Allowing third-party sellers to sell on an e-commerce site can instantly expand a retailer’s online offerings without the retailer having to invest in more merchandise, but can also confuse shoppers who want to return their merchandise. After 5 years, Best Buy is shutting down its third-party marketplace today, citing shopper confusion and a decision to invest in other parts of the business as their main reasons. [More]

merchants

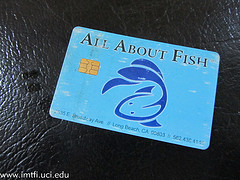

Visa Will Incentivize Stores To Install Smart Card Terminals

We could start to see “smart cards” — credit cards embedded with a PIN-encoded chip instead of just a magnetic strip — take hold in America next year due to a big move by Visa. They are offering some very enticing financial incentives to stores to get them to install point of sale terminals that can read smart cards. [More]

Long-Awaited Fed Ruling Caps Swipe Fees At 21 Cents

The Federal Reserve unveiled its ruling today on the fees banks can charge merchants for processing debit cards at 21 cents a swipe. The cap is far less restrictive than the 12 cent ceiling set by the Dodd-Frank bill, but is still less than the current 44 cent average. It’s uncertain how this will affect the consumer. [More]

Store Theft In The US Jumped 8.8% Last Year

Maybe this is why stores seem to be getting more and more aggressive about shoplifting: CNN says that retail theft in the US jumped 8.8% over the past year, versus only 1.5% in the prior year. But you may be surprised (only if you’ve never worked retail) to see where most of the theft occurs.

How To Reverse A Debit Card Overcharge Quickly

If someday you have the bad luck to have one of your debit transactions entered incorrectly by a merchant, here’s how to get things back to normal quickly. The important part is not to let the merchant “get back to you” at some later day. Instead, try to get your bank and the merchant on the line at the same time in order to get it rectified immediately.

Squash Minimum Purchase Fees With Wallet-Sized Merchant Agreement

Fed up with stores not knowing the rules for credit card purchases, Andy at NonToxicReviews created this handy credit-card-sized PDF of the relevant portions of Visa’s and MasterCard’s merchant agreements.

Why Do Lenders Want You To Use Your Debit Card Like A Credit Card?

A reader wants to know why Chase is pushing him so hard to use his debit card like a credit card when paying for things—they’re promoting a contest for people who do this, and on every insert or blank space in the paperwork that accompanied his newest card, they encourage him to always select “credit” over “debit” at checkout. Why?

Visa Covers Butt By 'Delisting' Breached Credit Card Payment Processors

Visa has removed Heartland Payment Systems and RBS WorldPay, the two huge payment processors that suffered recent data breaches, from its list of companies that are in compliance with Payment Card Industry (PCI) rules. It says they can get back on the list when they recertify that they have proper security in place. While this may sound like a significant change in the status of the companies, in reality it does little to change how the three companies do business with each other or with merchants. It’s just a way for Visa to protect itself from any upcoming lawsuits by banks and credit unions against the payment processors.