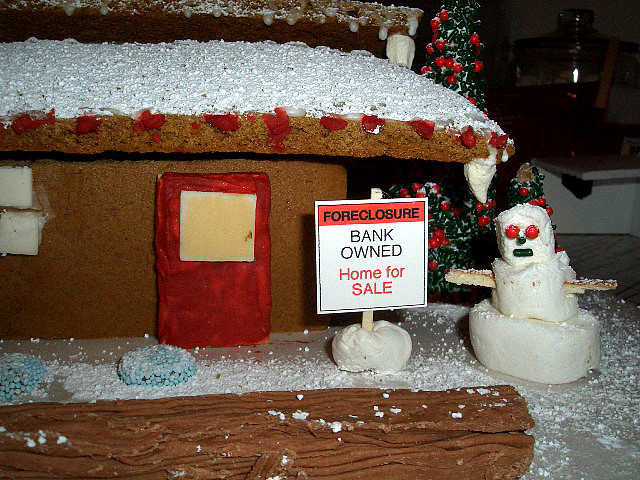

As the country tried to crawl out of the last recession, homeowners all across America sought mortgage modifications to make their home loans more manageable. However, some homeowners say that Wells Fargo not only modified their loans without asking, but that this lower rate added years — perhaps decades — to the terms of their mortgages. [More]

loan modifications

Mortgage Relief Scammers Ordered To Pay $5.4M

Eight months after federal regulators took action to stop a mortgage relief company from making hollow promises to homeowners facing foreclosure, the ringleaders behind the operation have agreed to pay more than $5.4 million in penalties and never work in the mortgage relief or telemarketing business again. [More]

Mortgage Servicer To Pay Back $1.5M To Screwed-Over Homeowners

Residential Credit Solutions is a mortgage servicer specializing in delinquent loans and “credit-sensitive” (read: high-risk for default) residential mortgages. But after allegedly screwing over homeowners by, among other things, not honoring loan modifications on mortgages transferred from other servicers, RCS is on the hook to pay $1.5 million in restitution and a $100,000 penalty to federal regulators. [More]

FTC Halts Mortgage Relief Operation Targeting Consumers In Foreclosure

Financially distressed consumers on the brink of foreclosure have enough to worry about without having to be on the lookout for shady mortgage relief companies making hollow promises to save their homes. Today, the Federal Trade Commission put an end to an operation that took advantage of homeowners’ vulnerabilities. [More]

Wells Fargo Breached 2010 Mortgage Settlement, Must Work To Provide Homeowner Assistance

Some homeowners who were wrongly denied mortgage assistance from Wells Fargo will soon receive the help they needed years ago after a federal judge ruled this week that the bank’s denial of modifications were in breach of a 2010 settlement involving adjustable-payment mortgages. [More]

Discover, Wells Fargo To Offer Private Student Loan Modifications

Consumers facing difficulty in paying back their private student loans often have a difficult time receiving any relief from lenders. While some smaller banks have relaxed their repayment terms for good borrowers in the past, two of the nation’s largest private lenders are set to make the same opportunities available to private student loan borrowers. [More]

Ohio Woman Sues Chase For Alleged Mortgage Law Violation

When you don’t follow the rules, you’re likely to get into a bit of trouble. In this case, JPMorgan Chase found itself party to a lawsuit alleging the company violated a law aimed to protect homeowners. [More]

Banks Received $814 Million In Federal Incentives For Mortgages That Ended Up In Redefault

According to the latest report from the Special Inspector General for the Troubled Asset Relief Program (or the much-cooler SIGTARP), the nation’s mortgage servicers have received more than $800 million in incentives for making modifications on mortgages that have ultimately resulted in the homeowner redefaulting on the loan. [More]

Court Halts Alleged “Forensic Audit” Scam Targeting Troubled Homeowners

The looming threat of foreclosure makes some homeowners easy targets for scammers who make hollow promises to help them keep their homes and lower their mortgages — all for a price. A U.S. District Court has pulled the emergency brake on a California-based operation alleged to be selling pricey “forensic audits” intended to provide relief, but which only pile on more troubles for consumers. [More]

