Wells Fargo is facing multiple lawsuits from customers and employees over the long-running fake account fiasco that saw more than two million bogus, unauthorized accounts being opened in customers’ names. Even though lawmakers and consumer advocates have repeatedly asked the bank to not sidestep its liability by using an often-ignored clause in its customer agreement, lawyers for Wells Fargo have already begun to play that “get out of jail free” card. [More]

mandatory binding arbitration

Wells Fargo Already Playing Its ‘Get Out Of Jail Free’ Card To Avoid Lawsuits Over Fake Accounts

Proposed “Justice For Victims Of Fraud Act” Would Take Away Wells Fargo’s Get Out Of Jail Free Card

Wells Fargo has admitted that millions of its customers were victimized by bank employees who opened unauthorized accounts in these customers’ names, but those fake account fiasco victims can’t file lawsuits against the bank because of clauses buried in their account contracts. A newly introduced piece of legislation would prevent Wells Fargo from using that clause to minimize its responsibility under the law. [More]

Court: Nursing Homes Can Continue Stripping New Residents Of Their Right To Day In Court

In September, the federal Centers for Medicare & Medicaid Services (CMS) issued a new rule that would prevent most nursing homes and other long-term care facilities from using forced arbitration to strip new residents of their right to file lawsuits against these companies. The industry soon fired back by doing the very thing it doesn’t want its customers to do: filing a lawsuit. This morning, the judge in the case granted the industry’s request for a preliminary injunction preventing the new rule from being enforced. [More]

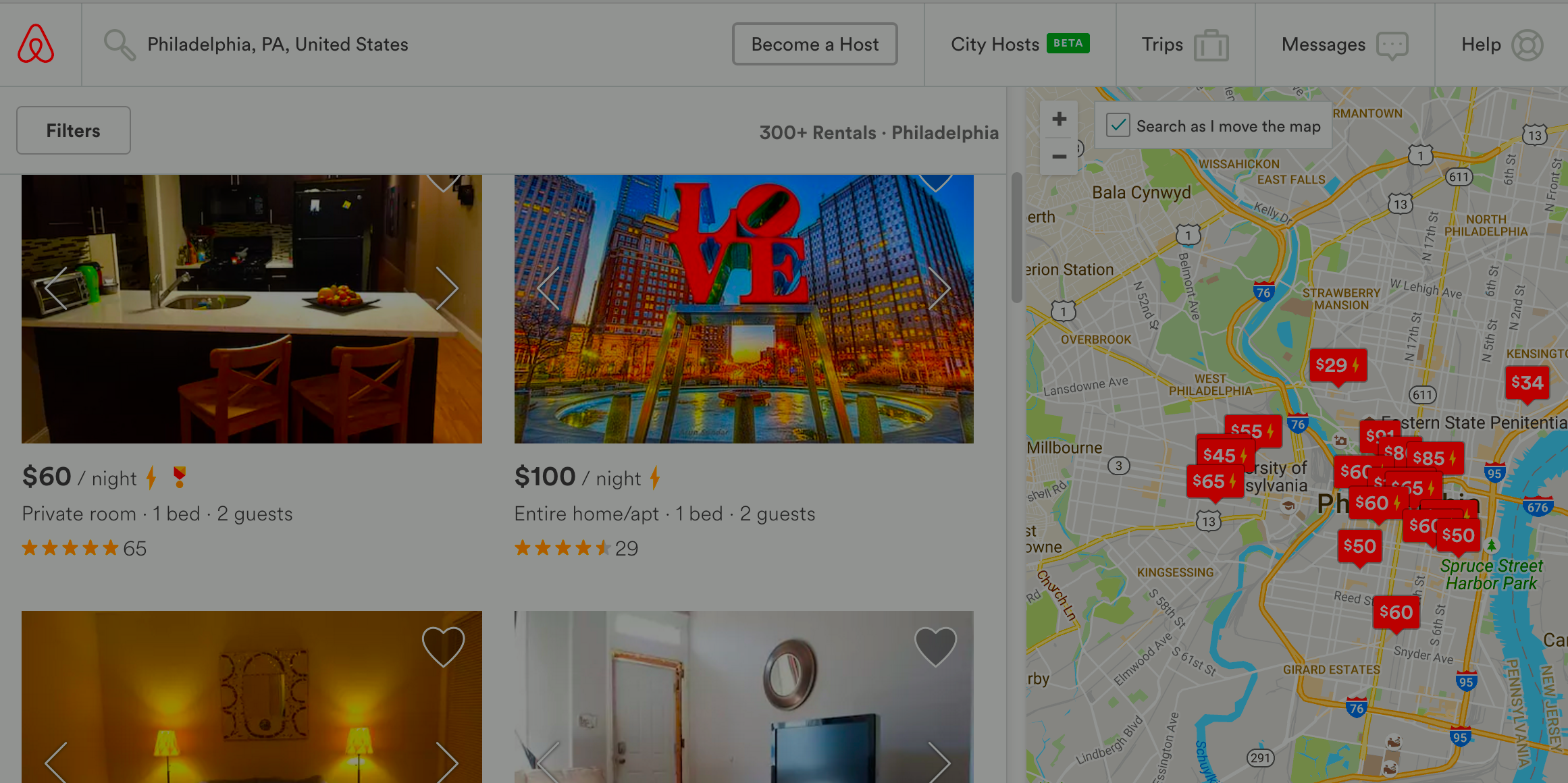

Judge: Airbnb Can Force Users’ Racial Discrimination Claims Out Of Courtroom

A large — and growing — number of companies use arbitration clauses in their overlong, legalese-stuffed customer agreements to prevent customers from bringing lawsuits and joining together in class actions, but can that arbitration agreement be used to avoid legal liability for possible violations of federal civil rights law? According to one federal judge, yes. [More]

