../../../..//2008/10/06/after-falling-800-points-in/

After falling 800 points in a single trading session, the Dow pulled back to finish down just 369.88. [NYT]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/10/06/after-falling-800-points-in/

After falling 800 points in a single trading session, the Dow pulled back to finish down just 369.88. [NYT]

Nashville Electric Service (NES) decided it would be a good idea to round up each customer’s bill to the nearest dollar, then take that extra change to donate to charity. It’s a great idea, and since the total amount donated per year can’t exceed $11.88, it’s not a hardship on most people. But there are a few problems. First, NES chooses the charities, if that matters to you. What’s more troublesome is that NES plans to opt-in every customer when the program begins on January 2009 without asking for explicit permission—if you pay your electricity bill through NES, you’ll donate to their charities next year, thank you very much.

Stuck in a $14,300 debt hole, reader Trixare4kids was able to dig herself out using tips she learned about on Consumerist.com. Let’s learn how she attacked her personal finances and learned to live frugally, and did it all in 20 months.

If you’ve got a few credit cards lying around that you haven’t used in a while but don’t want to lose, you might want to talk them out for a walk.

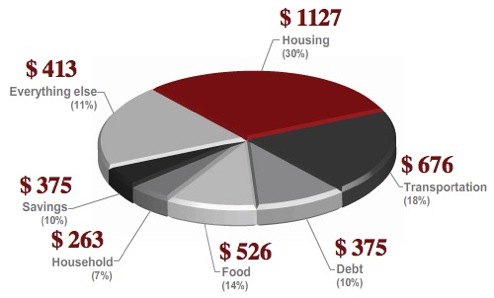

On The Money’s budget calculator makes it easy to determine how much you should be spending across the seven categories that make up any responsible budget. Regardless of income, tracking and limiting your overall spending is a foolproof strategy for keeping your accounts in the black. Though the percents will vary according to geography and personal situation, On The Money’s calculator gives you a quick glance at concrete spending targets that you can compare against your credit card bills and bank statements. Give it a try and tell us in the comments what other tools you use to control your spending.

I’m not convinced that they’re totally necessary but if you’re going to look for a financial planner, here’s how to go about it. While some financial planners argue that fees, investment returns, education and experience aren’t that important when selecting a financial advisor, impartial observers almost always disagree. Case in point is US News’ listing of six steps to finding a good financial planner. Their suggestions are as follows:

Instead of sucking off the blood of taxpayers, Swiss banking giant UBS is weathering a financial crisis wrought by investing in bad mortgages by aggressively selling off its U.S. commercial and residential mortgage-related assets. Reports Forbes:

There’s a happy ending to our story, “Always Look A Gift Check In The Mouth” about the guy who opened up a new bank account just to deposit a check he thought might be fraudulent and indeed, turned out to be. Fred writes:

All of a sudden, everyone is interested in how their banks, credit cards, credit scores, credit reports, mortgages, and money actually work. Staying out of the red is the new black. Have you found yourself talking more about money matters and strategies with friends, family, co-workers, and even strangers?

J is in a debt hole and needs help getting out. We’re going to give it to him: [More]

Knock $4,000 off your utility bill [CNN Money] “Invest $1,500 in insulation and maintenance and get over twice that in energy savings the first year.”

Don’t bother getting up early tomorrow to submit your Leading Hotels Of The World do-over app in the hopes of snagging a $19.28 hotel room. All the registrants just got an email saying it was postponed. Here’s their full email:

Brandon Savage writes that he’s having success with saving by taking the advice in our “Get Rich By Saving Every $5 Bill” post. Since starting in August, he’s got $425 in additional savings this way. Here’s how he does it:

Leading Hotels of The World is having a “do-over” for today’s botched $19.28 5-star hotel room promotion. You just need to fill out this document and email it to the email address listed inside it starting at 8am Eastern, tomorrow, Oct 2. The forms will only be accepted for 80 minutes. Orders will be handled on a first-come-first serve basis. The link was left in our comments section by a commenter reposting a message from Marshall Calder, SVP of Leading Hotels Of The World marketing. He also made an apology, posted inside…

If you’ve bought stocks through E*Trade, make sure you log into your account at least once a quarter. That way you can see if there’s any alerts on the account, like the one telling you about the “inactivity fee” for not executing at least one trade per quarter, the fee that they’ll sell some of your stocks to pay for. This happened to reader Brody, who writes:

../../../..//2008/10/01/word-is-sovereign-bank-and/

Word is Sovereign Bank and National City Corp are “next on the FDIC’s to-do-list.” [Clusterstock]

“Leading Hotels Of The World” was supposed to have a sick deal today where you could get five-star hotel rooms for $19.28 per night, but the inevitable short supply and online stampede left many futilely clicking refresh for over two hours as the servers crashed. Instead of polite bellboys, many consumers were greeted by the message, “Just a moment, please…Due to the overwhelming number of consumers participating in this promotion. We regret to inform you due to technical difficulties beyond our control the 1928 promotion has been suspended indefintely. [sic]” Irate would-be customers left messages in various forums describing their experiences…

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.