If we’ve learned anything from Wells Fargo’s recent fake account fiasco, it’s that high-pressure sales tactics can lead to unethical and sometimes illegal behavior. But did similar sales quotas and incentives lead Morgan Stanley employees to push customers into unneeded loans? That’s a question regulators in Massachusetts aim to answer. [More]

morgan stanley

Morgan Stanley To Pay $3.2 Billion To Settle State & Federal Mortgage Cases

Almost exactly a year after Morgan Stanley agreed to pay $2.6 billion to close the books on a Department of Justice investigation related to it role in the subprime mortgage crisis, the company is set to pay another $3.2 billion to settle federal and state allegations that it deceived investors in toxic mortgage-backed securities. [More]

Morgan Stanley To Pay $2.6B To Settle Charges Of Selling Troubled Mortgages Leading Up To The Financial Crisis

The Department of Justice has struck a multi-billion dollar deal with Morgan Stanley in what is expected to be one of the last major steps in resolving investigations related to banks’ roles in the subprime mortgage crisis. [More]

Morgan Stanley Fires Employee Accused Of Stealing Data From Up To 350K Clients, Posting Some Info Online

Another day, another bank reveals that client information was leaked where it shouldn’t have gone leaking: Morgan Stanley notified authorities and fired an employee accused of stealing data from up to 350,000 wealth-management clients and allegedly posting some of that information online. [More]

Goldman Sachs, Morgan Stanley Ready To Drop $247 Million In Mail To Victims Of Foreclosure Abuses

Back in January, Goldman Sachs and Morgan Stanley announced a $557 million settlement “for deficient practices in mortgage loan servicing and foreclosure processing.” Later this week, the chunk of that money earmarked for payouts to affected consumers will be going out in the mail. [More]

Banks Uncover Additional Wrongful Foreclosures On Military Members

The Servicemembers Civil Relief Act (SCRA) is intended, in part, to help protect active-duty members of the armed forces from having their homes taken away by foreclosure, but as we’ve seen, this hasn’t stopped banks from ignoring the law and taking those houses anyway. Now comes a report that banks have recently uncovered hundreds of additional wrongful foreclosures on the homes of servicemembers. [More]

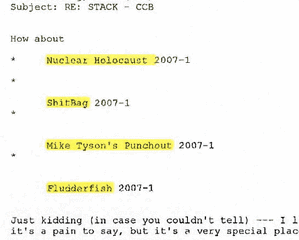

‘Nuclear Holocaust’ & ‘Sh!tBag’ Among Clever Names Morgan Stanley Bankers Gave To Toxic Mortgage-Backed Security

Federal prosecutor Lanny Breuer insists he has yet to find enough evidence to bring an indictment against a single Wall Street executive over the 2008 mortgage meltdown, yet lawyers in private lawsuits against the banks continue to turn up some gems — like this one from the Morgan Stanley e-mail vault. [More]

Goldman Sachs, Morgan Stanley Hit With $557 Million Settlement Over Foreclosure Practices

While most of the headlines about abusive or half-baked foreclosure practices have focused on the huge retail banks — Wells Fargo, Bank of America, Citi, Chase, et al. — the big investment banks haven’t exactly been let off the hook. [More]

I Accidentally Receive Millionaire Stranger's Financial Documents, Not His Cash

If Avi had ever considered using Morgan Stanley to handle his imaginary millions, he’s probably reconsidering now. A UPS envelope showed up at his house with detailed financial statements from a complete stranger. It wasn’t a mixup, since Avi has no relationship with the firm. Why did this show up on his doorstep? [More]

Fed Orders Review Of Thousands Of Morgan Stanley Foreclosures

Yesterday, Morgan Stanley finally finished selling off its one remaining unit involved in servicing subprime mortgages. Today, the Federal Reserve gave Morgan Stanley some unwelcome news: It must review thousands of foreclosures processed by that now-former subsidiary. [More]

Facebook Officially Files For IPO; World Continues To Turn

Facebook, the startup website that the kid from Squid & the Whale was accused of stealing from those twins in that pistachio commercial (or at least that’s what I learned from fast-forwarding through The Social Network), is finally set to join the ranks of the publicly traded. The company has filed papers for its initial public offering, which is expected to make a bunch of people really, really rich and maybe, just maybe, make us all love one another again. [More]

Morgan Stanley Data Breach Burns 34,000 Investment Clients

Morgan Stanley Smith Barney says it has lost two CD-ROMs containing password-protected but not-encrypted data from investment clients. A spokesman for the brokerage says there’s no evidence that there was criminal intent in the breach, or that the information has been misused. [More]

NY Attorney General Investigating Pre-Bust Hijinks At Bank Of America, Goldman Sachs & Morgan Stanley

Just when you think the beleaguered bankers of the world can finally stop dealing with pesky investigations into their roles in the recent financial ugliness (some would call it a global economic meltdown), some Columbo-like snoop has to say, “Just one more thing” and open up all new cans of worms. The latest can-opener is New York state Attorney General Eric Schneiderman, who has reportedly begun a broad investigation of Goldman Sachs, Bank of America and Morgan Stanley. [More]

Feds Gave $220 Million In Bailout Bucks To Two Morgan Stanley Wives For Some Reason

Rolling Stone’s Matt Taibbi – the guy who famously referred to Goldman Sachs as “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money” – has an interesting expose of how the wives of two Morgan Stanley hot shots, though they had no previous financial experience, set up their own investing initiative and got $220 million in bailout funds. [More]

Citi Beats Bank Of America At One Thing: Getting Bailout Money

The Congressional Oversight Panel overseeing the TARP program has finally made public the data on exactly how much each of the various bailed-out banks received from the combined coffers of TARP, FDIC and the Federal Reserve. The winner: Citigroup’s $476.2 billion. [More]

U.S. Investigating Morgan Stanley Subsidiary For Unlawfully Foreclosing On Military Families

A Morgan Stanley unit is under investigation by the Justice Department for foreclosing on nearly two dozen military families without a court hearing, a violation of Federal law meant to protect active duty service members. [More]

Bankers Back To Congratulating Themselves, Bonuses Up 17%

In these tough times, it’s easy to forget about the struggling bankers out there as you dodge their SUVs on your walk to the unemployment office. So it’s a good thing they have someone looking out for their financial interests — themselves. [More]

NY AG: Banks Paid Bonuses That Were Substantially Greater Than The Banks' Net Income

New York Attorney General Andrew Cuomo’s report on the bonus structures of the banking industry is out and — oh my— it’s damning. The AG says that 3 banks, Goldman Sachs, Morgan Stanley, and JP. Morgan Chase, paid out bonuses that ” were substantially greater than the banks’ net income.”