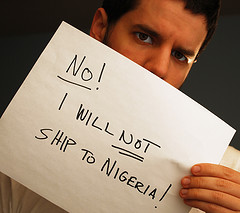

Auto Loan Modification Services Accused Of Bilking Consumers

While a lot of focus has been put on scammers who trick homeowners into costly schemes by promising to reduce their mortgage payments, people are also being taken in by bogus businesses that claim to help with auto loans. [More]

Woman's Late Brother Pays $217,000 To Online Scammers Now She's Facing Foreclosure

We’ve written these words too many times to count, but they obviously merit repeating once more: “Never co-sign a loan unless you are prepared and willing to pay back the entire thing — plus interest and penalties — if the other person defaults.” It’s a lesson a New Jersey woman has spent the last four years learning, and who now faces foreclosure because her dead brother was taken by scammers. [More]

Bank Of America, Chase, Wells Fargo Penalized By Treasury For Really Sucking At Loan Modifications

Yesterday, the Treasury Department released a scorecard of just how well (and poorly) the largest mortgage servicers are doing at meeting certain benchmarks of its Making Home Affordable program. Not surprisingly, Bank of America, Wells Fargo and JPMorgan Chase — the three largest servicers — were called out for needing “substantial improvement,” meaning that the banks will not receive millions of dollars in federal incentives until they get their acts together. [More]

Chase Screws Up Loan Modification, "Fixes" Error By Adding $8,000 To Balance Of Loan

The folks at ProPublica recently looked into the all-too-common problem of homeowners who thought they had successfully run through the loan modification gauntlet only to later find out that their bank had no record of the reduction and their house was suddenly in foreclosure. [More]

Bank Of America Does Something That Makes Sense, But Only Because It Has To

Ever since Bank of America got greedy and gobbled up the greasy, calorie-filled platter that was Countrywide, it’s been dealing with the indigestion caused by that company’s oodles of toxic mortgages. Now, after losing the Worst Company In America title by less than 1% to BP, BofA has decided to do something more than pay lip service to its crappy state of affairs. The bank has announced it will open 28 new foreclosure prevention centers in 22 states between now and July. [More]

Wells Fargo Says It Won't Foreclose For 30 Days, Then Does So Within A Week

A week after Wells Fargo rejected a couple’s loan mod app and said it wouldn’t start foreclosure proceedings any sooner than 30 days later, a guy showed up on their steps. He said he was with an investment firm that had just bought the house at a real estate auction, and if they would leave within 2 weeks, he would give them $1,500. [More]

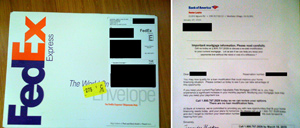

BofA Pays To Fedex You Multiple Loan Mod Opps You Don't Care About

BofA has been Fedexing Eli a loan mod opportunity once every two months for the past eight months. He has no intention of doing a refi, he’s never been late on a payment and likes his 5/1 ARM and low interest late. Wonder how many other homeowners is BofA frittering away their bailout bucks on by FedExing junk mail. Meanwhile, the people who actually want loan mods are stuck in purgatory. [More]

Will A Human At BofA Finally Please Modify My $160,000 Underwater Mortgage

Jim and Susan’s mortgage is underwater by $160,000. They want to live up to their obligations, they want to keep their home, but they can’t do it with a $370,000 mortgage on a house that’s only worth $210,000. An attorney told them to send some “jingle mail,” just pop the house keys in an envelope, mail it to the bank, and move away. What they really want is a modification so they can stay in their house, but Bank of America has been jerking them around and they don’t have faith that this last hurdle will actually get them a mod. Isn’t there a decision-making human at BofA that can finalize this deal for them? [More]

Maybe Homeowners Wouldn't Strategically Default If Lenders Cooperated

There’s an interesting detail at the end of this New York Times article on borrowers who strategically default–that is, they choose to walk away from the home when its value is significantly less than the mortgage balance. It turns out that the homeowner mentioned at the start of the article applied last fall for a loan modification with Bank of America after his income level had dropped, and this was BofA’s response: “The lender came back a few weeks ago with a plan that added more restrictive terms while keeping the payments about the same. ‘That may have been the last straw,’ Mr. Koellmann said.” [More]