Markets rallied in late trading in the biggest gain in six years, emboldened by news that Washington wants to create a new agency that will buy up ALL the bad loans on these financial companies’ books. The initiative would be an attempt to fashion a holistic solution instead of bailing out each individual bank as it fails. This would cost many more billions of dollars and require Congressional approval. In order for all those CongressCritters to keep their jobs, there is talk that the deal would be packaged with another stimulus package perhaps including more rebates, along with food stamps and unemployment benefits.

money

5-50% Off At Home Depot

Looking to spruce up the ol’ nest? Home Depot announced a big sale today, with temporary pricecuts of 5-50%, with 400 items being announced each Thursday for the next three weeks.

How Wall Street Lied To Its Computers

The people who ran the financial firms chose to program their risk-management systems with over-optimistic assumptions and to feed them oversimplified data.

Personal Finance Roundup

5 Simple Steps to a Successful Cover Letter [Yahoo Hotjobs] “[Here’s] an easy-to-follow, five-step formula for cover letter success”

WaMu Direct Deposit Customers: Print Your Statements

For Washington Mutual direct deposit customers, to protect yourself no matter who takes over and how good they are at handling WaMu’s computer systems, Carmen Wong Ulrich, host of CNBC’s personal finance show “On The Money,” wants you to hit Print. When that direct deposit hits your account, she wants you to go to your WaMu online banking account and make a printout of your statement. That way if it somehow gets lost in the shuffle, “go right up to the bank with your paperwork.” It would probably get eventually sorted out anyway, but this way can help expedite things, just in case.

What To Do In These Uncertain Financial Times

The housing crisis. The stock market plunge. The banking industry in shambles. What’s a person to do in the midst of all this financial turmoil? We thought we’d offer our suggestions for making it through the rough waters many of us are facing:

Favorite Comment Of The Day

laserjobs: The way things are going the FDIC will probably end up with WaMu. So as long as you are under the FDIC limits you will probably be with the safest bank around soon: WaMu Federal.

Morgan Stanley Ponders Wachovia Merger

The Morgan Stanley investment bank is considering merging with the Wachovia commercial bank. The point is for the investment bank to have lots of capital on hand in the form of consumers’ deposits. This would return the two back to their structure during the Great Depression, when the two split. Uh, oh, there’s the D word, and we’re not even officially allowed to say the R word yet! Let’s just say Wall Street is getting completely rewritten this week, and while it’s way too early to tell what this means to the average consumer, there will be repercussions. Blood, too, probably.

WaMu Begins To Sell Itself

WaMu has begun to try to sell itself. So far, no takers. If no one buys it, one of two things will happen. Either it will be placed into a conservatorship, like IndyMac, or form a bridge bank, a kind of temporary bank. So the question for depositors is: wait to find out who your new masters are, or pull out now and decide for yourself?

Regulators Seek WaMu Suitor

Regulators are trotting around Washington Mutual trying to get banks interested in buying it. It’s sort of like in the old days when the local beauty queen, last scion of the largest landowner in the county, would get maimed in a horrible combine accident and the town elders would trot her catatonic body around to arrange a marriage so all her fields wouldn’t turn fallow and destroy the local economy for years to come. Wasn’t that given treatment in Faulkner? As I Lay Hemmoraghing Equity?

How Hard Is It To Get A Car Loan These Days?

Having trouble getting a car loan? You’re not alone. “Gas at $4 a gallon changed the type of vehicles people buy. The credit crunch, however, has changed their ability to buy,” says a car dealer. Higher interest rates, higher down payments, fewer loans, and high aversion to dings on your credit report, this Kicking Tires post has more from the front lines about banks’ new level of pickiness when it comes to putting you in your next jalopy.

Feds Loan AIG $85 Billion

The Federal Reserve Bank of New York will lend AIG $85 billion. Explaining the breathtaking move the Fed said, “a disorderly failure of A.I.G. could add to already significant levels of financial market fragility and lead to substantially higher borrowing costs, reduced household wealth and materially weaker economic performance.” They’re not just dumping out the public purse on the counter, though. FBNY will take a 79.9% stake in the company, the collateralized loan is for two years, and is expected to be paid off by selling off assets. NYT writes, “the bailout is likely to prove controversial, because it effectively puts taxpayer money at risk while protecting bad investments made by A.I.G. and other institutions does business with.” You can say that again.

WaMu's Stock Bumps Upwards

WaMu’s stock is up this morning after the new CEO said the S&P rating downgrade to junk was based on “market conditions” and not their financial condition, and an unsourced Daily Mail article said Chase was going to bid for the beleaguered thrift.

Follow Virgin America's Twitter For Fare Drop Alerts

Follow twitter.com/VirginAmerica for a super-duper fast way to get fare-drop info. [via Xeni Jardin]

Chase to WaMu Customer: "God Bless Your Soul"

I went into a Brooklyn Chase today to see if, in the wake of the concerns about them going bust, Washington Mutual customers were switching over. I went up to the manager and said, “I’m a WaMu customer —” “—God bless your soul,” he interjected.

What Merrill, Lehman, And AIG Customers Need To Know

NYT’s Ron Leiber breaks down what you need to know and do if you are or were a customer of Merrill Lynch, Lehman, or AIG…

Don't Start Yanking Your WaMu Accounts

The scary headlines about WaMu’s stock slide have a few readers worrying if now is the time to pull their deposits. I’m a WaMu customer myself and I say no. For now, though I could be wrong, this just looks like more hot panic sweeping the market. First off, you’re FDIC-insured up to the first $100,000. You will get your money. Secondly…

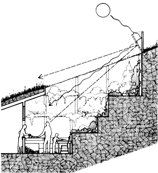

Live Underground For Cheap

Forget the sub-prime meltdown and get with the subterranean housing craze. This book – linked in one of Chris’s posts but I just had to bring it to the front page – has everything you need to know about building a house underground. The most amazing thing is that there’s ways to do it to get light from all four sides. The penultimate amazing thing is not being buried alive while you sleep.