beginning in 2009. If you were with Humana, formerly the cheapest Medicare drug plan you could get (its premium was $9.51 in 2006), you can expect to pay $40.83 per month in 2009, an increase of 60% over this year’s rate. As you would expect, Humana is no longer the cheapest option—so it may be time to shop around for a new plan.

Profitable Farmers Insurance "Error" Has Been Going On for A Year And A Half Now

Susan in Wisconsin was charged an extra $10.30 last October, even though she’d already paid the next six months of her premium in full a month before. “I thought maybe I had misread my initial bill and paid the amount said to be due,” she writes. But then it happened again last month, so she began to investigate.

Should Car Insurance Rates Be Based On Your Credit Score?

For a decade now, all the major auto insurers have used a customer’s credit rating to some degree in determining premiums. They claim that it results in lower rates for “most” customers, and that the data prove that people with lower credit scores make more claims and for higher amounts. The FTC released a report this summer that validated the practice—but also confirmed an unpleasant truth critics have been saying for years: because a higher percentage of Hispanics and African-Americans have low credit scores, there’s a good chance they’re disproportionately affected.