FCC To Propose Rules That Could Restore Consumers’ Right To Sue Phone, Broadband Providers

While the big headline of this morning’s monthly FCC meeting was the release of the Commission’s final rules on broadband privacy, the agency’s leadership also let it be known that it’s planning to take on one of the industry’s most controversial issues: The right of consumers to have their day in court. [More]

More Companies Turn To Mandatory Arbitration: CreditKarma, Redbox, Kitty Bed Maker

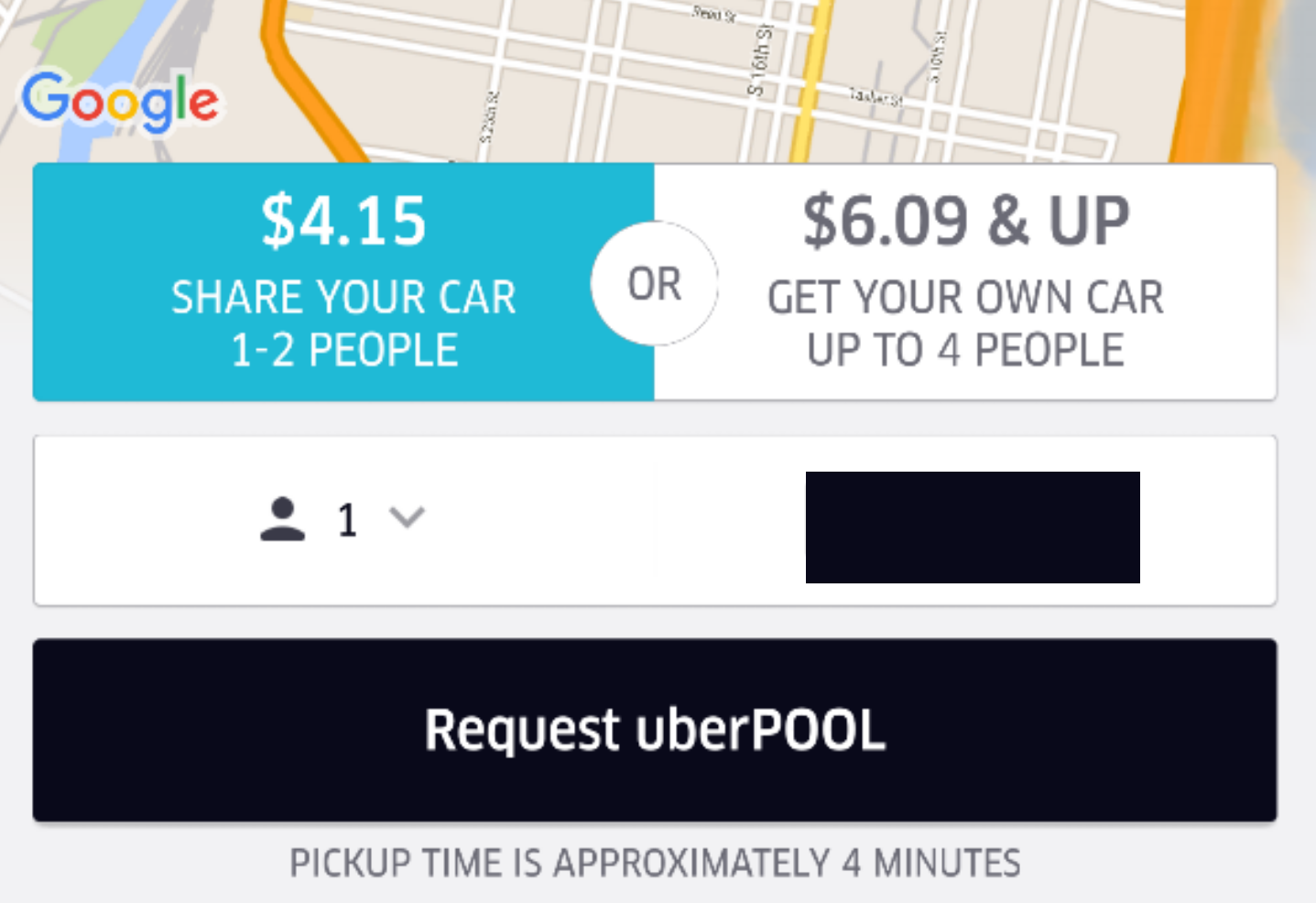

People in a wide variety of circumstances, from drivers signing up to work for Uber to senior citizens entering a nursing home, sign mandatory binding arbitration agreements. Two popular online services have recently started to require that customer disputes go to arbitration, and a reader sent along a product purchased online — a cat bed — that came with a arbitration agreement of its own. [More]

