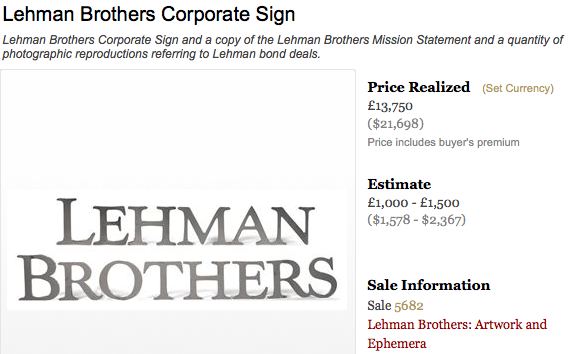

The art and ephemera of the failed Lehman Brothers firm fetched more interest at auction Wednesday than it itself could when it was put on the block, racking up $2.53 million in sales from over 200 participants. Of note was highest sale price item Gabriel Orozco’s “Atomists: Jump over” for $157,248, and a metal Lehman Brothers sign and a lot that included a sign of its mission statement that went for $21,744. The sign read, “We are one firm defined by our unwavering commitment to our clients, our shareholders and each other.” Ah, memories. [More]

lehman brothers

New Trailer For "Inside Job" Financial Crisis Documentary

Get ready to slake your thirst for populist rage. Inside Job is a new documentary coming out in October that aims to expose the truth about the true architects of the financial implosion of 2008. You can probably guess from the title whom they’re fingering. Matt Damon is the narrator and it’s released by Sony Pictures Classics. Here’s the trailer: [More]

Lehman Brothers CEO "Sold" $14 Million House To His Wife For $100

Dick Fuld is in the news again — this time for selling a $14 million Florida house to his wife for $100. No one is quite sure why he felt he needed to do this, but some are speculating that he may be trying to hide assets from Lehman Brothers shareholders in case they are getting ready to sue to him.

Video: Oil Speculators To Blame For Record Gas Prices After All

If you thought oil speculators as the reason behind the historic gas prices spikes of this summer was debunked, think again. From ’07 to when the price of oil collapsed, supply increased and demand dropped. According to basic economic theory, this should’ve meant the price went down. But all of a sudden an influx of capital, an infusion that brought the total at play from $13 billion to $300 billion, brought to market by large investment bankers, exploiting de-regulation and trading in black box private exchanges made possible by Enron, drove the price of oil from $69 to almost $150. A new 60 Minutes report explores the issue. Video inside.

How An Ex-Lehman Brothers ibanker Fills His Days

What does an ex-Lehman Brothers i-banker do now that he has no reason to live? This brilliant, amusing, well-put-together, and NSFW video explores the answer. “I’ve been waking up 5:40 every morning, not waking up for Lehman Brothers necessarily, but when I wake up, I put on a suit.” I know there’s a lot of so-called “funny videos” on the internet, but seriously, this is a good one. Watch it inside.

Days Before Bankruptcy, Lehman Brothers Approved $100 Million Parachute

The Times of London says that a mere three days before Lehman Brothers went bankrupt, the firm approved $100 million in payouts to departing executives.

5 More Wall Street Dudes Who Deserve A Punch In The Face

WallStreetFighter has listed 5 more Wall Street dudes that deserve the old “Dick Fuld” right in the face. Guess which Wall Street loser is most punchable?

Lehman Brothers CEO Got Punched In The Face

Dick “It Wasn’t My Fault” Fuld, the CEO of bankrupt investment bank Lehman Brothers, (seen here being heckled after testifying on Capitol Hill) was apparently punched in the face while working out in Lehman gym on the Sunday following the bankruptcy, according to CNBC’s Vicki Ward.

Treasury Says It Will Agree To Cap Wall Street Executive Pay

One of the major sticking points of the inevitable Wall Street bailout was executive pay — but the New York Times says that Treasury Secretary and former CEO of Goldman Sachs, Henry M. Paulson Jr., has agreed to compensation caps for the executives of firms that benefit from the bailout.

FBI Investigating Failed, Bailed, Financial Firms

The FBI has launched a fraud probe into Fannie Mae, Freddie Mac, Lehman Brothers and AIG. Sounds kinda like a move to placate the masses. “We’re on it.” No doubt in response to the seething outrage sweeping the nation over the size and audacity of the bailouts, however needed they might be. Sounds like an easy job. Sorta like dipping your hand in a barrel of ink and trying to pull up black stuff.

Two Economists From The University Of Chicago Explain What The Hell Just Happened

It’s one thing to understand what just happened to the financial markets, and yet another to actually be able to explain what just happened. Thankfully, Steven Levitt from Freakonomics walked down the hall and found two economists from the University of Chicago (Doug Diamond and Anil Kashyap,) who gave him the best explanation I’ve been able to find about what the hell just happened.

Nobody Gave A Crap About The FDIC Until Fairly Recently

Spend a little time looking at Google trends and you’ll notice that no one really gave a crap about the FDIC until fairly recently.

Feds Didn't Bail Out Lehman, They Just Loaned Them $87 Billion

Effectively, the Feds loaned the global financial firm Lehman Brothers $87 billion Monday as it filed for bankruptcy and sent Wall Street into even more of tizzy, CNBC reports. In order to “to avoid disruption of financial markets,” the feds asked JP Morgan Chase to advance Lehman the 87 really big ones, then the Federal Reserve Bank of New York repaid Chase. Wait, wasn’t everyone patting the government on the back for not bailing out Lehman? Looks like that was only half of the story. Your tax dollars at work.

The 10 Biggest Chapter 11 Bankruptcies In US History

CNBC has put together a quick slideshow list of the top 10 largest Chapter 11 bankruptcy filings in US history based on the pre-bankruptcy assets of the companies in question. It really gives you a sense of the incredible scale of the Lehman Brothers filing — the next closest bankruptcy was Worldcom, which had $103.9 billion in assets before the filing — 535.1 BILLION DOLLARS less than Lehman Brothers. Damn.

Signs Of The Apocalypse: Even Money Market Funds Are Losing Money

In the history of money market funds, says the NYT, only one had ever “broken the buck” or actually lost money… before yesterday. On Tuesday, the managers of a multi-billion dollar money market fund announced that their customers might lose money in the fund– a type of investment that is considered as safe as a savings account.

What Merrill, Lehman, And AIG Customers Need To Know

NYT’s Ron Leiber breaks down what you need to know and do if you are or were a customer of Merrill Lynch, Lehman, or AIG…

Lehman Brothers Did Business With Mortgage Fraudsters Back In 2000

The Lehman Brothers collapse is shocking! Unless you remember a little story from 8 years ago…