Mr Bill says his latest dealings with Capital One have him “wanting to spit venom.” Whence this reptilian impulse? There is apparently no structure to refinance your loan with them. They consider it makes you a new customer, and they aren’t making any new loans. This takes several hours and several phone calls to figure out. There also seems to be no way to pay off a loan with a credit or debit card. This also takes several hours and phone calls to figure out. It’s really just totally frustrating for Mr. Bill. “What is this, 1987?” he writes. So he’s taking his business elsewhere. His misanthropic misadventure, inside…

money

Here's A Cartoon Explaining The Types Of Bonds

Slate’s “The Big Money” has decided it’s time to start educating readers on some core financial principles, and they’re starting with the very basics, presented in a “Schoolhouse Rocks!” style. Their first cartoon explains the four types of bonds. Visually, it’s a perfect match to the style of the original cartoons, but we hope they work on a catchier jingle for their next installment.

../../../..//2008/11/18/are-you-so-loaded-that/

Are you so loaded that you exceed the FDIC’s guarantee limit for deposits? Consider the Certificate of Deposit Account Registry Service. Deposit the funds at one of 2,500 CDARS member banks and they’ll automatically spread your cash among other member banks as needed to stay within FDIC coverage limits. Kiplinger says, “You’ll earn one rate (set by the home bank) and get one statement and one form at tax time.” [Kiplinger]

Reader Saves $230 On Cable And Phone Bills By Rocking The Cancellation Threat

Here’s how Stephanie saved $230 on her cable and phone bills after following the tips in “3 Ways To Lower Your Out Of Control Cable, Internet And Phone Bills“

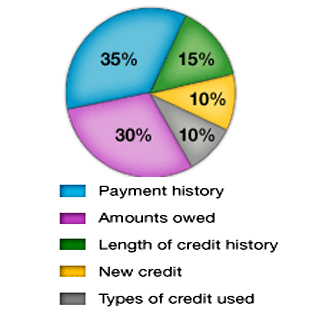

What Goes Into Your FICO?

How the heck do they figure out your FICO credit score? The five different factors, in order of decreasing importance are: 1) payment history 2) amounts owed 3) length of credit history 4) new credit 5) types of credit used. For a bit more detailed explanation on how each of these plays out, the “What’s in your FICO score” at myFico.com is a good place to start.

Escape Sprint ETF-Free Over Administrative Fee Increase

Want to break your Sprint cellphone contract without paying an early termination fee? On January 1, 2009, Sprint will increase the Administrative fee to $.99 per line. Because this is what is known as a “materially adverse change of contract,” and because of the basic contractual principle that you can’t change someone’s contract without their explicit permission (not the tacit, “opt-out” kind), you can use it to argue that the fee renders your contract void and you can end service without a termination fee. You do have to be willing to argue without giving up with a number of different Sprint employees first, like Matt did…

Alert: You Cannot Buy Consumerist With Doodle Money

Our post last Friday gave people some great business ideas. We appreciate the offers, but we must insist that you do not try to purchase Consumerist with doodle currency that you have minted yourself, probably while drinking. You can, however, try to bail out the auto industry with it if you want.

Price-Check Your Black Friday "Deals"

I’m really interested to see what happens with “Black Friday,” the hectic shopping day after Thanksgiving where retailers traditionally mark down their products for Christmas deal-seekers, this year. As the shark has been so thoroughly jumped on this shopping spree, the deals have gotten worse and the retail trickery more tricky, so can a consumer still make out?

Consumerist's Morning Deals Help Man Live Good Life For Less

Daniel read our post about a couple learning how to get their credit card rates lowered from The Consumerist and “realized I have a lot to thank the Consumerist for as well,” he says. “At the moment I am wearing an Italian suit I bought for $99 at amazon.com and next weekend I will be staying at the luxurious Hay-Adams five-star hotel in Washington, DC, for a mere $20 a night. Both of those deals were posted in your morning deals round-up.” Consumerist: saving you money on stuff you already have AND stuff you have yet to have. We’re your recession buddy!

Consumerist Helps Couple Lower Interest Rate On All Their Credit Cards

Yesterday I was on a conference call where a lady who’s been writing consumer journalism since before I was even born, in response to me saying how we repackage useful information and make it funny and make jokes and put up pictures of cats, asked me if the site actually helps anyone. I told her quite firmly and loudly that we do and gave examples, and here’s another one to throw on the evidence pile. Kevin writes:

Getting Crafty For Fun Holiday Frugality

Personal finance blogger JD Roth is on a mission to help us all save a bundle during the holidays. First he shared a ton of frugal Christmas ideas, and now he’s posted a list of 34 gifts you can make yourself. A few of our favorites include:

../../../..//2008/11/13/the-recession-in-the-eu/

The recession in the EU might be even deeper than the one in the US. Case in point: Ireland, which thrived off now-dormant construction cranes. [Washington Post]

Goldman Furious Over Our Posting Insider's Confession About Ripping Off Non-Profits

Goldman-Sachs read my post, “Goldman Rips Off Non-Profits, Endowments, Foundations, And Charities” about a conversation I had with a Goldman-Sachs trader where he boasted about ripping off charitable organizations with excessive fees, and they’re hopping mad. Here is the lovenote sent by Melissa Daly, VP of Corporate Communications:

McDonald's Sales Rise 8.2% In October As More Switch To Eating Crap

Good food costs more, so people are switching to eating less costly simulacrums of sustenance: McDonald’s same-store sales rose 8.2% in October. If you can’t afford to eat food, just eat “phood.”

The Town With The Most Screwed Housing Market In America

Nearly 90% of the homeowners in Mountain House, CA owe more on their mortgages than their house is worth. The average homeowner is down by $122,000. What are they doing to cut back? No more dinners at Applebee’s, buying 1 DVD a month instead of 50, canceling remodeling projects, and playing board games at home instead of going out to the movies, “But not Monopoly,” reports NYT, “with its real estate theme, it reminds them too much of real life.” One man is even cutting back on his scub and flying hobbies, and waiting until after Christmas to buy a high-def television. Wow. I think you’re going to have to dig a little deeper…

Personal Finance Roundup

Back to Basics: Start doing the little money-saving things again [Mighty Bargain Hunter] “Here are thirteen of those little money-saving things that you can do to lessen the pain during these trying times.”