Not all money is created equal. It costs retailers extra in fees when you use a credit card, a costs that gets passed right back to you in the form of higher prices, and how much that is depends on which credit card you use. To see how much more expensive your credit card is making life, enter the first 6 digits of your credit card over at truecostofcredit.com, a mashup developed by reader Sean Harper and his friend. This is the bank identification number and cannot be used to steal your credit card, so don’t worry. If you rather not do that, you can also see the results for an AMEX, a debit card, Mastercard rewards card, or a Visa rewards card. Of the project, Sean writes:

money

Consumer Borrowing Dropped $7.9 Billion In November

“Consumers have clammed up,” said Ken Mayland, president of ClearView Economics LLC in Pepper Pike, Ohio, who forecast a decline. “The reduction in consumer credit doesn’t stop here, and will spill over into 2009. Households are bolstering their balance sheets.”

9 Ways The IRS Can Help You Save On Taxes This Year

Taxes aren’t that far off, and the IRS is here to help you give them less money, or take longer in giving it to them! Here’s 9 ways they can make your tax life easier.

Oprah & Orman Give Out Free Book: "2009 Action Plan"

“Suze Orman’s 2009 Action Plan” is free to download from Oprah.com for the next week. Unlike last year’s “Women & Money,” this book is intended for pretty much everyone. We haven’t read it, so here’s a line from the Amazon editorial review: “There are safeguards to put in place, actions to take, costly mistakes to avoid, and even opportunities to be had, so that you are protected during the bad times and prepared to prosper when things take a turn for the better.”

Reach Sprint's Retention Department

Retentions, the place where you threaten to cancel because service sucks and they throw goodies and freebies and discounts at you to get you stick around, the place where dreams come true. Here’s two numbers to directly reach Sprint’s Retentions Department: 800-235-1185, 888-211-4727. (Photo: SlapAyoda)

Personal Finance Roundup

8 Bad Work Habits (And How to Break Them) [Yahoo Hotjobs] “Experts offer this list of common bad habits at work — and how to break them.”

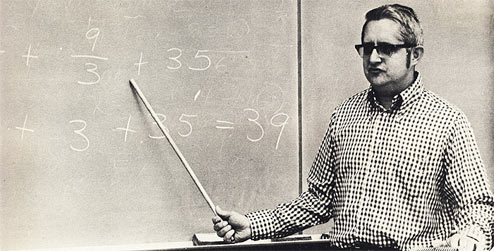

Mathematicians Have The Best Job In America

The Wall Street Journal covers a new study that determines the best and worst jobs in America using five criteria: environment, income, employment outlook, physical demands and stress. When all was said and done, all the data weighed and all the experts consulted, one occupation stood head and shoulders above the rest: mathematician. Yep, you read that correctly. Here’s why it took the top spot:

Inspiration: Go From Unemployed To Entrepreneur

One thing I’ve certainly learned is that great ideas really do need to start somewhere. If I don’t pull the trigger and take some fliers based on nothing but faith in my own ability, great dreams won’t ever be realized

Get One Free Tax Answer

Got a Federal tax question you can’t figure out? Input your question at FreeTaxQuestion.com now through Jan 31st and they will call you back within 24 hours with an answer or guidance. Limit one question per person.

Get An Employer Discount With Any Cellphone Company

Save money on your cellphone bill by checking out to see if you can get an employer discount! Here’s the necessary info for every major cellphone provider:

94th Richest Man In World Kills Self

Adolf Merckle, the 94th richest man in the world, committed suicide this week. Stock speculation is hazardous to your health. [NYT]

../../../..//2009/01/06/the-consistently-useful-get-rich/

The consistently useful Get Rich Slowly has some New Year’s resolutions for you: 9 Methods for Mastering Your Money in 2009. We especially like methods 3 and 7, as they’re easy fixes that shouldn’t take more than a couple hours to implement.

AARP-Endorsed Insurance May Not Be So Cheap After All

A Bloomberg investigation found that some insurance policies with the AARP stamp of approval actually cost senior citizens more, and part of that money is getting kicked back to AARP in the form of “royalties” and “fees.” Essentially, the AARP is taking a cut of your premium before passing it on to the insurer. These payments have gone from 11% of AARP’s revenue in 1999, to 43% in 2007. One man found he was paying twice the average for his car insurance. When walked into the the group’s brass and marbled headquarters, flashing his 20-year AARP card, to find out where his money was going, he was told the AARP doesn’t give tours.

How Much Change Can You Find On The Ground? Over $1,000

Do you stop and pick up change that you find on the ground? No? Well, if you did — how much money do you think you could collect? Marketplace Money talked to some people who make change hunting a hobby — and they say every penny is worth stopping for.

Despite Having A S*%!load Of Our Money, Banks Still Aren't Lending

Gripped by “catatonic fear,” banks still aren’t thawing credit markets, “leaving taxpayers propping up an industry that won’t lend to them.” [Bloomberg] (Photo: The Joy of the Mundane)

What's The Difference Between Money Market Accounts And Money Market Funds?

This year, many investors learned the hard way the difference between a money market account and a money market fund. Do you know the difference?

Money Resolutions Everywhere!

The web is full of financial resolutions for 2009, telling us all what we should and shouldn’t do for the next year. And whether or not you’re the resolution type, it’s probably worthwhile to review what some of the leading financial publications are recommending. After all, aren’t we all interested in ideas for improving our financial lives?