It’s tough for consumers to rationalize how inflation could be a good thing, especially if they haven’t received pay increases in years, but increasing costs are believed by many to be a sign of a healthy economy. That’s why Federal Reserve Chairman Ben S. Bernanke said Wednesday that the central bank will keep a close eye on inflation levels and may altar monetary policy to maintain the phenomenon if prices start to level off. [More]

monetary policy

Do We Need A Little Inflation To Get The Economy Moving?

Inflation is good, at the right time, and in moderate amounts. Like adding just a smidge during a recession when there’s a lot of people in debt. Knowing that prices will rise, some consumers and businesses are prodded to crack open their pocketbooks. The value of debts drop, easing the burden on strapped borrowers. Having used up a lot of options already, the Fed could slightly raise its inflation target and let prices slowly rise over the next few years, but they’re unlikely to announce anything remotely close to that in their meeting this week. Namely because people really really really hate inflation. Why is that? [More]

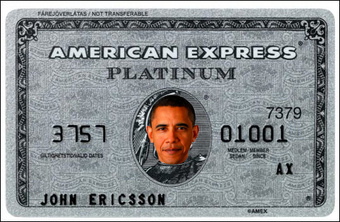

Would You Use A Government-Issued Credit Card?

With President Obama and Congress threatening to tag-spank credit card issuers, Slate is left wondering why the government doesn’t just issue its own credit card. Before you scream “SOCIALISM!,” consider the government’s heavy involvement in the banking sector, not just through the recent bailouts, but through long-standing institutions like Fannie and Sallie Mae, and Freddie Mac. Credit-worthy borrowers in Germany, France, and India all have access to low-interest, no-fee credit cards issued by their central banks. Would you ever be interested in an Obama-backed credit card?

Greenspan Says That His Free-Market Ideology Was Flawed

Here’s something that probably doesn’t happen too often. Former Federal Reserve chairman Alan Greenspan had a crappier day than you did. He had to admit before our federal government that his free-market, anti-regulation ideology was “flawed.” Ouch.