Nursing Home Industry Files Lawsuit To Keep Preventing Patients From Filing Lawsuits

Last month, the federal government issued new rules for nursing homes, barring most long-term care facilities from using forced arbitration agreements to stop new residents from filing lawsuits against the homes. Now nursing home operators and industry trade groups are challenging that rule by doing the one thing they want to prevent their patients from doing: going to court. [More]

New Rule Will Stop Many Nursing Homes From Stripping Residents Of Their Right To Sue

As we’ve written about previously, some nursing homes and other long-term care facilities use forced arbitration contracts to prevent their residents bringing a legal action against the home in a court of law. Today, the Department of Health and Human Services issued a new rule that will prohibit long-term care facilities that accept Medicare or Medicaid from forcing residents into arbitration. [More]

Appeals Court: Sorry Uber Drivers, You Signed Away Your Right To Sue Company

Just like a growing number of companies are quietly stripping consumers of their right to a jury trial, so too are employers using workers’ contracts to insert clauses that prevent them from bringing lawsuits in court. Yesterday, a federal appeals court ruled that most Uber drivers signed away their rights to pursue legal action against the company, putting multiple lawsuits — and a potential $100 million class action settlement — at risk. [More]

Lawyer: Employers Should Take Away Workers’ Right To Sue; Arbitrators “Know Where Their Bread & Butter Comes From”

The Consumer Financial Protection Bureau is currently working on rules to stop banks, credit card issuers, and others from forcing customers to sign away their right to a jury trial. Opponents claim that this change will only benefit trial lawyers, but some candid advice from one lawyer shows exactly why these protections are needed — and who really stands to benefit. [More]

9-In-10 Big Banks Strip Customers Of Their Right To Jury Trial

If you ask someone on the street if they should have the right to sue their bank over something like an illegal overdraft fee, nearly everyone you speak to will invariably say yes. But a new report confirms that nearly all big banks are forcing customers to give up their right to a jury trial. [More]

103 Lawmakers Come Out In Favor Of Revoking Banks’ “Get Out Of Jail Free” Card

In May, the Consumer Financial Protection Bureau proposed new rules for financial services companies that could severely limit their ability to sidestep legal liability by forcing wronged customers out of the courtroom and into the byzantine, unfair world of binding arbitration. Some in Congress recently tacked on some legislative pork to an appropriations bill that would prevent the CFPB from moving forward on these rules, but today more than 100 federal lawmakers came out to commend the Bureau for its efforts. [More]

From Credit Cards To Mail-Order Steaks: 87 Companies That Are Taking Away Your Right To Sue

A recent study by the Consumer Financial Protection Bureau found that even though most Americans have at least one financial product — checking accounts, credit cards, loans, investment accounts — that use forced arbitration clauses to strip the account-holder of their right to sue, very few of us know about these restrictions or understand what they mean. And as the list we’ve compiled shows, it’s not just banks that are playing the “get out of jail free” card with arbitration. [More]

Judge Shreds Uber; Says Company Can’t Prove Riders Are Giving Up Right To Sue

Uber, like a large and growing number of companies, has a clause in its terms of use that prohibits customers from suing the company or joining together in any sort of class action against the ride-hailing service. However, a federal judge recently scolded Uber over this contractual gamesmanship and deemed this particular clause unenforceable because the company can’t prove that users actually agreed to these terms. [More]

Google Fiber Copies Comcast, AT&T; Forces Users To Give Up Their Legal Right To Sue

Since its introduction in Kansas City, Google Fiber has presented itself as a disruptive force in the pay-TV and internet markets, offering high speeds for reasonable prices, and bringing new competition to markets generally dominated by a single provider. So it’s disappointing to learn that Fiber has decided to follow in the footsteps of AT&T, Comcast, Verizon, Time Warner Cable, and other reviled providers by quietly stripping its customers of their right to sue the company in a court of law. [More]

Proposed Rule Stops Colleges From Stripping Students Of Their Right To Sue

A recent study found that almost all of the nation’s largest for-profit college chains have enrollment agreements that block students from suing the school and prevent them from joining in class actions against these colleges. Following the 2015 bankruptcy and collapse of mega-chain Corinthian Colleges Inc., the sagging numbers at University of Phoenix, last week’s death knell for Brown Mackie College, and pending investigations and lawsuits against ITT and others, the Department of Education has decided that maybe these schools — which reap billions in federal aid each year — should probably have to be held accountable in a court of law when they screw students over. [More]

210 Law Professors Agree: Banks Should Not Be Able To Sidestep Legal System When They Break The Law

Earlier this month, the Consumer Financial Protection Bureau proposed rules that would make it more difficult for banks, credit card companies, and other financial services to stripping customers of their constitutional right to file lawsuits against these companies. The 90-day public comment period has finally opened on this rule, and the first one comes from a chorus of 210 law professors who all agree that consumers deserve the right to their day in court. [More]