One of the first studies of the recent market splat found that the investors most likely to be crushed thought they were investing for the long haul, only to be forced into cashing out at the worst possible time. According to the study, cleverly titled “When Everyone Runs for the Exit,” there are only two good ways to react to a liquidity crisis: hold onto your portfolio and trust that it will recover, or fold immediately to limit your losses.

panic at the disco

Understanding The Money Meltdown In 10 Easy Links

After reading these 10 links, the I Will Teach You To Be Rich blog believes they will make you smarter than 99% of other people about the financial crisis, what it means, and what to do about it. [I Will Teach You To Be Rich]

How Not To Panic About The Stock Market

Seeing the greatest single-day point drop in the Dow is probably not the kind of history anyone wants to be living through right now. The failure of the bailout bill to pass caused a big freakout in the market, which thought we were going to get a bailout today. But before you click the button to transfer all your investments to 0% return T-bonds (aka I give up on investing), first ask yourself if that’s really in line with your long-term investment goals. Secondly, realize that point-wise it might the greatest drop, but it’s not the greatest drop percentage-wise. In other words, we’ve been here, and bounced back, before. If you’re decades away from retirement, today’s plunge is a buying opportunity. Here are some thoughts about fighting the urge to panic.

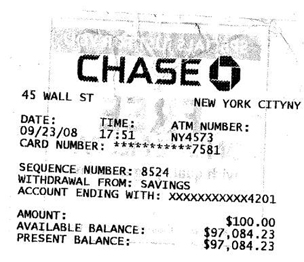

Found Wall Street ATM Receipt Shows $97,084.23 Balance

With all the concern about unemployed Wall Street sloggers and whether they’ll be able to keep up their leveraged lifestyle, or even get an apartment, this ATM receipt a reader’s coworker found sitting in a Wall Street ATM with a balance of $97,084.23 shows there’s at least one person who is going to be okay. Plus, this guy knows what he’s doing; note how the balance is just under the $100,000 limit for full FDIC coverage.

Warren Buffett Buys $5 Billion Worth Of Goldman

Warren Buffett buys $5 billion in Goldman Sachs stocks, causing a subdued “yay” to rise among investors. Is the contemporary equivalent to J.P. Morgan helping to calm the Panic of 1907 by walking onto New York Stock Exchange and buying bank stocks?

FBI Investigating Failed, Bailed, Financial Firms

The FBI has launched a fraud probe into Fannie Mae, Freddie Mac, Lehman Brothers and AIG. Sounds kinda like a move to placate the masses. “We’re on it.” No doubt in response to the seething outrage sweeping the nation over the size and audacity of the bailouts, however needed they might be. Sounds like an easy job. Sorta like dipping your hand in a barrel of ink and trying to pull up black stuff.

Understanding The Panic Of 2008 In 15 Easy Steps

If you’re wondering how we got into the big money mess, Kiplinger has a nice and easy 15 step guide to the market meltdown. They trace the origins back to 2000, when the Federal Reserve made the federal funds rate, the interest rate banks charge each other for short term loans, very low. Then we go through the speculative bullshit of the subprime mortgage market, the various imaginary castles built on top of it, and then just how everything went to pot once the naked emperor was revealed. No blame-casting, just the straight up facts.

Wall Street Is Dead

Wall Street is dead. According to its Journal, it died last night when the Federal Reserve agreed to convert Goldman Sachs and Morgan Stanley, the last remaining mega brokerages on Wall Street, into bank-holding companies. The Wall Street that was, “a coterie of independent brokerage firms that buy and sell securities, advise clients and are less regulated than old-fashioned banks,” is no more. In exchange for access to more Federal loan money, and not having have to mark its assets at market value, the two companies will be subject to tighter capital requirements and more government regulation and oversight about how they do their business. This will blunt profits, but that seems in order considering the run racked by so much reckless profiteering, for so long.

New Super Agency Proposed To Buy Up All The Very Bad Loans And Save Our Financial System

Markets rallied in late trading in the biggest gain in six years, emboldened by news that Washington wants to create a new agency that will buy up ALL the bad loans on these financial companies’ books. The initiative would be an attempt to fashion a holistic solution instead of bailing out each individual bank as it fails. This would cost many more billions of dollars and require Congressional approval. In order for all those CongressCritters to keep their jobs, there is talk that the deal would be packaged with another stimulus package perhaps including more rebates, along with food stamps and unemployment benefits.

../..//2008/09/18/passed-by-a-wamu-on/

Passed by a WaMu on my lunchbreak as I wait to see if I will have jury duty – the place looked no busier than a normal bank during lunch hour. No runs on the bank here in Brooklyn so far.

WaMu Direct Deposit Customers: Print Your Statements

For Washington Mutual direct deposit customers, to protect yourself no matter who takes over and how good they are at handling WaMu’s computer systems, Carmen Wong Ulrich, host of CNBC’s personal finance show “On The Money,” wants you to hit Print. When that direct deposit hits your account, she wants you to go to your WaMu online banking account and make a printout of your statement. That way if it somehow gets lost in the shuffle, “go right up to the bank with your paperwork.” It would probably get eventually sorted out anyway, but this way can help expedite things, just in case.

Favorite Comment Of The Day

laserjobs: The way things are going the FDIC will probably end up with WaMu. So as long as you are under the FDIC limits you will probably be with the safest bank around soon: WaMu Federal.

Morgan Stanley Ponders Wachovia Merger

The Morgan Stanley investment bank is considering merging with the Wachovia commercial bank. The point is for the investment bank to have lots of capital on hand in the form of consumers’ deposits. This would return the two back to their structure during the Great Depression, when the two split. Uh, oh, there’s the D word, and we’re not even officially allowed to say the R word yet! Let’s just say Wall Street is getting completely rewritten this week, and while it’s way too early to tell what this means to the average consumer, there will be repercussions. Blood, too, probably.

WaMu Begins To Sell Itself

WaMu has begun to try to sell itself. So far, no takers. If no one buys it, one of two things will happen. Either it will be placed into a conservatorship, like IndyMac, or form a bridge bank, a kind of temporary bank. So the question for depositors is: wait to find out who your new masters are, or pull out now and decide for yourself?

Feds Didn't Bail Out Lehman, They Just Loaned Them $87 Billion

Effectively, the Feds loaned the global financial firm Lehman Brothers $87 billion Monday as it filed for bankruptcy and sent Wall Street into even more of tizzy, CNBC reports. In order to “to avoid disruption of financial markets,” the feds asked JP Morgan Chase to advance Lehman the 87 really big ones, then the Federal Reserve Bank of New York repaid Chase. Wait, wasn’t everyone patting the government on the back for not bailing out Lehman? Looks like that was only half of the story. Your tax dollars at work.

Don't Start Yanking Your WaMu Accounts

The scary headlines about WaMu’s stock slide have a few readers worrying if now is the time to pull their deposits. I’m a WaMu customer myself and I say no. For now, though I could be wrong, this just looks like more hot panic sweeping the market. First off, you’re FDIC-insured up to the first $100,000. You will get your money. Secondly…

"Years Of Silliness" Unwound Over Single Weekend

“I’ve been on Wall Street for many years, and I’ve never seen a weekend like this one,” said Michael Holland, 64, chairman and founder of New York-based Holland & Co. “We are unwinding what has been years of silliness in the financial markets, and the silliness is being vaporized as we speak, unfortunately with the stock price of a number of companies involved in it.”

But How How Does The Bailout Affect Me?