Fewer than half of loan modifications made at the end of last year actually reduced borrowers’ payments by more than 10 percent… [while] nearly one in four loan modifications in the fourth quarter actually resulted in increased monthly payments.

payments

Report: Loan Modifications To Date Haven't Been That Effective

Google Checkout Just As Bad As PayPal

Web brokers Google and PayPal don’t believe in human-to-human communication, and one place where you really need that is when you’re troubleshooting financial transactions. An interface designer/developer who used Google Checkout to sell an ebook has just been given a huge serving of suck by the “don’t be evil” company—they closed her account on her without warning and refuse to tell her why the closed it. The $200 in earnings that hadn’t been paid out yet are unretrievable, and she can’t open a new one.

Your Credit Card Limit Can Be Reduced Below Your Current Balance

We’ve seen how available balances can disappear when lenders cut credit card limits, but SmartMoney points out that lenders can cut your limit below your current balance, causing all sorts of problems. They’ll send you a notice, of course, but you may not receive it for several weeks. Your best bet is to set up your own alert system. A web-based financial service (like Mint) will send you an email or SMS alert if your available balance drops below a specified threshold.

Help, This Restaurant Won't Accept My Restaurant.com Coupon!

Adam bought a gift certificate coupon from restaurant.com, but the restaurant where he tried to use it turned him down: “They informed me that restaurant.com had started selling certificates to their restaurant without the restaurant’s knowledge or approval.” Now he wants to know what to do.

Congresswoman Marcy Kaptur Urges Squatting In Foreclosed Homes

Last week I was watching Lou Dobbs while scrubbing my dentures and complaining about joint pain (two of those things are true, sadly), and I saw a segment on Ohio congresswoman Marcy Kaptur, who is encouraging homeowners to stay put in their foreclosed houses. She argues that many of the loans made during the subprime fiasco may not be legit, and that you should seek legal counseling and demand a mortgage audit from the bank before leaving. Kaptur admits her advice doesn’t trump the sheriff knocking at your door with an eviction notice, but a real estate lawyer told the Toledo Blade that otherwise she has a point.

Beware: Credit Card Minimum Payments Are Messing With Your Mind

Credit Card minimum payments are supposed to help keep the accumulation of interest on credit card debt from getting out of control — but a new study reported in the Economist suggests that minimum payments do more harm than good.

PRBC Helps You Create A Credit Score From On-Time Rent, Bill Payments

Payment Reporting Builds Credit (PRBC) is an alternative credit reporting agency that will record your payment histories for things like rent and utilities bills. PRBC says you can then use this verified credit history to supplement your FICO score and credit history from the big three reporting companies. It’s meant in part as a way to help people who don’t have extensive standard credit histories, or who have always paid monthly expenses on time but have other blots (like medical bills) on their official credit histories.

Citibank's Website Glitch Tricks Man Into Overpaying $755, But They Won't Issue Refund

Citibank’s website isn’t reliable, at least according to them. Matt assumed that a website from a bank could be trustworthy, and that if there was no scheduled payment showing up, then he must have forgotten to arrange it. He scheduled a second payment, but then both payments went through one day apart. Now Citibank refuses to give him a refund: he should have called or emailed before rescheduling, they’ve told him, and not trusted what the website was telling him.

Man Sets Himself On Fire At Rent-A-Center After Receiving Too Many Late Payment Notices

There are lots of good ways to escalate your complaints. Going to the store, dousing yourself with lighter fluid and setting yourself on fire is not one of them. Unfortunately, that’s exactly what one Newark, NJ man did after becoming frustrated with the amount of late payment notices and collection calls he was receiving from Rent-A-Center.

Don't Maintain A Negative Balance With Sprint Or They Will Disconnect Your Service

Sprint disconnected Bill’s service for “exceeding his account spending limit,” even though his account had a -$50 balance and he was signed up for Sprint’s Simply Everything unlimited plan. Sprint quickly reactivated Bill’s phone after he pointed this out, but warned that his service “will probably shut back off in a couple of days.”

What Happens When You Pay Your $0.19 Amex Bill With 7 Origami Checks?

Bad Consumer Smith finally paid off her American Express Optima card after 14 years, but couldn’t believe that Amex tacked on a $0.19 finance charge to her last bill. Smith summoned her lesser angels to work out a fitting response. Here’s what she came up with:

I sent AmEx two checks for a penny each, one for two cents, two for three cents, one for four cents, and one for a nickel.

Citigroup Developing Citi-Branded Phone That Can Make Contactless Payments

Do you wish you had a way to spend your money more easily, without all that opening-the-wallet or punching-the-pin-number manual labor? The trade publication Cards & Payments (registration required) says that it’s received a copy of a report filed with the FCC that indicates Citigroup is developing a Near Field Communication, or NFC, mobile phone that would allow its customers to make contactless payments at participating retailers.

../../../..//2008/03/07/in-response-to-yesterdays-post/

In response to yesterday’s post, another AT&T employee writes, “Just to clear up some confusion, AT&T may charge an administrative fee when paying your wireless bill with a representative. There is no charge to use the automated payment systems. The source for this is the tagline on my bill.”

Hotel Monaco Denver Doesn't Care What Happened, They're Locking You Out Of Your Room, Enjoy Your Business Trip

Rebecca is—as this story is being posted—locked out of her room at the Hotel Monaco in Denver, Colorado, where she’s attending a work related conference. She accidentally left her wallet and cell phone in her husband’s car on the way to the airport, so she’s trying to make do with a passport and debit card that she had on her when she realized what had happened. Hotel Monaco told her she had to have the room paid for by 5pm today, but while she was attending the conference this morning they changed their minds and locked her out at 12 noon.

AT&T To Charge $5 For Payments Over The Phone In May

An anonymous AT&T employee who says to call him “Vernon” wrote in to tell us that starting next Tuesday, March 11th, some customers in the Southeast who call in to make a payment will be charged $5, with the fee going nationwide by May. He writes, “I feel this is taking advantage of our customers’ trust, because even when we put it on all of their bills, and let people know, there will be tons of reps that won’t let the customer know they’re being charged for taking their payment.”

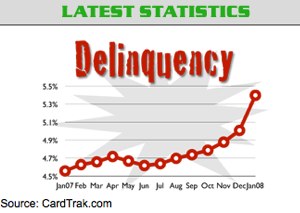

Late Payments On Credit Cards Highest In Three Years

CardTrack.com says “the percentage of people delinquent on their credit cards is the highest it’s been in three years,” according to CNN. Over the past year, U.S. consumers have charged “more than $2.2 trillion in purchases and cash advances.” The article gives the usual advice: Stop buying stuff!

Verizon Will Waive Late Fee Only If You Pay Through The Automated Phone System

Verizon was willing to refund the late fee on reader Steve’s bill, but only if he paid through Verizon’s automated phone system. Steve instead offered to give his billing information to the Verizon CSR to whom he was speaking, an offer that was refused. Steve writes:

I used to work at a call center for a certain mobile provider. I understand exactly what reps deal with. I’ve had my manager tell me I need to cut back on bathroom time. I’ve had them tell me I need to get my calls shorter. I’ve had them tell me I can’ waive reconnection fees. I’ve been there. I know.

The Perils of No Interest No Payment Financing

You’ve seen the deals, but do you really understand the fine print? Maybe not. According to the founder of Consolidated Credit Counseling, a lot of us don’t. “Retailers understand the nature of the American consumer,” Dvorkin said.