Last spring, New York state Attorney General Eric Schneiderman threatened to sue both Bank of America and Wells Fargo, alleging that the banks had repeatedly failed to comply with the 2012 $26 billion settlement between multiple states and the nation’s five largest mortgage servicers. Now the AG intends to make good on that threat by actually filing suit against Wells. [More]

mortgage modifications

Judge Denies Class-Action Request In Massive Bank Of America Lawsuit

An effort to consolidate 26 separate homeowner lawsuits against Bank of America hit a huge roadblock yesterday when a federal judge ruled that while the individual cases appear to have merit, they can not be heard as a group in a class action. [More]

Banks Received $814 Million In Federal Incentives For Mortgages That Ended Up In Redefault

According to the latest report from the Special Inspector General for the Troubled Asset Relief Program (or the much-cooler SIGTARP), the nation’s mortgage servicers have received more than $800 million in incentives for making modifications on mortgages that have ultimately resulted in the homeowner redefaulting on the loan. [More]

Bank Of America Attempts To Discredit Statements Of Former Employees

Last month, it was revealed that six former Bank of America employees and one ex-contractor for the bank, had given sworn statements in a lawsuit filed against BofA, and that these statements painted a picture of a system that deliberately lost mortgage modification paperwork and rewarded staffers for pushing employees into foreclosure. Now BofA has issued a detailed rebuttal of those allegations and why it believes that these statements misrepresent the truth. [More]

Homeowners Accuse Bank Of America Of Racketeering In Lawsuit Over Mortgage Modifications

Following the recent revelations from former Bank of America employees that the nation’s most-hated financial institution allegedly engaged in deliberate schemes to delay and deny mortgage modifications, a group of three homeowners have sued BofA, alleging violations of federal anti-racketeering laws. [More]

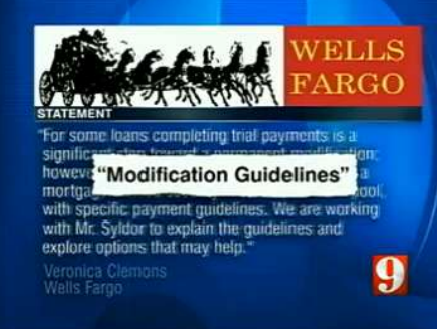

Wells Fargo Forecloses On Homeowner Who Made Payments Too Early

A homeowner in Orlando is confused, and with good reason. He says he not only made his mortgage payments on time to Wells Fargo, but that he sometimes paid early and sometimes paid more than he was supposed to. And yet, the bank decided to foreclose on his home. [More]

California Lawmakers Move Forward With Homeowner Bill of Rights

California is one of the many states hit in the gut by the collapse of the housing market, with at least a million homes already lost to foreclosure and about half as many struggling homeowners simultaneously trying to stave off foreclosure while jumping through hoop after hoop in the hopes of getting a mortgage modification. Yesterday, pending legislation that could help these homeowners came one step closer to being a reality. [More]

Group Alleges 'Good Morning Vietnam' DJ Misled Troubled Homeowners

Though he bears little resemblance to the record-slinging, Nixon-impersonating prankster played by Robin Williams in Good Morning, Vietnam, former Air Force radio DJ Adrian Cronauer is still closely associated with the 1987 comedy. Now, Cronauer is making a different sort of headline after the National Community Reinvestment Coalition has filed a pair of complaints against the law firm that bears his name. [More]

Former Goldman Sachs Staffer: Company's Mortgage Mod Process Was "Total Disaster"

In 2009, tens of thousands of homeowners with mortgages serviced by Goldman Sachs subsidiary Litton Loan Servicing entered into trial loan modifications. But fewer than 12% of those same people ever received permanent adjustments to their mortgages, not because they didn’t qualify, but because Litton’s system for handling paperwork was a horrendous mess. [More]

Feds To Stop Punishing Chase, Bank of America For Sucking At Mortgage Modifications

Since the Treasury Dept. began releasing quarterly report cards on big banks’ efforts to improve their mortgage modification processes, Bank of America and JPMorgan Chase have consistently received subpar marks, leading the feds to withhold a total of $171 million in incentives. That money is now set to be released to BofA and Chase — but not necessarily because they suck any less at mortgage mods. [More]

Bank Of America & Chase Continue To Be Penalized For Sucking At Loan Modifications

For the third quarter in a row, the Treasury Dept. has released its report card detailing how the country’s largest mortgage servicers are doing with processing loan modifications. And for the third consecutive quarter, both Bank of America and JPMorgan Chase will not receive incentive payments from the Treasury because the banks are doing such a craptastic job at complying. [More]

6 Warning Signs Of A Mortgage Modification Scam

Getting a mortgage is difficult enough. Having that mortgage modified because your house has dropped in value can be a Minotaur’s maze full of unscrupulous types looking to cash in on your uncertainty about the often complicated process. [More]

Judge Rips Into U.S. Bank For Taking Bailout Money But Denying Mortgage Modifications

A judge in Georgia is quickly becoming an internet folk hero after he publicly slammed U.S. Bank for taking billions in government bailout money and all the while refusing mortgage modifications for homeowners in need of help. [More]

More Towns To Withdraw Millions From Chase Over Mortgage Mod Practices

We know the story. Chase and other banks got billions in bailouts that they were encouraged, but not required, to use to help people modify their mortgages. Instead they sat on it and smiled like cheshire cats. Now a movement has sprung up to punish Chase for its intransigence by withdrawing money from their accounts. On the individual account level, that’s not much. But in New York state, entire towns are getting in on the act. [More]

Class Action Suit Against BofA For Deceptive Loan Mods Goes National

Olly, olly, oxen, free. A class action lawsuit against Bank of America claiming they were less than above board with their loan modification practices has been certified for national participation. [More]

FTC Wants To Ban Mortgage Mod Services From Charging Up-Front Fees

To combat mortgage relief fraud, the FTC would like to make a new rule that would ban mortgage modification services from charging up-front fees. “Homeowners facing foreclosure or struggling to make mortgage payments shouldn’t have to contend with fraudulent ‘companies’ that don’t provide what they promise,” FTC Chairman Jon Leibowitz said in a statement. “The proposed rule would outlaw up-front fees so companies can’t take the money and run.” Indeed, there are some shady operators in this area and consumers need to beware. [More]

265,000 Homeowners Stuck In "3 Month" Trial Loan Period For 6+ Months

Newly released data shows 265,000 homeowners are trapped in loan mod limbo, stuck in “3 month” trial loan periods for over 6 months, reports ProPublica. [More]